Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.12E

Inventory analysis

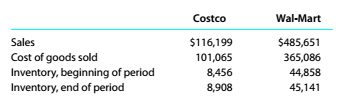

Costco Wholesale Corporation (COST)

and Wal-Mart Stores Inc. (WMT)

compete against each other in general merchandise retailing, gas stations, pharmacies, and optical centers. Below is selected financial information for both companies from a recent year's financial statements (in millions):

a. Determine for bom companies (1) the inventory turnover and (2) the days' sales in inventory. Round to one decimal place.

b. Compare and interpret the inventory metrics computed in (a).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Survey of Accounting (Accounting I)

Ch. 9 - What type of analysis is indicated by the...Ch. 9 - Which of the following measures indicates the...Ch. 9 - Prob. 3SEQCh. 9 - Prob. 4SEQCh. 9 - Prob. 5SEQCh. 9 - That is the difference between horizontal and...Ch. 9 - Prob. 2CDQCh. 9 - Prob. 3CDQCh. 9 - Prob. 4CDQCh. 9 - How would the current and quick ratios of a...

Ch. 9 - For Belzcr Corporation, the working capital at the...Ch. 9 - Prob. 7CDQCh. 9 - Prob. 8CDQCh. 9 - a. Why is it advantageous to have a high inventory...Ch. 9 - Prob. 10CDQCh. 9 - Prob. 11CDQCh. 9 - Prob. 12CDQCh. 9 - Prob. 13CDQCh. 9 - Prob. 14CDQCh. 9 - Prob. 15CDQCh. 9 - Favorable business conditions may bring about...Ch. 9 - Prob. 17CDQCh. 9 - Prob. 9.1ECh. 9 - Vertical analysis of income statement The...Ch. 9 - Common-sized income statement Revenue and expense...Ch. 9 - Prob. 9.4ECh. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Current position analysis The bond indenture for...Ch. 9 - Accounts receivable analysis The following data...Ch. 9 - Prob. 9.10ECh. 9 - Inventory analysis The following data were...Ch. 9 - Inventory analysis Costco Wholesale Corporation...Ch. 9 - Ratio of liabilities to stockholders' equity and...Ch. 9 - Prob. 9.14ECh. 9 - Debt ratio, ratio of liabilities to stockholders'...Ch. 9 - Prob. 9.16ECh. 9 - Profitability metrics The following selected data...Ch. 9 - Profitability metrics Macy's, Inc. (M). sells...Ch. 9 - Seven metrics The following data were taken from...Ch. 9 - Prob. 9.20ECh. 9 - Prob. 9.21ECh. 9 - Prob. 9.22ECh. 9 - Unusual income statement items Assume that the...Ch. 9 - Horizontal analysis for income statement For 20Y3....Ch. 9 - Horizontal analysis for income statement For 20Y3....Ch. 9 - Prob. 9.2.1PCh. 9 - Prob. 9.2.2PCh. 9 - Effect of transactions on current position...Ch. 9 - Effect of transactions on current position...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Prob. 9.4.7PCh. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Prob. 9.4.20PCh. 9 - Trend analysis Critelli Company has provided the...Ch. 9 - Trend analysis Critelli Company has provided the...Ch. 9 - Prob. 9.1CCh. 9 - Prob. 9.2CCh. 9 - Prob. 9.3CCh. 9 - Prob. 9.4.1CCh. 9 - Prob. 9.4.2CCh. 9 - Prob. 9.4.3CCh. 9 - Comprehensive profitability and solvency analysis...Ch. 9 - Comprehensive profitability and solvency analysis...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analyzing Inventory The recent financial statements of McLelland Clothing Inc. include the following data: Required: 1. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the FIFO inventory costing method. Be sure to explain what each ratio means. 2. Calculate McLellands gross profit ratio (rounded to two decimal places), inventory turnover ratio (rounded to three decimal places), and the average days to sell inventory (assume a 365-day year and round to two decimal places) using the LIFO inventory costing method. Be sure to explain what each ratio means. 3. CONCEPTUAL CONNECTION Which ratios-the ones computed using FIFO or LIFO inventory values-provide the better indicator of how successful McLelland was at managing and controlling its inventory?arrow_forwardLast year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardInventory Analysis Singleton Inc. reported the following information for the current year: Required: Compute Singletons (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Note: Round all answers to two decimal places.)arrow_forward

- Inventory Analysis Callahan Company reported the following information for the current year. Required: 1. Compute Callahans (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Round all answers to two decimal places.) 2. Explain the meaning of each number.arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardInventory Analysis The following account balances are taken from the records of Lewis Inc., a wholesaler of fresh fruits and vegetables: Required Compute Lewiss inventory turnover ratio for 2016 and 2015. Compute the number of days sales in inventory for 2016 and 2015. Assume 360 days in a year. Comment on your answers in parts (1) and (2) relative to the companys management of inventory over the two years. What problems do you see in its inventory management?arrow_forward

- Retail method; gross profit method Selected data on inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Instructions 1. Determine the estimated cost of the inventory of Jaffe Co. on February 28 by the retail method, presenting details of the computations. 2. a. Estimate the cost of the inventory of Coronado Co. on October 31 by the gross profit method, presenting details of the computations. b. Assume that Coronado Co. took a physical inventory on October 31 and discovered that 366,500 of inventory was on hand. What was the estimated loss of inventory due to theft or damage during May through October?arrow_forwardFinancial statement data for years ending December 31 for Tango Company follow: a. Determine the inventory turnover for 20Y7 and 20Y6. b. Determine the days sales in inventory for 20Y7 and 20Y6. Use 365 days and round to one decimal place. c. Does the change in inventory turnover and the days sales in inventory from 20Y6 to 20Y7 indicate a favorable or an unfavorable trend?arrow_forwardFinancial statement data for years ending December 31 for Holland Company follow: a. Determine the inventory turnover for 20Y4 and 20Y3. b. Determine the days sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decimal place. c. Does the change in inventory turnover and the days sales in inventory from 20Y3 to 20Y4 indicate a favorable or an unfavorable trend?arrow_forward

- Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following transactions: a. Made credit sales of $825,000. The cost of the merchandise sold was $560,000. b. Collected accounts receivable in the amount of $752,600. c. Purchased goods on credit in the amount of $574,300. d. Paid accounts payable in the amount of $536,200. Required: Prepare the journal entries necessary to record the transactions. Indicate whether each transaction increased cash, decreased cash, or had no effect on cash.arrow_forwardMonster Beverage Corporation (MNST) develops, markets, and sells energy and other alternative beverage brands. Brown-Forman Corporation (BF.B) manufactures and sells a wide variety of spirit and wine beverages, such as Jack Daniels. The cost of goods sold and inventory were obtained from a recent annual report for both companies as follows (in millions): a. Determine the inventory turnover for both companies. Round all calculations to one decimal place. b. Determine the number of days sales in inventory for both companies. Use 365 days and round all calculations to one decimal place. c. Interpret the difference in inventory efficiency based on the companies respective product types.arrow_forwardThe general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies: a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place. b. Determine the number of days sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place. c. Interpret these results based on each companys merchandising concept.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License