Hasbro Mattel Liabilities: $ 1,064,647 $ 1,645,572 Current liabilities Long-term debt 1,547,115 1,800,000 Other liabilities 404,883 473,863 $ 3,016,645 $ 3,919,435 Total liabilities Stockholders' equity: $ 104,847 $ 441,369 Common stock Additional paid in capital Retained earnings 893,630 1,789,870 3,852,321 3,745,815 Accumulated other comprehensive loss and other equity items Treasury stock, at cost Total stockholders' equity (146,001) (848,899) (3,040,895) (2,494,901) $ 1,663,902 $ 4,680,547 $ 2,633,254 $ 6,522,689 Total liabilities and stockholders'equity The income from operations and interest expense from the income statement for each company were as follows (in thousands): Hasbro Mattel Income from operations (before income tax) $603,915 $463,915 97,122 Interest expense 85,270

Hasbro Mattel Liabilities: $ 1,064,647 $ 1,645,572 Current liabilities Long-term debt 1,547,115 1,800,000 Other liabilities 404,883 473,863 $ 3,016,645 $ 3,919,435 Total liabilities Stockholders' equity: $ 104,847 $ 441,369 Common stock Additional paid in capital Retained earnings 893,630 1,789,870 3,852,321 3,745,815 Accumulated other comprehensive loss and other equity items Treasury stock, at cost Total stockholders' equity (146,001) (848,899) (3,040,895) (2,494,901) $ 1,663,902 $ 4,680,547 $ 2,633,254 $ 6,522,689 Total liabilities and stockholders'equity The income from operations and interest expense from the income statement for each company were as follows (in thousands): Hasbro Mattel Income from operations (before income tax) $603,915 $463,915 97,122 Interest expense 85,270

Chapter12: Capital Structure

Section: Chapter Questions

Problem 1PROB

Related questions

Question

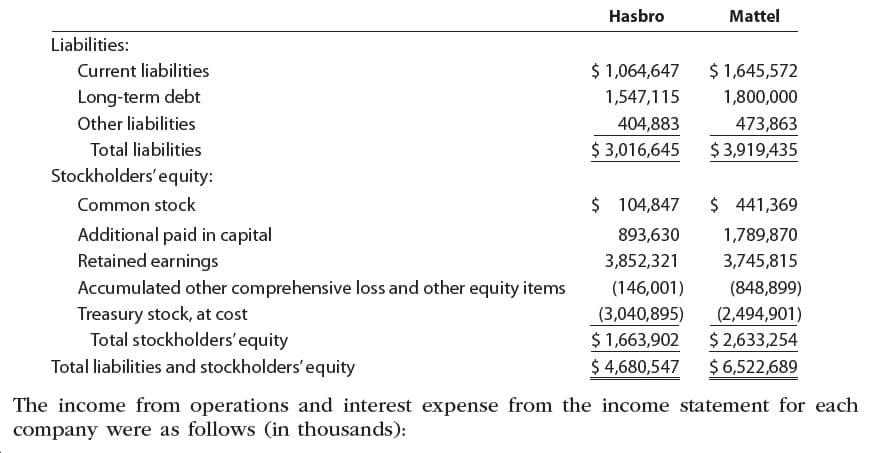

Hasbro, Inc. and Mattel, Inc. are the two largest toy companies in North America. Condensed liabilities and

Please see the attachment for details:

a. Determine the ratio of liabilities to stockholders’ equity for both companies. Round to

one decimal place.

b. Determine the times interest earned ratio for both companies. Round to one decimal

place.

c. Interpret the ratio differences between the two companies.

Transcribed Image Text:Hasbro

Mattel

Liabilities:

$ 1,064,647

$ 1,645,572

Current liabilities

Long-term debt

1,547,115

1,800,000

Other liabilities

404,883

473,863

$ 3,016,645

$ 3,919,435

Total liabilities

Stockholders' equity:

$ 104,847

$ 441,369

Common stock

Additional paid in capital

Retained earnings

893,630

1,789,870

3,852,321

3,745,815

Accumulated other comprehensive loss and other equity items

Treasury stock, at cost

Total stockholders' equity

(146,001)

(848,899)

(3,040,895)

(2,494,901)

$ 1,663,902

$ 4,680,547

$ 2,633,254

$ 6,522,689

Total liabilities and stockholders'equity

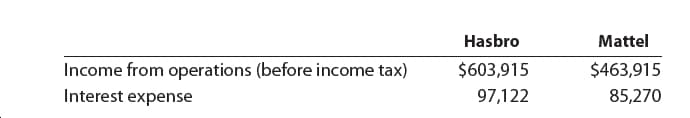

The income from operations and interest expense from the income statement for each

company were as follows (in thousands):

Transcribed Image Text:Hasbro

Mattel

Income from operations (before income tax)

$603,915

$463,915

97,122

Interest expense

85,270

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you