College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter C, Problem 2P

Use the information presented in Problem C-1 to solve this problem.

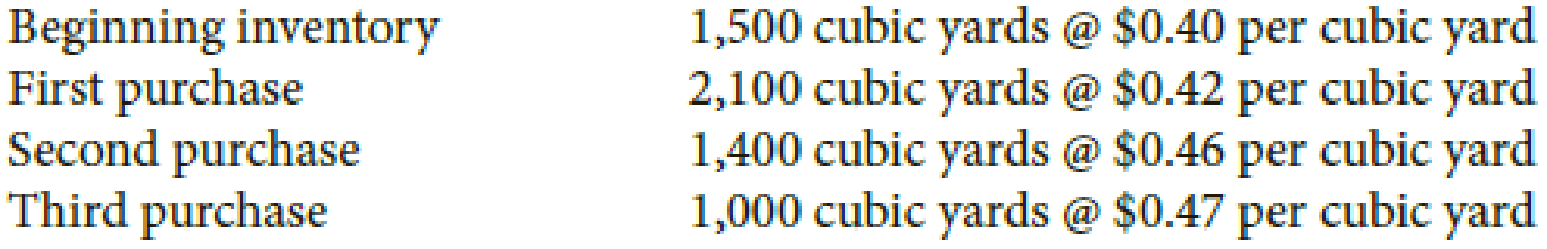

Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of the ending inventory by the first-in, first-out method.

Check Figure

Cost of ending inventory, $562

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the following information for the Quick Study below.

Trey Monson starts a merchandising business on December 1 and enters into three inventory purchases:

Purchases on December 7

15 units @ $18.00 cost

Purchases on December 14

29 units @ $27.00 cost

Purchases on December 21

25 units @ $32.00 cost

QS 5-11 Periodic: Inventory costing with LIFO LO P1

Required:Monson sells 25 units for $45 each on December 15. Assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Amounts to be deducted should be indicated with a minus sign. Round cost per units to 2 decimals.)

Next Visit question map

the next two questions use the following facts. The Corner Frame Shop wants to know theeffect of different inventory costing methods on its financial statements. Inventory and purchases data for June are:Units Unit Cost Total CostJun 1 Beginning inventory 2,500 $11.00 $27,5004 Purchase 1,800 $11.80 21,2409 Sale (1,900)Q6-48. If The Corner Frame Shop uses the FIFO method, the cost of the ending inventory will bea. $21,200.b. $20,900.c. $21,240.d. $27,840.

A home improvement store, like Lowe’s, carries the following items:

Inventory Items

Quantity

Unit Cost

Unit NRV

Hammers

100

$6.80

$7.30

Saws

50

9.80

8.80

Screwdrivers

130

1.80

2.40

Drills

40

24.80

21.60

One-gallon paint cans

160

5.30

4.80

Paintbrushes

180

5.80

6.30

Required:

1. Compute the total cost of inventory.2. Determine whether each inventory item would be reported at cost or net realizable value, and then place that unit amount in the “Lower of Cost and NRV per unit” column. Multiply the quantity of each inventory item by the appropriate cost or NRV unit amount and place the total in the “Total” column.3. Record any necessary adjusting entry to write down inventory from cost to net realizable value.4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory.

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Find more solutions based on key concepts

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals. Check Figure Cost of ending inventory, 519.24arrow_forwardThe following is an excerpt from a conversation between Paula Marlo, the warehouse manager for Musick Foods Wholesale Co., and its accountant, Mike Hayes. Musick Foods operates a large regional warehouse that supplies produce and other grocery products to grocery stores in smaller communities. Paula: Mike, can you explain whats going on here with these monthly statements? Mike: Sure, Paula. How can I help you? Paula: I dont understand this last-in, first-out inventory procedure. It just doesnt make sense. Mike: Well, what it means is that we assume that the last goods we receive are the first ones sold. So the inventory consists of the items we purchased first. Paula: Yes, but thats my problem. It doesnt work that way! We always distribute the oldest produce first. Some of that produce is perishable! We cant keep any of it very long or itll spoil. Mike: Paula, you dont understand. We only assume that the products we distribute are the last ones received. We dont actually have to distribute the goods in this way. Paula: I always thought that accounting was supposed to show what really happened. It all sounds like make believe to me! Why not report what really happens? Respond to Paulas concerns.arrow_forwardYou own a clothing store and use a periodic inventory system. Research like companies in the clothing industry and answer the following questions. Which inventory system is most used in clothing stores, periodic or perpetual? Why can periodic inventory reporting be a better approach to use than perpetual inventory reporting for this type of industry? What are some of the advantages and disadvantages to the periodic inventory method? What other types of businesses may use the periodic inventory method rather than the perpetual method?arrow_forward

- Lower of Cost or Market Shaw Systems sells a limited line of specially made products, using television advertising campaigns in large cities. At year end, Shaw has the following data for its inventory: Required: 1. Compute the carrying value of the ending inventory using the lower of cost or market rule applied on an item-by-item basis. 2. Prepare the journal entry required to value the inventory at lower of cost or market. 3. CONCEPTUAL CONNECTION What is the impact of applying the lower of cost or market rule on the financial statements of the current period? What is the impact on the financial statements of a subsequent period in which the inventory is sold?arrow_forwardUncle Butchs Hunting Supply Shop reports the following information related to inventory: Calculate Uncle Butchs ending inventory using the retail inventory method under the FIFO cost flow assumption. Round the cost-to-retail ratio to 3 decimal places.arrow_forwardUse the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.arrow_forward

- Beginning inventory, purchases, and sales data for portable game players are as follows: The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of the merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. b. Based upon the preceding data, would you expect the inventory to be higher or lower using the last-in, first-out method?arrow_forwardLower of Cost or Market Merediths Appliance Store has the following data for the items in its inventory at the end of the accounting period: Required: 1. Compute the carrying value of Merediths ending inventory using the lower of cost or market rule applied on an item-by-item basis. 2. Prepare the journal entry required to value the inventory at lower of cost or market. 3. CONCEPTUAL CONNECTION What is the conceptual justification for valuing inventory at the lower of cost or market?arrow_forwardA home improvement store, like Lowe’s, carries the following items:Required:1. Compute the total cost of inventory.2. Determine whether each inventory item would be reported at cost or net realizable value. Multiply the quantity of each inventory item by the appropriate cost or NRV amount and place the total in the “Lower of Cost and NRV” column. Then determine the total of that column.3. Compare your answers in requirement 1 and requirement 2 and then record any necessary adjustment to write down inventory from cost to net realizable value.4. Discuss the financial statement effects of using lower of cost and net realizable value to report inventory.arrow_forward

- help me The following information is taken from the records of Wildlife Florist. The company usesthe perpetual inventory system.Date Description Units Unit Cost (RM)Dec1 Opening inventory 200 20Dec 5 Sale 108Dec 6 Purchase 200 18Dec 12 Purchase 125 17Dec 13 Sale 300Dec 19 Purchase 350 21Dec 29 Purchase 150 18Dec 30 Sale 4005Required:-a. Calculate cost of goods sold and the cost of ending inventory under each of thefollowing inventory cost flow assumptions:i. FIFO.ii. Weighted average.arrow_forwardThe following is an excerpt from a conversation between Paula Marlo, the warehouse manager for Musick Foods Wholesale Co., and its accountant, Mike Hayes. Musick Foods operates a large regional warehouse that supplies produce and other grocery products to grocery stores in smaller communities.Paula: Mike, can you explain what’s going on here with these monthly statements?Mike: Sure, Paula. How can I help you?Paula: I don’t understand this last-in, first-out inventory procedure. It just doesn’t make sense.Mike: Well, what it means is that we assume that the last goods we receive are the first ones sold. So the inventory consists of the items we purchased first.Paula: Yes, but that’s my problem. It doesn’t work that way! We always distribute the oldest produce first. Some of that produce is perishable! We can’t keep any of it very long or it’ll spoil.Mike: Paula, you don’t understand. We only assume that the products we distribute are the last ones received. We don’t actually have to…arrow_forwardSport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $130. Description Units Unit Cost Mar. 1 Beginning Inventory 19 $ 44 Mar. 3 Purchase 64 $ 49 Mar. 6 Purchase 114 $ 54 Mar. 17 Sale 59 Mar. 23 Purchase 58 $ 54 Mar. 31 Sale 148 Required: Calculate the cost of goods sold and ending inventory under the perpetual inventory system using the following methods. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License