Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

Requirement 1:

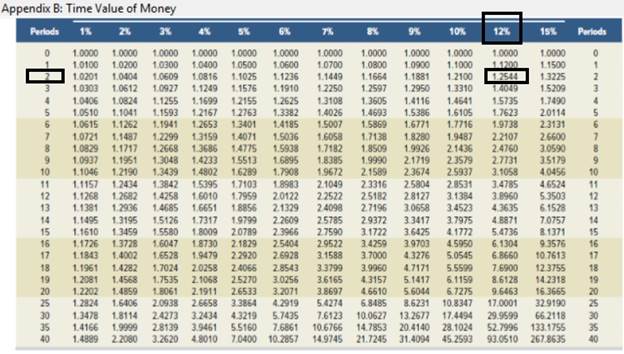

Interest rate column and number-of-periods row when 12% annual rate, compounded annually.

Answer to Problem 1QS

Interest rate column = 12th column (Which is given under 12% interest rate).

Number-of-periods row = 3rd row (Which is given in front of 2 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate is given = 12%

Number of periods are given = 2

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 12th column (Which is given under 12% interest rate).

Number-of-periods row = 3rd row (Which is given infront of 2 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

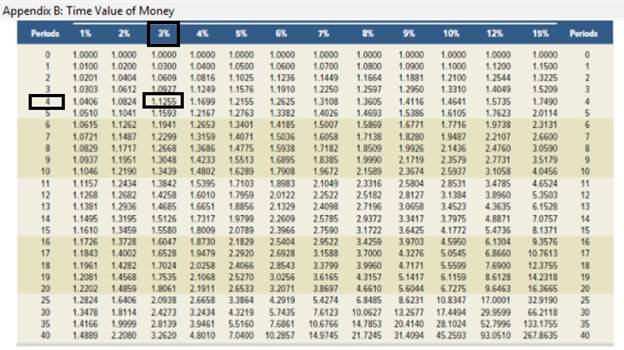

Requirement 2:

Interest rate column and number-of-periods row when 6% annual rate, compounded semiannually.

Answer to Problem 1QS

Interest rate column = 3rdcolumn (Which is given under 3% interest rate).

Number-of-periods row = 5th row (Which is given infront of 4 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate (6% / 2) = 3%

Number of periods (2 x 2) = 4

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 3rd column (Which is given under 3% interest rate).

Number-of-periods row = 5th row (Which is given infront of 4 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

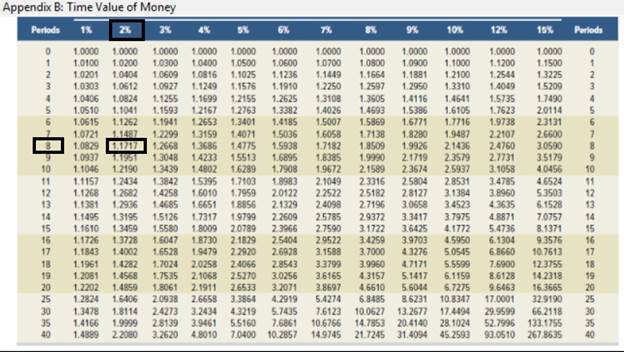

Requirement 3:

Interest rate column and number-of-periods row when 8% annual rate, compounded quarterly.

Answer to Problem 1QS

Interest rate column = 2nd column (Which is given under 2% interest rate).

Number-of-periods row = 9th row (Which is given infront of 8 number period).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate per period (8% / 4) = 2%

Number of periods (2 x 4) = 8

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 2nd column (Which is given under 2% interest rate).

Number-of-periods row = 9th row (Which is given infront of 8 number period).

Concept Introduction:

Future value:

Future value refers to the amount to be received in future time. In other words we can say that money that will be received after some time which is calculated with the help of interest rate and number of period interest compunded is known as future value.

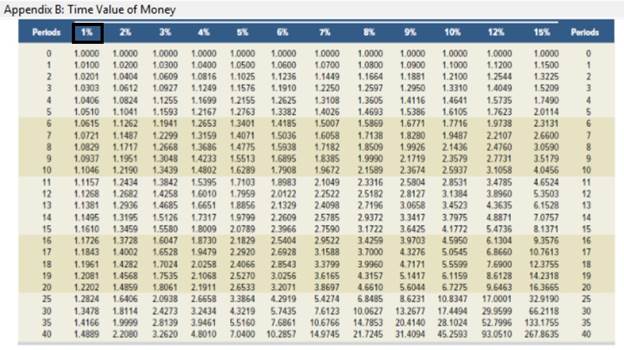

Requirement 4:

Interest rate column and number-of-periods row when 12% annual rate, compounded monthly.

Answer to Problem 1QS

Interest rate column = 1stcolumn (Which is given under 1% interest rate).

Number-of-periods row = Not given in the table (n = 24).

Explanation of Solution

Future value is calculated with the help of following formula;

Interest rate per period (12% / 12) = 1%

Number of periods (2 x 12) = 24

As per Table B.2, we will use column and row as follow;

Thus,

Interest rate column = 1st column (Which is given under 1% interest rate).

Number-of-periods row = Not given in the table (n = 24)

Want to see more full solutions like this?

Chapter B Solutions

Fundamental Accounting Principles

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education