The relation between the

Explanation of Solution

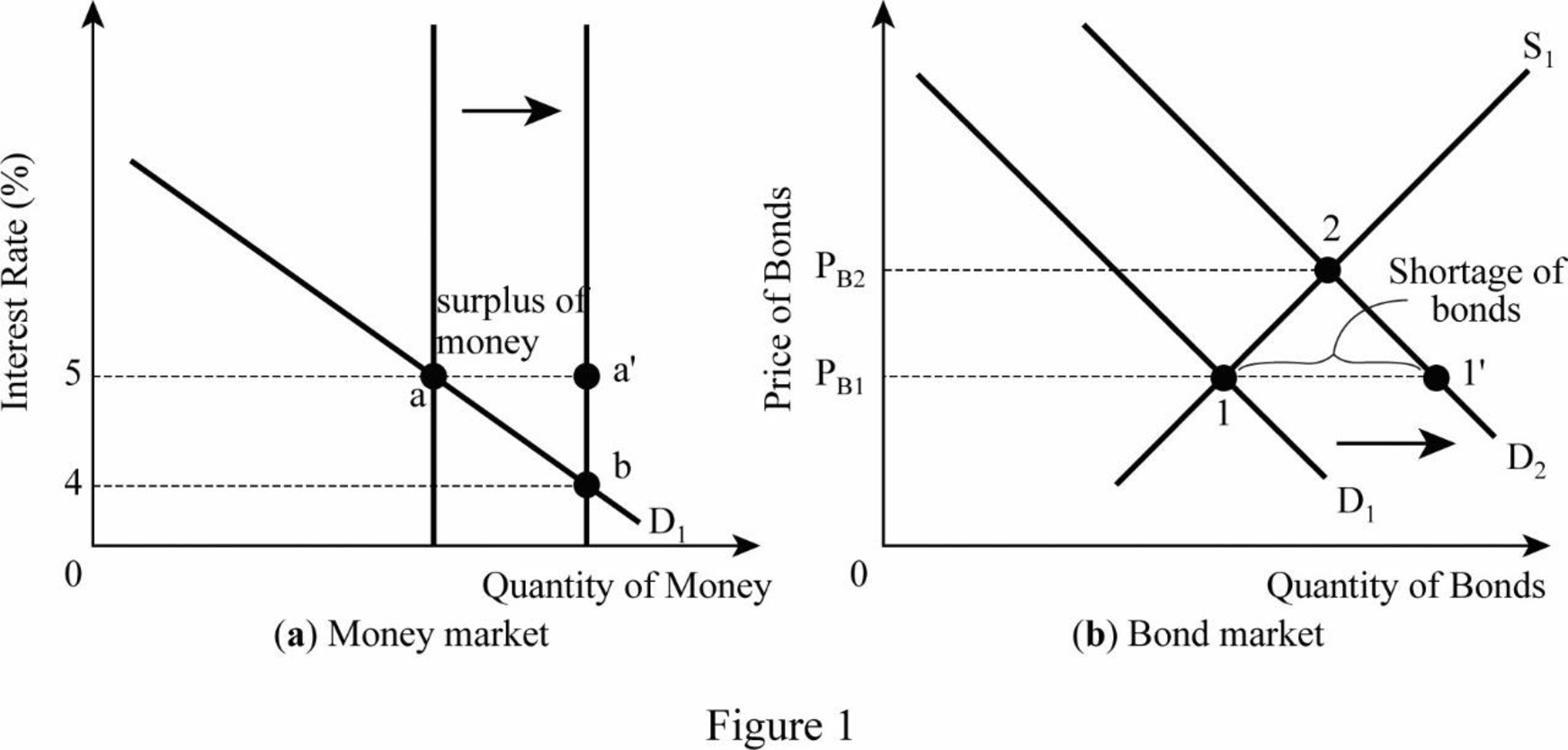

The inverse relation between the bond price and its interest rate is shown in the figure below:

According to the diagram, initially, the

Bond price: Bond price is the present value of a bond compared to its future promises of pay. It is inversely related to its interest rate.

Want to see more full solutions like this?

Chapter D Solutions

Economics (MindTap Course List)

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning