Concept explainers

JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

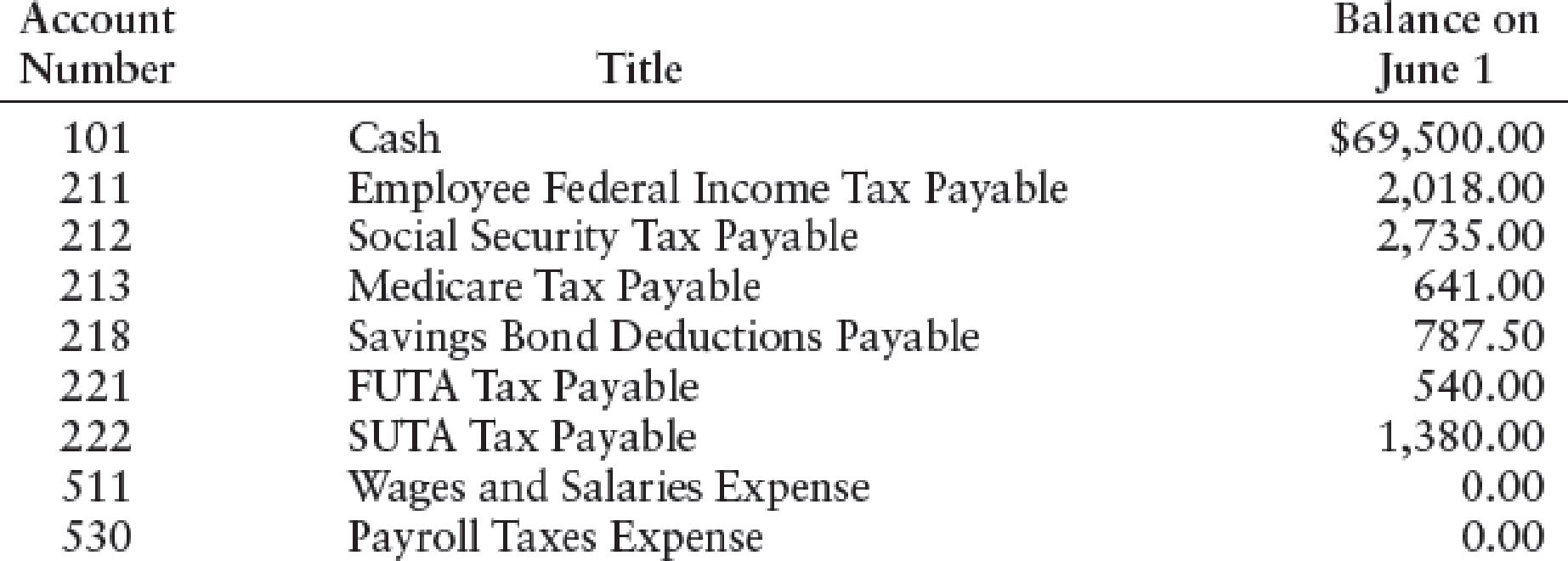

The accounts kept by Oxford Company include the following:

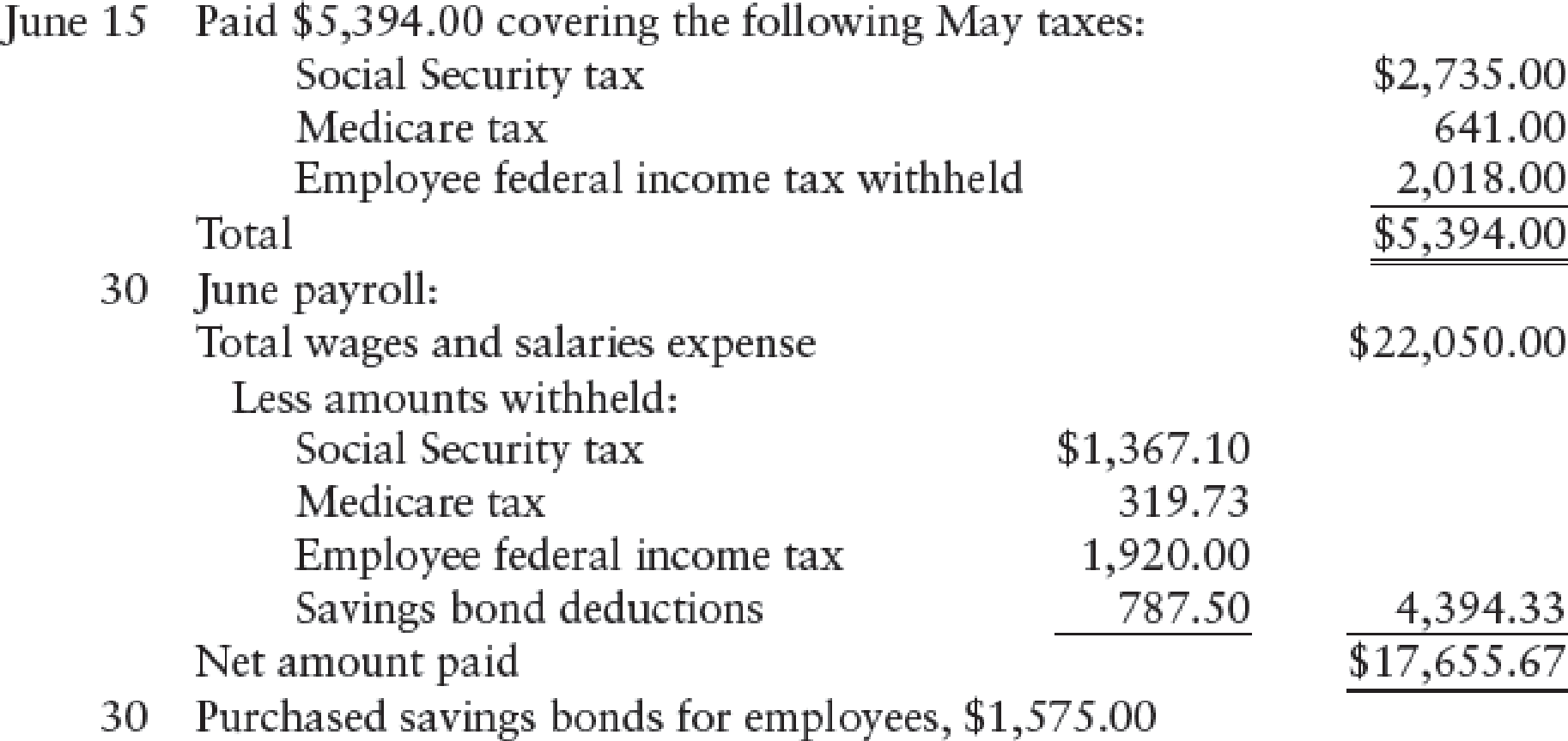

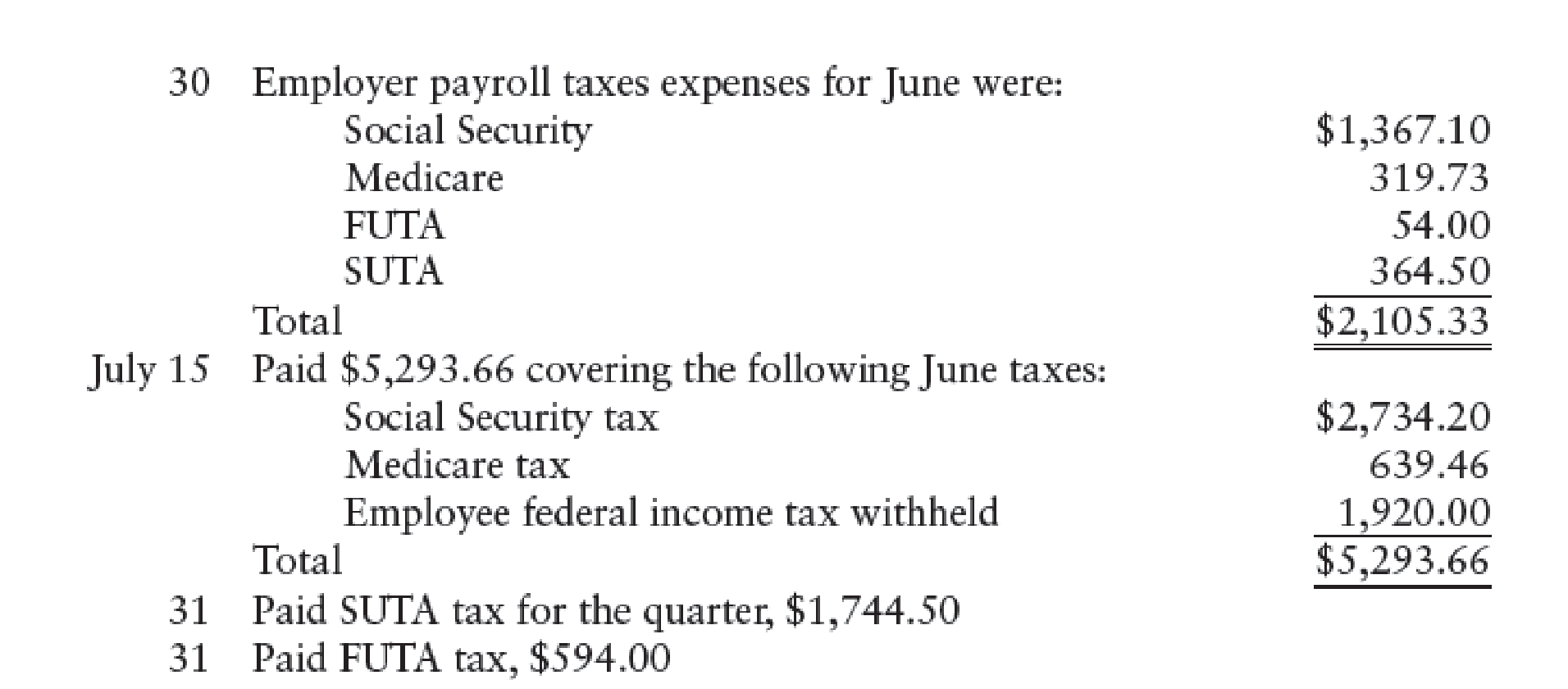

The following transactions relating to payrolls and payroll taxes occurred during June and July:

REQUIRED

- 1. Journalize the preceding transactions using a general journal.

- 2. Open T accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.

1.

Prepare journal entry to record the given transactions.

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Prepare journal entry to record the payment of payroll tax of May on June 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 15 | Employee Federal income tax payable | 211 | 2,018.00 | |

| FICA-Social Security taxes payable | 212 | 2,735.00 | ||

| FICA-Medicare Taxes payable | 213 | 641.00 | ||

| Cash | 101 | 5,394.00 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (1)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $2,018.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,735.00.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $641.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,394.00.

Prepare journal entry to record the June payroll.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Wages and Salaries expense | 511 | 22,050.00 | |

| Employee federal income tax payable | 211 | 1,920.00 | ||

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| Savings bonds deductions payable | 218 | 787.50 | ||

| Cash | 101 | 17,655.67 | ||

| (To record the payroll for the week ended June 30) |

Table (2)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $22,050.00.

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- Savings bonds deductions payable is a liability and it is increased. Hence, credit savings bonds deductions payable by $787.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $17,655.67.

Prepare journal entry to record the purchase of bonds for employees.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Savings bonds deductions payable | 218 | 1,575.00 | |

| Cash | 101 | 1,575.00 | ||

| (To record the purchase of U.S savings bonds for employees.) |

Table (3)

- Savings bonds deductions payable is a liability and it is decreased. Hence, debit savings bonds deductions payable by $1,575.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,575.00.

Prepare journal entry to record the employer payroll tax expense.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Payroll tax expense | 530 | 2,105.33 | |

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| FUTA tax payable | 221 | 54.00 | ||

| SUTA tax payable | 222 | 364.50 | ||

| (To record the employer payroll taxes expense) |

Table (4)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $2,105.33.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $54.00.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $364.50.

Prepare journal entry to record the payment of June taxes.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 15 | Employee Federal income tax payable | 211 | 1,920.00 | |

| FICA-Social Security taxes payable | 212 | 2,734.20 | ||

| FICA-Medicare Taxes payable | 213 | 639.46 | ||

| Cash | 101 | 5,293.66 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (5)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,734.20.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $639.46.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,293.66.

Prepare journal entry to record the payment of SUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | SUTA tax payable | 222 | 1,744.50 | |

| Cash | 101 | 1,744.50 | ||

| (To record the payment of SUTA tax) |

Table (6)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $1,744.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,744.50.

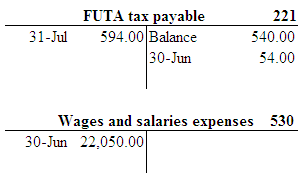

Prepare journal entry to record the payment of FUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | FUTA tax payable | 221 | 594 | |

| Cash | 101 | 594 | ||

| (To record the payment of FUTA tax) |

Table (7)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $594.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $594.

2.

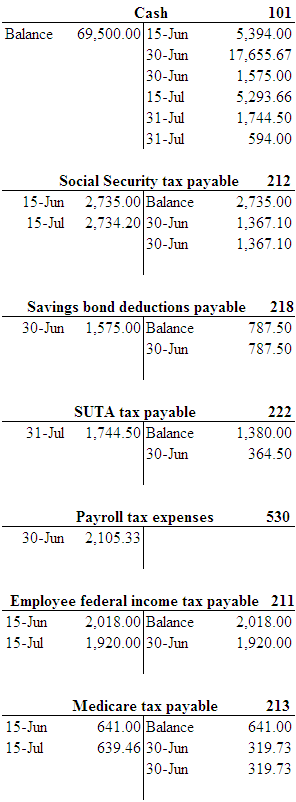

Prepare T-Account for the payroll expenses and liabilities.

Explanation of Solution

Prepare T-Account for the payroll expenses and liabilities.

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting, Chapters 1-27

- JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQURED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardJOURNALIZING AND POSTING PAYROLL ENTRIES Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Cascade include the following: The following transactions relating to payrolls and payroll taxes occurred during June and July: REQUIRED 1. Journalize the preceding transactions using a general journal. 2. Open accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.arrow_forwardPayment and distribution of payroll The general ledger of Berskshire Mountain Manufacturing Inc. showed the following credit balances on January 15: Direct labor earnings amounted to 10,500 from January 16 to 31. Indirect labor was 5,700, and sales and administrative salaries for the same period amounted to 3,800. All wages are subject to FICA, FUTA, state unemployment taxes, and 10% income tax withholding. Required: 1. Prepare the journal entries for the following: a. Recording the payroll. b. Paying the payroll. c. Recording the employers payroll tax liability. d. Distributing the payroll costs for January 1631. 2. Prepare the journal entry to record the payment of the amounts due for the month to the government for FICA and income tax withholdings. 3. Calculate the amount of total earnings for the period from January 1 to 15. 4. Should the same person be responsible for computing the payroll, paying the payroll and making the entry to distribute the payroll? Why or why not?arrow_forward

- Payroll Accounting and Discussion of Labor Costs Blitzen Marketing Research paid its weekly and monthly payroll on January 31. The following information is available about the payroll: Blitzen will pay both the employers taxes and the taxes withheld on April 15. Required: 1. Prepare the journal entries to record the payroll payment and the incurrence of the associated expenses and liabilities. ( Note: Round to nearest penny.) 2. What is the employees' gross pay? What amount does Blitzen pay in excess of gross pay as a result of taxes? ( Note: Provide both an absolute dollar amount and as a percentage of gross pay, rounding to two decimal places.) 3. How much is the employees' net pay as a percentage of total payroll related expenses? ( Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION If another employee can be hired for $60,000 per year, what would be the total cost of this employee to Blitzen?arrow_forwardIn the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firms fiscal year. The last quarter begins on April 1, 20--. Refer to the Illustrative Case on pages 6-27 to 6-33 and proceed as follows: a. Analyze and journalize the transactions described in the following narrative. Use the two-column journal paper provided on pages 6-73 to 6-77. Omit the writing of explanations in the journal entries. b. Post the journal entries to the general ledger accounts on pages 6-78 to 6-83. Narrative of Transactions: c. Answer the following questions: 1. The total amount of the liability for FICA taxes and federal income taxes withheld as of June 30 is................................................................................ ________ 2. The total amount of the liability for state income taxes withheld as of June 30 is................................................................................................................ ________ 3. The amount of FUTA taxes that must be paid to the federal government on or before August 1 (assume July 31 is a Sunday) is........................................ ________ 4. The amount of contributions that must be paid into the state unemployment compensation fund on or before August 1 is.................................................. ________ 5. The total amount due the treasurer of the union is........................................ ________ 6. The total amount of wages and salaries expense since the beginning of the fiscal year is ................................................................................................... ________ 7. The total amount of payroll taxes expense since the beginning of the fiscal year is ............................................................................................................ ________ 8. Using the partial journal below, journalize the entry to record the vacation accrual at the end of the companys fiscal year. The amount of Brookins Companys vacation accrual for the fiscal year is 15,000.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries, 1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forward

- Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for 2,520, in payment of the semiannual premium on the group medical insurance policy. 1. Issued Check No. 816 to Alvarez Bank for 8,131, in payment for 2,913 of social security tax, 728 of Medicare tax, and 4,490 of employees federal income tax due. 2. Issued Check No. 817 for 2,300 to Alvarez Bank to invest in a retirement savings account for employees. 12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for 2,520, in payment of the semiannual premium on the group medical insurance policy. 1. Issued Check No. 816 to Alvarez Bank for 8,131, in payment for 2,913 of social security tax, 728 of Medicare tax, and 4,490 of employees federal income tax due. 2. Issued Check No. 817 for 2,300 to Alvarez Bank to invest in a retirement savings account for employees. 12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 12. Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 12. Journalized the entry to record payroll taxes on employees earnings of December12: social security tax, 1,452; Medicare tax, 363; state unemployment tax, 315; federal unemployment tax, 90. 15. Issued Check No. 830 to Alvarez Bank for 7,938, in payment of 2,904 of social security tax, 726 of Medicare tax, and 4,308 of employees federal income tax due. 26. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 26. Issued Check No. 840 for the net amount of the biweekly payroll to fund the payroll bank account. Dec. 26. Journalized the entry to record payroll taxes on employees earnings of December 26: social security tax, 1,455; Medicare tax, 364; state unemployment tax, 150; federal unemployment tax, 40. 30. Issued Check No. 851 for 6,258 to State Department of Revenue, in payment of employees state income tax due on December 31. 30. Issued Check No. 852 to Alvarez Bank for 2,300 to invest in a retirement savings account for employees. 31. Paid 55,400 to the employee pension plan. The annual pension cost is 65,500. (Record both the payment and the unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forwardThe totals from the payroll register of Olt Company for the week of January 25 show: Journalize the entry to record the payroll of January 25.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forward

- Irina Company pays its employees weekly. The last pay period for 20-1 was on December 28. From December 28 through December 31, the employees earned 1,754, so the following adjusting entry was made: The first pay period in 20-2 was on Januar)-4. The totals line from Irina Companys payroll register for the week ended Januar)-4, 20-2, was as follows: REQUIRED 1. Prepare the journal entry for the payment of the payroll on January 4, 20-2. 2. Prepare T accounts for Wages and Salaries Expense and Wages and Salaries Payable showing the beginning balance, January 4, 20-2, entry, and aiding balance as of January 4, 20-2.arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 2. Issued Check No. 410 for 3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 27,046, in payment of 9,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees earnings of December13: social security tax, 4,632; Medicare tax, 1,158; state unemployment tax, 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020, in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees earnings of December27: social security tax, 4,668; Medicare tax, 1,167; state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3,400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries,1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forwardReviewing payroll records indicates that employee salaries that are due to be paid on January 3 include $3,575 in wages for the last week of December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage