Concept explainers

Plantwide and Departmental

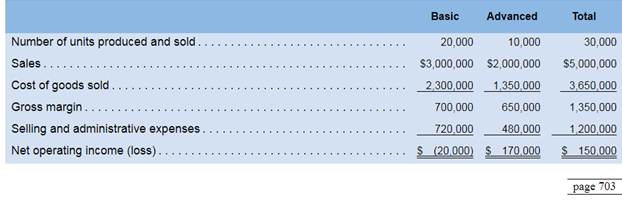

Koontz Company manufactures two models of industrial components−a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars):

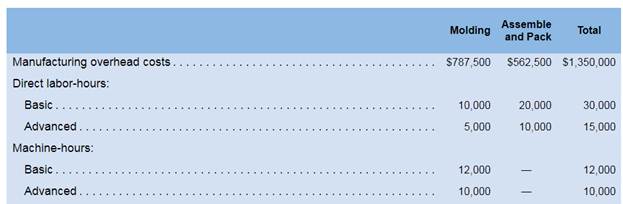

Direct laborers are paid S20 per hour. Direct materials cost $40 per unit for the Basic model and S60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's Molding Department would be allocated based on machine-hours and the overhead costs in its Assemble and Pack Department would be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information:

Required:

1. Using the plantwide approach:

a. Calculate the plantwide overhead rate.

b. Calculate the amount of overhead that would be assigned to each product.

2.Using a departmental approach:

a. Calculate the departmental overhead rates.

b.Calculate the total amount of overhead that would be assigned to each product.

c.Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars).

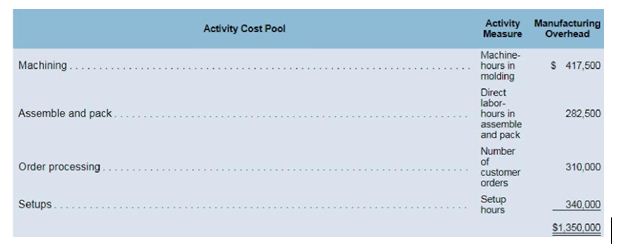

3.Koontz's production manager has suggested using activity-based costing instead of either the plantwide or departmental approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to four activity cost pools as follows:

She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is requited for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model.

Using the additional information provided by the production manager calculate:

a, An activity rate for each activity cost pool.

b.The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach.

4.The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising expenses include $150.000 for the Basic model and $200,000 for the Advanced model, The remainder of the company's selling and administrative costs are common fixed expenses.

Prepare a contribution format segmented income statement that is adapted from Exhibit 7-8. Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common fixed expenses. Use your activity-based cost assignments from requirement 3 to assign the

5. Using your contribution format segmented income statement from requirement 5, calculate the break-even point in dollar sales for the Advanced model.

6. Explain how Koontz's activity-based costing approach differs from its planrwide and departmental approaches. Also. explain how the controller's allocation of the selling and administrative expenses differs from how you accounted for these expenses within your contribution format segmented income statement.

Want to see the full answer?

Check out a sample textbook solution

Chapter IE Solutions

Introduction To Managerial Accounting

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Auditing and Assurance Services (16th Edition)

Intermediate Accounting (2nd Edition)

Fundamentals Of Financial Accounting

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

- Activity-based department rate product costing and product cost distortions Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: The activity-base usage quantities and units produced for the two products follow: Instructions Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 420,000 and 294,000 for the Subassembly and Final Assembly departments, respectively. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Determine the total and per-unit cost assigned to each product under activity-based costing. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods. production department factory overhead rate and activity-based costing methods.arrow_forwardActivity-based product costing Mello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 40 minutes per unit of machine time. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forwardActivity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 0.5 machine hour per unit. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forward

- Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardActivity cost pools, activity rates, and product costs using activity-based costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: The estimated activity-base usage and unit information for two product lines was determined as follows: A. Determine the activity rate for each activity cost pool. B. Determine the activity-based cost per unit of each product.arrow_forwardFlowchart of accounts related to service and processing departments Alcoa Inc. (AA) is the worlds largest producer of aluminum products. One product that Alcoa manufactures is aluminum sheet products for the aerospace industry. The entire output of the Smelting Department is transferred to the Rolling Department. Part of the fully processed goods from the Rolling Department are sold as rolled sheet, and the remainder of the goods are transferred to the Converting Department for further processing into sheared sheet. Prepare a chart of the flow of costs from the processing department accounts into the finished goods accounts and then into the cost of goods sold account. The relevant accounts are as follows:arrow_forward

- Production-Based Costing versus Activity-Based Costing, Assigning Costs to Activities, Resource Drivers Willow Company produces lawnmowers. One of its plants produces two versions of mowers: a basic model and a deluxe model. The deluxe model has a sturdier frame, a higher horsepower engine, a wider blade, and mulching capability. At the beginning of the year, the following data were prepared for this plant: Additionally, the following overhead activity costs are reported: Facility-level costs are allocated in proportion to machine hours (provides a measure of time the facility is used by each product). Receiving and materials handling use three inputs: two forklifts, gasoline to operate the forklift, and three operators. The three operators are paid a salary of 40,000 each. The operators spend 25% of their time on the receiving activity and 75% on moving goods (materials handling). Gasoline costs 3 per move. Depreciation amounts to 8,000 per forklift per year. Required: (Note: Round answers to two decimal places.) 1. Calculate the cost of the materials handling activity. Label the cost assignments as driver tracing or direct tracing. Identify the resource drivers. 2. Calculate the cost per unit for each product by using direct labor hours to assign all overhead costs. 3. Calculate activity rates, and assign costs to each product. Calculate a unit cost for each product, and compare these costs with those calculated in Requirement 2. 4. Calculate consumption ratios for each activity. 5. CONCEPTUAL CONNECTION Explain how the consumption ratios calculated in Requirement 4 can be used to reduce the number of rates. Calculate the rates that would apply under this approach.arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning