Concept explainers

Use the information presented in Problem C-1 to solve this problem.

Required

Find the cost of the ending inventory by the last-in, first-out method.

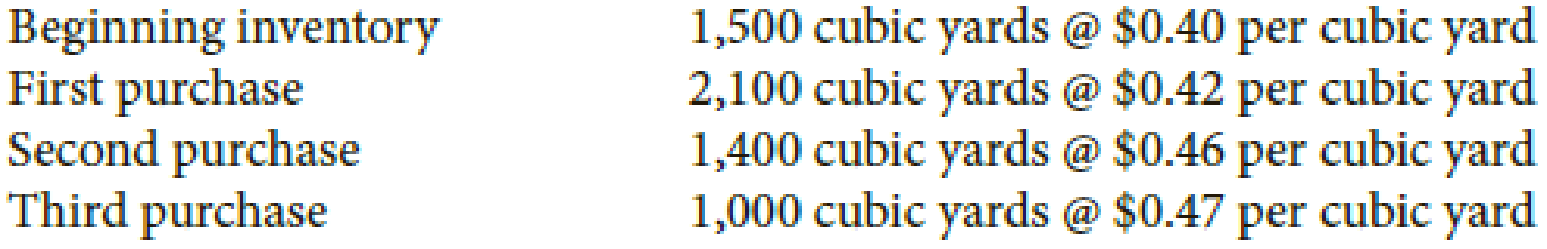

PROBLEM C-1 Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $480

Want to see the full answer?

Check out a sample textbook solution

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Advanced Financial Accounting

Managerial Accounting

Principles Of Taxation For Business And Investment Planning 2020 Edition

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting

Accounting for Governmental & Nonprofit Entities

- Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals. Check Figure Cost of ending inventory, 519.24arrow_forwardUse the information presented in Problem C-1 to solve this problem. Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of the ending inventory by the first-in, first-out method. Check Figure Cost of ending inventory, $562arrow_forwardLower of Cost or Market Shaw Systems sells a limited line of specially made products, using television advertising campaigns in large cities. At year end, Shaw has the following data for its inventory: Required: 1. Compute the carrying value of the ending inventory using the lower of cost or market rule applied on an item-by-item basis. 2. Prepare the journal entry required to value the inventory at lower of cost or market. 3. CONCEPTUAL CONNECTION What is the impact of applying the lower of cost or market rule on the financial statements of the current period? What is the impact on the financial statements of a subsequent period in which the inventory is sold?arrow_forward

- Lower of Cost or Market Merediths Appliance Store has the following data for the items in its inventory at the end of the accounting period: Required: 1. Compute the carrying value of Merediths ending inventory using the lower of cost or market rule applied on an item-by-item basis. 2. Prepare the journal entry required to value the inventory at lower of cost or market. 3. CONCEPTUAL CONNECTION What is the conceptual justification for valuing inventory at the lower of cost or market?arrow_forwardThe following is an excerpt from a conversation between Paula Marlo, the warehouse manager for Musick Foods Wholesale Co., and its accountant, Mike Hayes. Musick Foods operates a large regional warehouse that supplies produce and other grocery products to grocery stores in smaller communities. Paula: Mike, can you explain whats going on here with these monthly statements? Mike: Sure, Paula. How can I help you? Paula: I dont understand this last-in, first-out inventory procedure. It just doesnt make sense. Mike: Well, what it means is that we assume that the last goods we receive are the first ones sold. So the inventory consists of the items we purchased first. Paula: Yes, but thats my problem. It doesnt work that way! We always distribute the oldest produce first. Some of that produce is perishable! We cant keep any of it very long or itll spoil. Mike: Paula, you dont understand. We only assume that the products we distribute are the last ones received. We dont actually have to distribute the goods in this way. Paula: I always thought that accounting was supposed to show what really happened. It all sounds like make believe to me! Why not report what really happens? Respond to Paulas concerns.arrow_forwardUncle Butchs Hunting Supply Shop reports the following information related to inventory: Calculate Uncle Butchs ending inventory using the retail inventory method under the FIFO cost flow assumption. Round the cost-to-retail ratio to 3 decimal places.arrow_forward

- Use the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.arrow_forwardShown below is activity for one of the products of Monique Aaron Corp Purchases Sales # Units $ per Unit # Units $ per Unit 1-Jan 500 55 10-Jan 500 60 12-Jan 800 75 20-Jan 1000 63 28-Jan 750 80 Compute the ending inventory, cost of goods available for sale, cost of goods sold in both units and dollars and the Gross Profit assuming the company uses the perpetual Lifo and perpetual fifo methods.arrow_forwardCity Bicycle, a cycling store has a beginning inventory of one bi-level touring bicycle 1, for which it paid $2,500. Suppose that during the period the store purchases bi-level touring bicycle 2 for $2,900 and bi-level touring bicycle 3 for $3,000, and that it sells one bicycle for $5,500. The three bicycles are physically identical; only their acquisition costs differ because they were purchased at different times. Suppose City Bicycle uses the FIFO cost-flow assumption. The cost of goods sold is _____; and the ending inventory is _______. Select one: a. Cannot be determined with the information given. b. $2,800; $5,600 c. $2,500; $5,900 d. $3,000; $5,400 e. $2,900; $5,500arrow_forward

- Ravenna Candles recently purchased candleholders for resale in its shops. Which of thefollowing costs would be part of the cost of the candleholder inventory?a. Advertising costsb. Freight inc. Freight outd. Purchasing agent wagesarrow_forwardHuddell Company, which is both a wholesaler and retailer, purchases merchandise from various suppliers. Thedollar-value LIFO method is used for the wholesale inventories.Huddell determines the estimated cost of its retail ending inventories using the conventional retail inventorymethod, which approximates lower of average cost or market.Required:1. a. What are the advantages of using the dollar-value LIFO method as opposed to the traditional LIFOmethod?b. How does the application of the dollar-value LIFO method differ from the application of the traditionalLIFO method?2. a. In the calculation of the cost-to-retail percentage used to determine the estimated cost of its ending inventories, how should Huddell use∙ Net markups?∙ Net markdowns?b. Why does Huddell’s retail inventory method approximate lower of average cost or market?arrow_forwardUse the following information for the Quick Study below. Trey Monson starts a merchandising business on December 1 and enters into three inventory purchases: Purchases on December 7 15 units @ $18.00 cost Purchases on December 14 29 units @ $27.00 cost Purchases on December 21 25 units @ $32.00 cost QS 5-11 Periodic: Inventory costing with LIFO LO P1 Required:Monson sells 25 units for $45 each on December 15. Assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Amounts to be deducted should be indicated with a minus sign. Round cost per units to 2 decimals.) Next Visit question maparrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,