Name Number of Shares Total Cost Total Fair Value $ 44,800 $ 40,000 Griffin Inc. 1,600 Luck Company 1,250 37,500 33,750 Wilson Company 1,000 40,000 37,000 Total $117,500 $115,550

Name Number of Shares Total Cost Total Fair Value $ 44,800 $ 40,000 Griffin Inc. 1,600 Luck Company 1,250 37,500 33,750 Wilson Company 1,000 40,000 37,000 Total $117,500 $115,550

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 17E

Related questions

Question

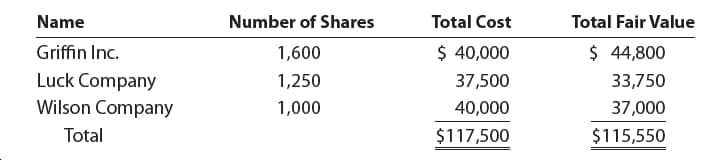

Gruden Bancorp Inc. purchased a portfolio of trading securities during Year 1. The cost and fair value of this portfolio on December 31, Year 1, was as follows:

Please see the attachment for details:

On May 10, Year 2, Gruden Bancorp Inc. purchased 1,200 shares of Carroll Inc. at $29 per share plus a $100 brokerage commission.

Provide the

a. The adjustment of the trading security portfolio to fair value on December 31, Year 1.

b. The May 10, Year 2, purchase of Carroll Inc. stock.

Transcribed Image Text:Name

Number of Shares

Total Cost

Total Fair Value

$ 44,800

$ 40,000

Griffin Inc.

1,600

Luck Company

1,250

37,500

33,750

Wilson Company

1,000

40,000

37,000

Total

$117,500

$115,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning