Concept explainers

Following is a

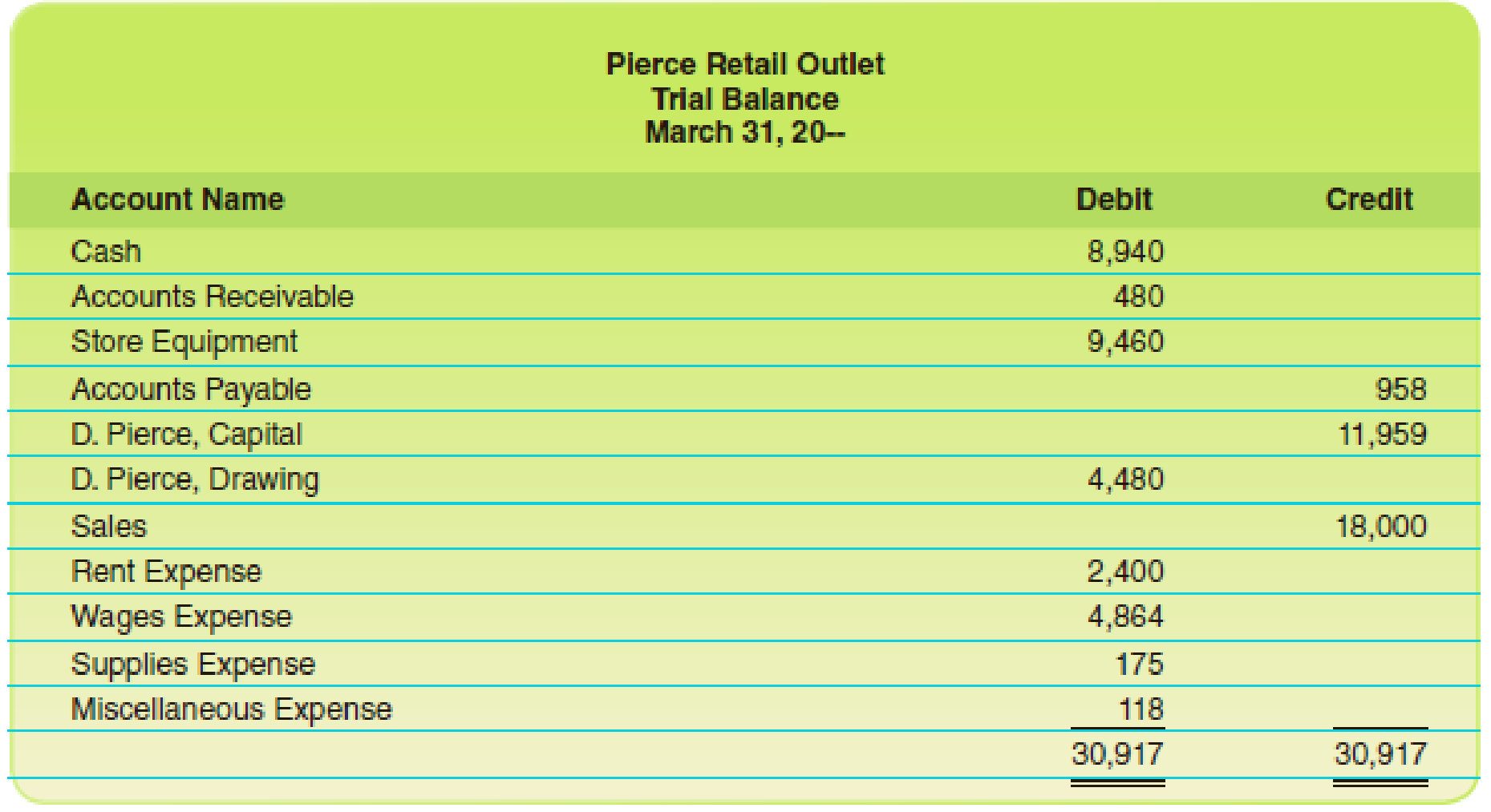

- 1. Think about where these amounts might have been put, think about what accounts are missing, and use T accounts to solve the problems.

- 2. Prepare a corrected trial balance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Financial Accounting

Managerial Accounting (5th Edition)

Fundamentals of Financial Accounting

Managerial Accounting: Tools for Business Decision Making

Financial Accounting (12th Edition) (What's New in Accounting)

Auditing and Assurance Services (16th Edition)

- Your client is preparing financial statements to show the bank. You know that he has incurred a refrigeration repair expense during the month, but you see no such expense on the books. When you question the client, he tells you that he has not yet paid the 1,255 bill. Your client is on the accrual basis of accounting. He does not want the refrigeration repair expense on the books as of the end of the month because he wants his profits to look good for the bank. Is your client behaving ethically by suggesting that the refrigeration repair expense not be booked until the 1,255 is paid? Are you behaving ethically if you agree to the clients request? What principle is involved here?arrow_forwardEvery March, Buddie, who owns and operates a small retail shop, takes a large box of receipts and invoices to her accountant so the accountant can file Buddie's taxes in April. Only then does Buddie know if her business has been profitable. Buddie could benefit from a(n) ________.Select one:a. concurrent control systemb. management information system c. balanced scorecard systemd. inventory control systemarrow_forwardOn a recent trip to Hongkong, Brian Santos, sales manager of Micro electronic Devices, took his wife at company expense. Erika Tan, vice president of sales and Santos' boss, thought his travel and entertainment expenses seemed excessive. Tan approved the reimbursement, however, because she owed Santos a favor. Tan, well aware that the company president routinely reviewed all expenses recorded in the cash disbursements journal, had the accountant record Santos' wife's expenses in the general journal as follows: Sales Promotion Expense 35,000 Cash 35,000 QUESTION: Based on Case 2, does recording the transaction in the general journal rather than in the cash disbursements journal affect the amounts of cash and total expenses reported in the financial statements? Why?arrow_forward

- You are an auditor at a public accounting firm. You and your team are entrusted by Partner to handle clients engaged in the home appliance retail business. Your client is a company that has go public. The client's financial statement in the previous year reported a loss, however this year reported a material gain. After you check, it turns out that the client reports income that is not much different from the previous year, however, there can be a profit due to the decrease in Cost of Goods Sold (COGS). The client reports that the amount of inventory has increased drastically, even though sales have not increased and the account payable balance is almost the same as in previous years, this has led to suspicion of a double counting scheme in the client's inventory. In addition, when a random check was carried out incidentally at one of the client's warehouses, it was found that many inventory were out of date but the client did not make adjustments. Question:a. If you wanted to perform…arrow_forwardOn a recent trip to Hongkong, Brian Santos, sales manager of Micro- electronic Devices, took his wife at company expense. Erika Tan, vice- president of sales and Santos' boss, thought his travel and entertainment expenses seemed excessive. Tan approved the reimbursement, however, because she owed Santos a favor. Tan, well aware that the company president routinely reviewed all expenses recorded in the cash disbursements journal, had the accountant record Santos' wife's expenses in the general journal as follows: Sales Promotion Expense 35,000 Cash 35,000 Does recording the transaction in the general journal rather than in the cash disbursements journal affect the amounts of cash and total expenses reported in the financial statements?arrow_forwardA large company has hired your friend. She tells you that her boss has asked customers to sign sales agreements just before year end indicating a sale has been made.The boss told customers that he will give them 30 days (well into the next year) to change their minds. If they do not change their minds they will quickly receive the merchandise. If they do change their minds he promised to cancel their orders, take merchandise back, and cancel the invoices.Your friend has been told by her boss to recognize the sales agreements as revenue this year. Your friend has concerns about recognizing revenue before the merchandise is shipped. She likes the company and wants to keep her job.What do you advise her to do?arrow_forward

- In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Pina Colada Corp. enters sales and sales taxes separately in its cash register. On April 10, the register totals are sales $37,000 and sales taxes $1,850. 2. Cullumber Company does not segregate sales and sales taxes. Its register total for April 15 is $22,896, which includes a 6% sales tax. Prepare the entry to record the sales transactions and related taxes for each client. Omit the cost of goods sold entry.arrow_forwardA friend, Wazir, has asked you for advice because he understands very little about accounting statements. His accountant has prepared the following summary of the last three years results of Wazir’ shoe business: Wazir tells you that in the early months of 20X5 a discount shoe operation opened near his shop. His sales suffered at first because of the competition, but after about 8 months the rival went out of business. Wazir decided, however, that he had better extend the range of inventory carried and also increase the floor area of the selling space so as to build up revenue. Since the end of 20X5 he has rented additional showroom and storage space from the business next door. Wazir would like you to explain to him the impact of these events on his business performance. Questions: (indicative wordcount 280 words) Calculate his gross and net profit margins and Write a brief report.arrow_forwardYou are the manager of the Accounts Receivable Department for a merchandising business. Your billing clerk sent a bill for $2 to a customer who had charged $100 in goods (including sales tax) with terms 2/10, n/30. The customer has called and indicated his displeasure; he can't understand an error like this since he paid on time. For your initial post, explain to your billing clerk why Accounts Receivable is credited for $100 and not $98. Include an explanation as to how permission was given to send less than the full amount?arrow_forward

- Tom’s Tax Services is a small accounting firm that offers tax services to small businesses and individuals. A local store owner has approached Tom about doing his taxes but is concerned about the fees Tom normally charges. The costs and revenues at Tom’s Tax Services follow: Tom’s Tax Services Annual Income Statement Sales Revenue 724,000 Costs Labor 457,000 Equipment Lease 48,000 Rent 42,500 Supplies 31,300 Tom’s Salary 73,800 Other Costs 21,400 Total Costs 674,900 Operating Profit (Loss) 49,100 If Tom gets the store’s business, he will incur an additional $59,200 in labor costs. Tom also estimates that he will have to increase equipment leases by about 5 percent, supplies by 5 percent, and other costs by 15 percent. Required: What are the differential costs that would be incurred as…arrow_forwardAn accounting intern for a local CPA firm was reviewing the financial statements of a client in the electronics industry. The intern noticed that the client used the FIFO method of determining ending inventory and cost of goods sold. When she asked a colleague why the firm used FIFO instead of LIFO, she was told that the client used FIFO to minimize its income tax liability. This response puzzled the intern because she thought that LIFO would minimize income tax liability. Required: What would you tell the intern to resolve the confusion?arrow_forwardYou run a consulting firm. During Year 1, your firm collected $200,000 from clients (all of these payments were for work previously done). On January 1, Year 1, the Accounts Receivable account had a balance of $40,000. On December 31, Year 1, the Accounts Receivable account had a balance of $60,000. Based on this information, what amount should your firm recognize as revenue for Year 1?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,