Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.1E

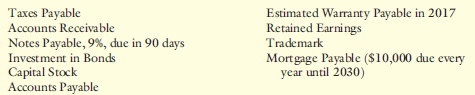

Current Liabilities

The following items are accounts on Smith’s balance sheet of December 31, 2016:

Required

Identify which of the accounts should be classified as a current liability on Smith’s balance sheet. For each item that is not a current liability, indicate the category of the balance sheet in which it would be classified. Assume the company has the following balance sheet categories: current asset; property, plant, and equipment; long-term investment; intangible asset; current liability; long-term liability; and stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(Current versus Noncurrent Classification) Rodriguez Corporation includes the following items in its liabilities at December 31, 2017.1. Notes payable, $25,000,000, due June 30, 2018.2. Deposits from customers on equipment ordered by them from Rodriguez, $6,250,000.3. Salaries and wages payable, $3,750,000, due January 14, 2018.InstructionsIndicate in what circumstances, if any, each of the three liabilities above would be excluded from current liabilities.

items appear on the balance sheet of a company with a one-year operating cycle. Identifythe proper classification of each item as follows: C if it is a current liability, L if it is a long-term liability,or N if it is not a liability. Current portion of long-term debt.

Q.Relax Company provided the following information for the purpose of presenting the statement of financial position on December 31, 2020:

Retained Earnings 87,600

Cash 32,800

Common stock 20,000

Inventory 39,800

Long-term liabilities 25,000

Leasehold Improvements 100,000

Accrued Expenses 1,000

Accumulated Depreciation (2,000)

Accounts Payable 49,000

Trademarks 20,000

Accumulated Amortization (8,000)

Required: Prepare in good form a properly classified statement of financial position on December 31,2020 with supporting notes and computations.

Chapter 9 Solutions

Financial Accounting: The Impact on Decision Makers

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forwardComprehensive: Balance Sheet, Schedules, and Notes The following is an alphabetical listing of Stone Boat Companys balances sheet accounts and account balances on December 31, 2019: Additional information: 1. The company reports on the balance sheet the net book value of property and equipment and long-term liabilities (known as control accounts). The related details are disclosed in the notes. 2. The straight-line method is used to depreciate property and equipment based upon cost, estimated residual value, and estimated life. The costs of the assets in this account are: land, 29,500; buildings, 164,600; store fixtures, 72,600; and office equipment, 30,000. 3. The accumulated depreciation breakdown is as follows: buildings, 54,600; store fixtures, 37,400; and office equipment, 17,300. 4. The long term debt includes 12%, 36,000 face value bonds that mature on December 31, 2024, and have an unamortized bond discount of 1,000; 11%, 48,000 face value bonds that mature on December 31, 2025, have a premium on bonds payable of 1,800, and whose retirement is being funded by a bond sinking fund; and a 13% note payable that has a face value of 6,200 and matures on January 1, 2022. 5. The non-interest-bearing note receivable matures on June 1, 2023. 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affiliate is carried at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bonds issued by this affiliate, Jay Company. 8. Common stock has a 10 par value per share, 10,000 shares are authorized, and 1,000 shares were issued during 2019 at a price of 13 per share, resulting in 8,000 shares issued at year-end. 9. Preferred stock has a 50 par value per share, 2,000 shares are authorized, and 140 shares were issued during 2019 at a price of 55 per share, resulting in 640 shares issued at year-end. 10. On January 15, 2020, before the December 31, 2019, balance sheet was issued, a building with a cost of 20,000 and a book value of 7,000 was totally destroyed. Insurance proceeds will amount to only 5,000. 11. Net income and dividends declared and paid during the year were 50,500 and 21,000, respectively. Required: 1. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). 2. Prepare a statement of shareholders equity for 2019. (Hint: Work back from the ending account balances.) 3. Prepare notes that itemize the balance sheet control accounts and those necessary to disclose any company accounting policies, contingent liabilities, and subsequent events. 4. Next Level Compute the debt-to-assets ratio at the cud of 2019. What is your evaluation of this ratio if it was 39% at the end of 2018? Use the following information for P415 and P416: McCormick Company, Inc. is one of the worlds leading producers of spices, herbs, seasonings, condiments, and other flavorings for foods. Its products are sold to consumers, with sonic of the leading brands of spices and seasonings, as well as to industrial producers of foods. McCormicks consolidated balance sheets for 20X2 and 20X3 follow.arrow_forwardInvestments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.arrow_forward

- On September 1, 2019, a company borrowed cash and signed a 1-year,interest-bearing note on which both the principal and interest arepayable on September 1, 2021. How will the note payable and the relatedinterest be classified in the December 31, 2019, balance sheet? Note Payable Accrued Interest a. Current liabilityb. Noncurrent liabilityc. Current liabilityd. Noncurrent liability Noncurrent liabilityCurrent liabilityCurrent liabilityNo entryarrow_forwardAnalyze your company’s liability section of the comparative balance sheets. Has the composition of current and long-term liabilities changed significantly over the period? Explain? Liabilities and Equity sections of Walmart's Balance Sheet As of January 31, (Amounts in millions) 2019 2018 LIABILITIES AND EQUITY Current liabilities: Short-term borrowings $ 5,225 $ 5,257 Accounts payable 47,060 46,092 Accrued liabilities 22,159 22,122 Accrued income taxes 428 645 Long-term debt due within one year 1,876 3,738 Capital lease and financing obligations due within one year 729 667 Total current liabilities 77,477 78,521 Long-term debt 43,520 30,045 Long-term capital lease and financing obligations 6,683 6,780 Deferred income taxes and other 11,981 8,354 Total liabilities 139,661 123,700arrow_forwardPresented below are long-term liability items for Crane Company at December 31, 2020. Bonds payable, due 2022 $575,000 Lease liability 70,000 Notes payable, due 2025 80,000 Discount on bonds payable 37,375 Prepare the long-term liabilities section of the balance sheet for Crane Company. (Enter account name only and do not provide descriptive information.) Crane CompanyBalance Sheet (Partial) For the Month Ended December 31, 2020For the Year Ended December 31, 2020December 31, 2020 Current AssetsCurrent LiabilitiesIntangible AssetsLong-term InvestmentsLong-term LiabilitiesProperty, Plant and EquipmentStockholders' EquityTotal AssetsTotal Current AssetsTotal Current LiabilitiesTotal Intangible AssetsTotal LiabilitiesTotal Liabilities and Stockholders' EquityTotal Long-term InvestmentsTotal Long-term LiabilitiesTotal Property, Plant and EquipmentTotal Stockholders’ Equity $ Add Less :…arrow_forward

- Under IFRS 15, what is the net income/(loss) to be reported by the company for the years ended December 31, 2017 and 2018? A. 30M and (15M) B. 50M and (10M) C. 60M and (15M) D. 40M and (15M)arrow_forwardReporting liabilities on the balance sheet and computing debt to equity ratio The accounting records of Compass Wireless include the following as of December 31, 2018: Requirements Report these liabilities on the Compass Wireless balance sheet, including headings and totals for current liabilities and long-term liabilities. Compute Compass Wireless’s debt to equity ratio at December 31, 2018.arrow_forwardMorlan Corporation is preparing its December 31, 2017, financial statements. Two events that occurred betweenDecember 31, 2017, and March 10, 2018, when the statements were issued, are described below.1. A liability, estimated at $160,000 at December 31, 2017, was settled on February 26, 2018, at $170,000.2. A flood loss of $80,000 occurred on March 1, 2018.What effect do these subsequent events have on 2017 net income?arrow_forward

- Assume on December 1, 2017, a company borrows funds to purchase equipment. The company will make the following principal payments: 2018, $5,200 2019, $3,400 2020, $2,207 2021, $1,434 On December 31, 2018, the total long term liabilities will be $______arrow_forwardBaggett Company’s balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: 1. Prepare a December 31,2019, balance sheet for Baggett. 2. Compute the debt-to-assets ratio.arrow_forwardMarigold Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost $51,100 Fair value 42,200 Expected credit losses 12,600 A. What is the amount of credit loss that marigold should report on this available-for-sale security at december 31, 2020? Amount of the credit loss $ 8,900 B. Prepare the journal entry to record the credit loss, if any ( and other adjustments needed), at December 31, 2020? date account titles and explanations debit credit 12/31/20 8,900 8,900 Please note that the answer is NOT Debit Loss on available for sale debt securities and Credit avilable for sale debt securities. These are the account titles I can choose from... Accumulated Other…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Current assets and current liabilities; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Jw4TaiP42P4;License: Standard youtube license