Concept explainers

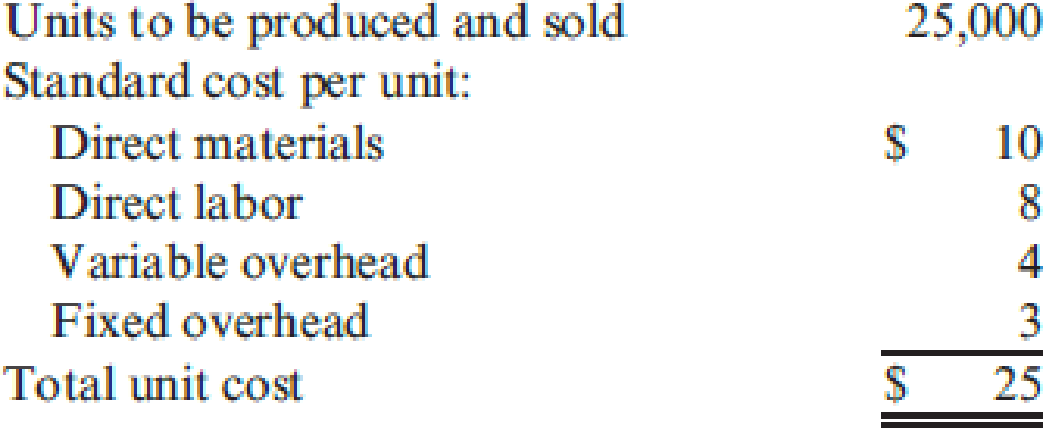

Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed:

During the year, 24,800 units were produced and sold. The following actual costs were incurred:

There were no beginning or ending inventories of direct materials. The direct materials price variance was $10,168 unfavorable. In producing the 24,800 units, a total of 12,772 hours were worked, 3 percent more hours than the standard allowed for the actual output. Overhead costs are applied to production using direct labor hours.

Required:

- 1. Prepare a performance report comparing expected costs to actual costs.

- 2. Determine the following:

- a. Direct materials usage variance

- b. Direct labor rate variance

- c. Direct labor usage variance

- d. Fixed overhead spending and volume variances

- e. Variable overhead spending and efficiency variances

- 3. Use T-accounts to show the flow of costs through the system. In showing the flow, you do not need to show detailed overhead variances. Show only the over- and underapplied variances for fixed and variable overhead.

1.

Prepare a performance report by comparing the expected costs to actual costs.

Explanation of Solution

Flexible budget performance report: This report associates actual performance and budgeted performance on par with actual sales volume. Flexible budget performance report gains the management attention to the cost or revenues that differ from budgeted amount.

A flexible budget performance report is used for analyzing the difference between actual performance and budgeted performance. It is also called as variance analysis. Its usefulness comes from the budgeted and actual results that are based on similar level of activity.

Prepare a performance report by comparing the expected costs to actual costs:

| Particulars | Actual Cost | Flexible Budget Cost | Variance |

| Direct materials | 264,368 | 248,000 | 16,368 U |

| Direct labor | 204,352 | 198,400 | 5,952 U |

| Variable overhead | 107,310 | 99,200 | 8,110 U |

| Fixed overhead | 73,904 | 75,000 | 1,096 F |

| Total cost | $649,934 | $620,600 | $29,334 U |

Table (1)

Working note 1: Calculate the budgeted cost for direct materials:

Working note 2: Calculate the budgeted cost for direct labor:

Working note 3: Calculate the budgeted cost for variable overhead:

Working note 4: Calculate the budgeted cost for fixed overhead:

Note: Fixed overhead unit is based on 25,000.

2.

Calculate the followings:

- a. Direct materials usage variance.

- b. Direct labor rate variance.

- c. Direct labor usage variance.

- d. Fixed overhead spending and volume variances.

- e. Variable overhead spending and efficiency variances.

Explanation of Solution

a.

Direct material usage (efficiency) variance: It is a measure that determines the variation in between actual and standard quantity of input multiplied by the standard unit price is called material usage variance.

The following formula is used to calculate direct material usage variance:

Calculate direct materials usage variance by using total variance formula:

b.

Direct Labor Rate Variance: The direct labor rate variance is a measure to determine the variation in the estimated cost of the direct labor and the actual cost of the direct labor and is multiplied by the actual hours is called direct labor rate variance.

The following formula is used to calculate the direct labor rate variance:

Calculate direct labor rate variance:

Step 1: Calculate standard hour.

Step 2: Calculate standard rate.

Step 3: Calculate direct labor rate variance.

c.

Direct labor efficiency variance is a measure that determines the difference between the estimated labor hours and the actual labor hours used and is multiplied by the standard rate per hour is called material usage variance.

The following formula is used to calculate direct labor efficiency variance:

Calculate the direct labor usage or efficiency variance:

d.

Fixed overhead spending variance: It is the difference between actual fixed overhead and the budgeted fixed overhead.

The following formula is used to calculate fixed overhead spending variance:

Calculate the fixed overhead spending variance:

Fixed overhead volume variance: It is the difference between budgeted fixed overhead and the applied fixed overhead.

The following formula is used to calculate fixed overhead volume variance:

Calculate the volume variance:

Working note 5: Calculate the applied fixed overhead:

Working note 6: Calculate the standard fixed overhead rate:

e.

Spending variances: It arises when management pays an amount which is different from the standard price for purchasing an item. The variable overhead spending variance measures the total effect of differences in the actual variable overhead rate (AVOR) and the standard variable overhead rate (SVOR).

Efficiency variances: It arises when standard direct labor hours expected for actual production different from labor the actual direct labor hours used.

Variable overhead efficiency variance tells managers how much of the total variable manufacturing overhead variance is due to using more or fewer machine hours than anticipated for the actual volume of output.

Calculate variable overhead spending variance:

Calculate variable overhead efficiency variance:

3.

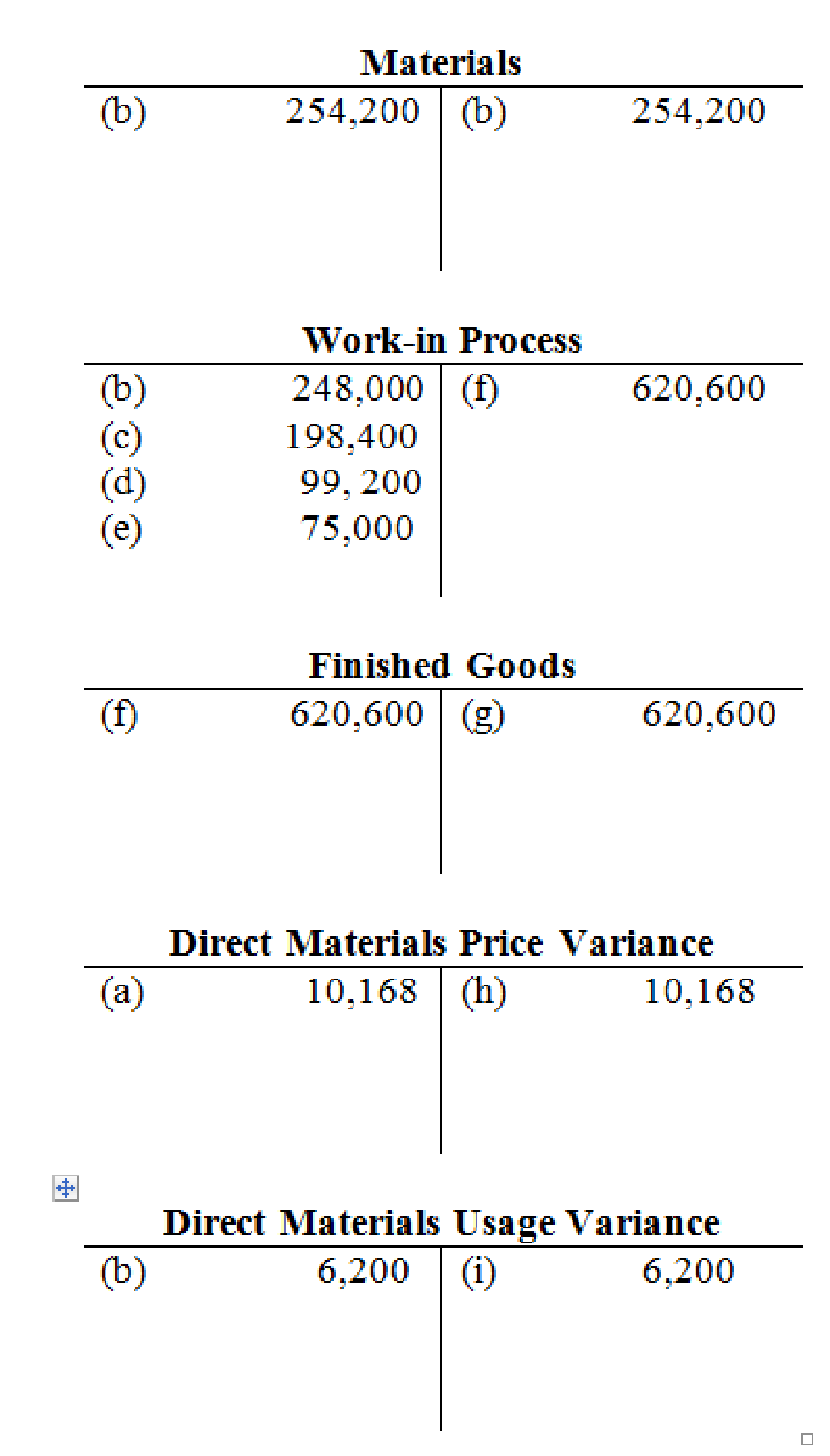

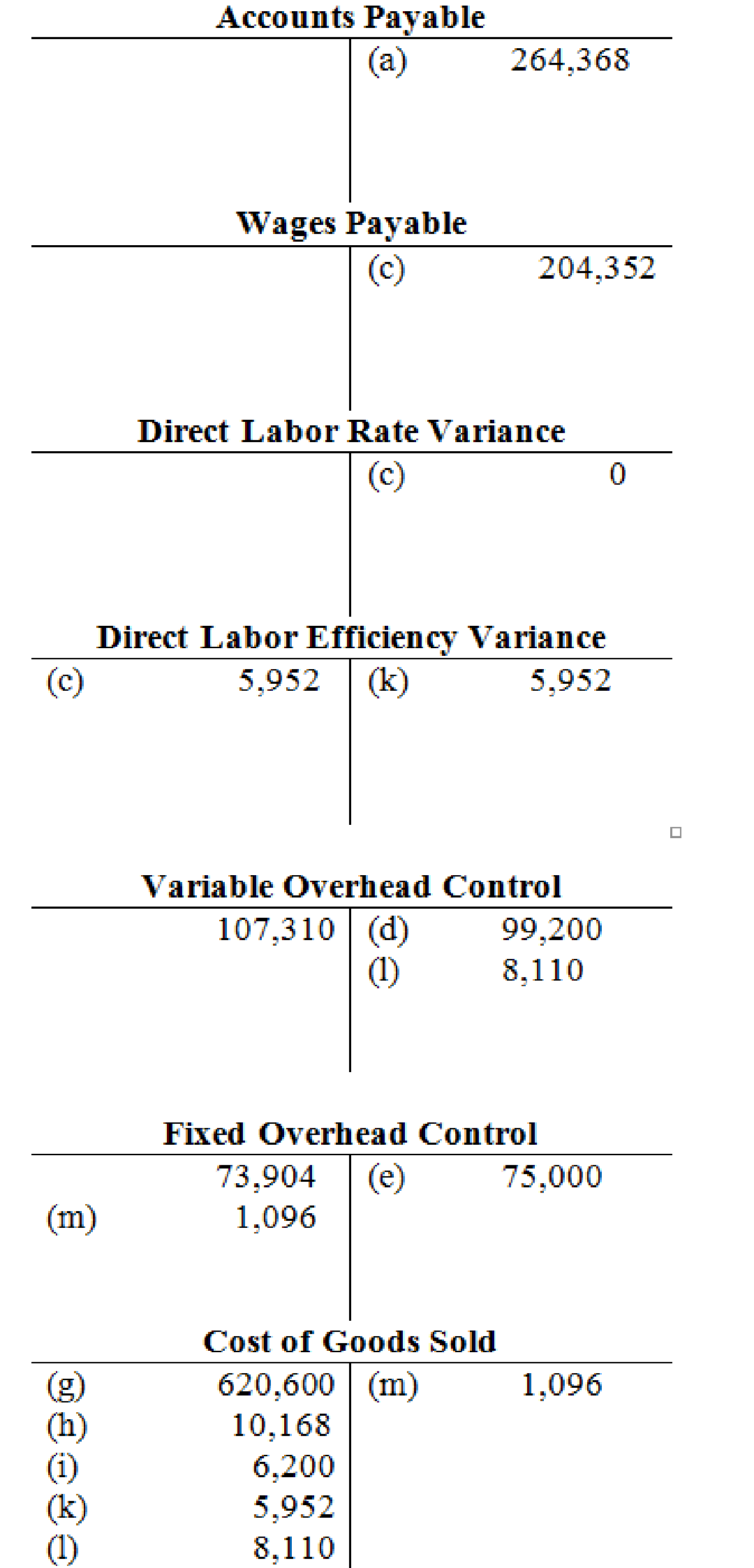

Prepare T-accounts to show the flow of costs through the system.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Prepare T-accounts to show the flow of costs through the system:

Want to see more full solutions like this?

Chapter 9 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Flaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forwardCarlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forward

- Shinto Corp. uses a standard cost system and manufactures one product. The variable costs per product follow: Budgeted fixed overhead costs for the month are $4,000, and Shinto expected to manufacture 2,000 units. Actual production, however, was only 1,800 units. Materials prices were 10% over standard, and labor rates were 5% over standard. Of the factory overhead expense, only 80% was used, and fixed overhead was $100 over budget. The actual variable overhead cost was $4,800. In materials usage, 8% more parts were used than were allowed for actual production by the standard, and 6% more labor hours were used than were allowed. Required: Calculate the materials and labor variances. Calculate the variances for overhead by the four-variance method. (Hint: First compute the fixed and variable overhead rates per hour.)arrow_forwardJameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardQueen Industries uses a standard costing system in the manufacturing of its single product. It requires 2 hours of labor to produce 1 unit of final product. In February, Queen Industries produced 12,000 units. The standard cost for labor allowed for the output was $90,000, and there was an unfavorable direct labor time variance of $5,520. A. What was the standard cost per hour? B. How many actual hours were worked? C. If the workers were paid $3.90 per hour, what was the direct labor rate variance?arrow_forward

- Eagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardDuring its first year of operations, Snobegon, Inc. (located in Lake Snobegon, Minnesota), produced 40,000 plastic snow scoops. Snow scoops are oversized shovel-type scoops that are used to push snow away. Unit sales were 38,200 scoops. Fixed overhead was applied at 0.75 per unit produced. Fixed overhead was underapplied by 2,900. This fixed overhead variance was closed to Cost of Goods Sold. There was no variable overhead variance. The results of the years operations are as follows (on an absorption-costing basis): Required: 1. Calculate the cost of the firms ending inventory under absorption costing. What is the cost of the ending inventory under variable costing? (Round unit costs to five significant digits.) 2. Prepare a variable-costing income statement. Reconcile the difference between the two income figures.arrow_forwardMoleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.arrow_forward

- Corolla Manufacturing has a standard cost for steel of $20 per pound for a product that uses 4 pounds of steel. During September, Corolla purchased and used 4,200 pounds of steel to make 1,040 units. They paid $20.75 per pound for the steel. Compute the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance for the month of September. What would change if Corolla had made 2,200 units?arrow_forwardYohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Unadjusted Cost of Goods Sold equals 1,500,000, unadjusted Work in Process equals 236,000, and unadjusted Finished Goods equals 180,000. Required: 1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances? 2. What if any ending balance in a variance account that exceeds 10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods on the basis of prime costs in these accounts. The prime cost in Cost of Goods Sold is 1,050,000, the prime cost in Work in Process is 165,200, and the prime cost in Finished Goods is 126,000. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances? (Round ratios to four significant digits. Round journal entries to the nearest dollar.)arrow_forwardOn May 1, Athens Inc. began the manufacture of a new mechanical device known as Snap. The company installed a standard cost system in accounting for manufacturing costs. The standard direct materials and labor costs for a unit of Snap follow: The following data came from Athens’ records for May: The amount shown above for the materials price variance is applicable to raw materials purchased during May. Required: Compute each of the following items for Athens for May. Show computations in good form. Standard quantity of raw materials allowed (in pounds) for actual production. Actual quantity of raw materials used (in pounds). (Hint: Be sure to consider the materials quantity variance.) Standard direct labor hours allowed. Actual direct labor hours worked. (Hint: Be sure to consider the direct labor efficiency variance.) Actual direct labor rate. (Hint: Be sure to consider the direct labor rate variance.)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning