002.

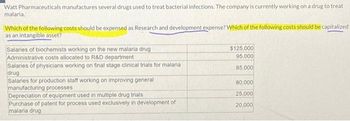

Watt Pharmaceuticals manufactures several drugs used to treat bacterial infections. The company is currently working on a drug to treat malaria. Which of the following costs should be expensed as Research and development expense? Which of the following costs should be capitalized as an intangible asset? Salaries of biochemists working on the new malaria drug Administrative costs allocated to R&D department Salaries of physicians working on final stage clinical trials for malaria drug Salaries for production staff working on improving general manufacturing processes

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- An IE works in the automation department of a surgical equipment manufacturing company that produces specially ordered equipment for hospitals. To upgrade the quality of the assembly process of the camera used in laparoscopic surgery probes, two approaches are available: make and buy. The make alternative has an initial equipment cost of $175,000, a life of 5 years, a $25,000 salvage value, a processing cost of $3,000 per camera, and an M&O cost of $65,000. The buy alternative requires contracting the assembly operation externally at a cost of $6,000 per camera. If the MARR is 12% per year, how many cameras per year must be assembled to justify the make alternative? cameras must be assembled per year to justify the make alternative.arrow_forwardP22-38 (similar to) Bobwhite Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of new high-efficiency washing machines that will allow for the laundry's status to be checked via smartphone. Bobwhite estimates the cost of the new equipment at $191,000. The equipment has a useful life of 9 years. Bobwhite expects cash fixed costs of $76,000 per year to operate the new machines, as well as cash variable costs in the amount of 5% of revenues. Bobwhite evaluates investments using a cost of capital of 10%. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Calculate the payba (Round your answer to two decimal p The payback period in years, for the 1. Requirements Calculate the payback period and the discounted payback period for this investment, assuming Bobwhite expects to generate $150,000 in incremental…arrow_forwardSandhill Communications contracted to set up a call center for the City of Phoenix. Under the terms of the contract, Sandhill Communications will design and set-up a call center with the following costs: Design of call center $18000 Computers, servers, telephone equipment $510000 Software $150000 Installation and testing of equipment $26000 Selling commission $46000 Annual service contract $80000 In addition, Sandhill Communications will maintain and service the equipment and software to ensure smooth operations of the call center for an annual fee of $160000. Ownership of equipment installed remains with the City of Phoenix. The contract costs that should be capitalized is $678000. $830000. $660000. $750000.arrow_forward

- N10. Accountarrow_forwardA firm that manufactures paper is considering a project to set up a logging operation. Wood pulp generated by the project - normally an unwanted by-product of a logging operation - is an input to the paper manufacturing process. This will save the company $340,000 in wood pulp purchases, but it will cost $50,000 more to transport the wood pulp to the paper factory than it would cost to dump it as waste. How would you describe this situation in terms of the NPV analysis for the logging operation? Question 2Answer a. There is a positive externality equal to $290,000 which should be included in the NPV analysis. b. There is a positive externality equal to $340,000 which should be included in the NPV analysis. c. There is a negative externality equal to $290,000 which should be included in the NPV analysis. d. There is a negative externality equal to $340,000 which should be included in the NPV analysis.arrow_forwardWoodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 200,000 200,000 200,000 Installing parts Direct labor hours 20,000 20,000 16,000 Purchasing parts Number of orders 7,600 6,498 3,990 Additionally, the following activity cost data are provided: Material usage: $11 per specialized part used; $27 per commodity part; no fixed activity cost. Installing parts: $21 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $47,000 annual salary; each clerk is capable of processing 1,900…arrow_forward

- Restoring balance to the nitrogen cycle is one of the challenges facing engineers. Improving the effectiveness and economical use of fertilizer has been identified as an important step in the right direction. Engineers have designed an improved way to transport fertilizer and then to apply it directly at the point where crops are grown. Further development, assessment, and optimization of the necessary equipment is estimated to require $220,000 in year 1, increasing by a gradient of $80,000 in each of years 2, 3, and 4. Then, it will begin to decrease by $95,000 in years 5, 6, 7, and 8. Interest is 14% per year. Part c What gradient series, beginning with the $220,000 in year 1 is equivalent to these cash flows? Click here to access the TVM Factor Table calculator. $ tAarrow_forward22. Glenn Medical Center has seen a growth in patient volume since its primary competitor decided to relocate to a different area of the city. To accommodate this growth, a consul- tant has advised Glenn Medical to invest in a positron-emission tomography (PET) scanner. The cost to implement the unit would be $4,000,000. The useful life of this equip- ment is typically about six years, and it will be depreciated over a six-year life to a $400,000 salvage value. Additional patient volume will yield $3,000,000 in new revenues the first year. These first-year total revenues will increase by $600,000 each year thereafter, but the unit is expensive to operate. Additional staff and variable costs, excluding depreciation expense, will come to $2,200,000 the first year, but these expenses are expected to rise by $400,000 each year thereafter. Over the life of the machine, net working capital will increase by $18,000 per year for six years. a. Assuming that Glenn Medical Center is a…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education