1. Calculate your gross annual income, if you get paid $15.00 an hour and you work 8 hours a day and 4 days a week for 36 weeks of the year. 2. Calculate your gross monthly income, if you get paid a yearly salary of $132,000. 3. Calculate your gross annual income, if you make 3% commission from your total sales, assuming you average total sales each month of $750,000. 4. Calculate your after tax monthly income on problem # 1 above, if you pay 10% federal income tax, 6% social security, and 1% medicare. 5. Calculate your after tax monthly income on problem # 2 above, if you pay 18% federal income tax, 6% social security, and 1% medicare.

1. Calculate your gross annual income, if you get paid $15.00 an hour and you work 8 hours a day and 4 days a week for 36 weeks of the year. 2. Calculate your gross monthly income, if you get paid a yearly salary of $132,000. 3. Calculate your gross annual income, if you make 3% commission from your total sales, assuming you average total sales each month of $750,000. 4. Calculate your after tax monthly income on problem # 1 above, if you pay 10% federal income tax, 6% social security, and 1% medicare. 5. Calculate your after tax monthly income on problem # 2 above, if you pay 18% federal income tax, 6% social security, and 1% medicare.

A First Course in Probability (10th Edition)

10th Edition

ISBN:9780134753119

Author:Sheldon Ross

Publisher:Sheldon Ross

Chapter1: Combinatorial Analysis

Section: Chapter Questions

Problem 1.1P: a. How many different 7-place license plates are possible if the first 2 places are for letters and...

Related questions

Question

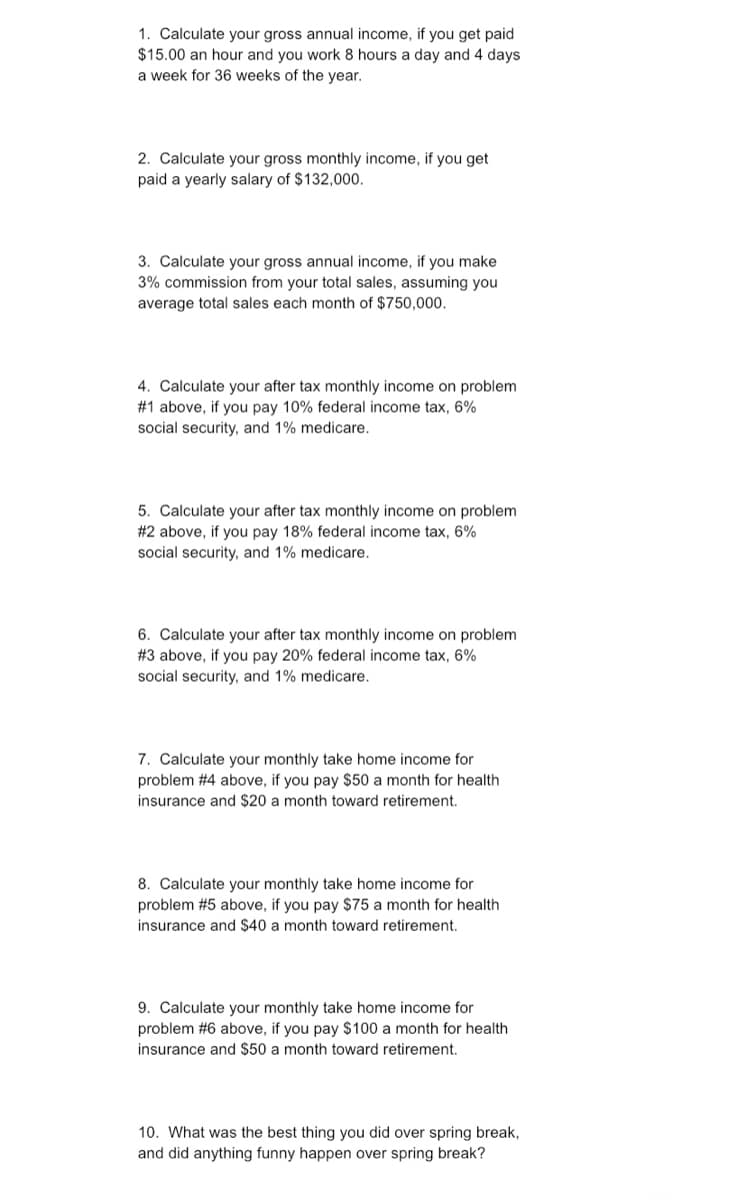

Transcribed Image Text:1. Calculate your gross annual income, if you get paid

$15.00 an hour and you work 8 hours a day and 4 days

a week for 36 weeks of the year.

2. Calculate your gross monthly income, if you get

paid a yearly salary of $132,000.

3. Calculate your gross annual income, if you make

3% commission from your total sales, assuming you

average total sales each month of $750,000.

4. Calculate your after tax monthly income on problem

#1 above, if you pay 10% federal income tax, 6%

social security, and 1% medicare.

5. Calculate your after tax monthly income on problem

#2 above, if you pay 18% federal income tax, 6%

social security, and 1% medicare.

6. Calculate your after tax monthly income on problem

# 3 above, if you pay 20% federal income tax, 6%

social security, and 1% medicare.

7. Calculate your monthly take home income for

problem #4 above, if you pay $50 a month for health

insurance and $20 a month toward retirement.

8. Calculate your monthly take home income for

problem #5 above, if you pay $75 a month for health

insurance and $40 a month toward retirement.

9. Calculate your monthly take home income for

problem #6 above, if you pay $100 a month for health

insurance and $50 a month toward retirement.

10. What was the best thing you did over spring break,

and did anything funny happen over spring break?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON