Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please explain the answers step by step

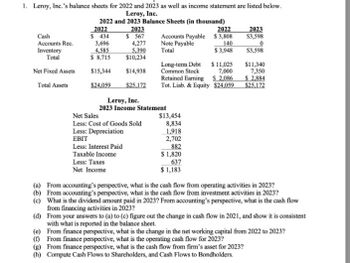

Transcribed Image Text:1. Leroy, Inc.'s balance sheets for 2022 and 2023 as well as income statement are listed below.

Leroy, Inc.

2022 and 2023 Balance Sheets (in thousand)

2022

2023

2022

2023

Cash

Accounts Rec.

$ 434

$ 567

Accounts Payable $3,808

$3,598

3,696

4,277

Note Payable

140

Inventory

4,585

5,390

Total

$3,948

$3,598

Total

$ 8,715

$10,234

Long-term Debt

$ 11,025

$11,340

Net Fixed Assets

$15,344

$14,938

Common Stock

7,000

7,350

Retained Earning

S 2,086

$ 2,884

Total Assets

$24,059

$25,172

Tot. Liab. & Equity $24,059

$25,172

Leroy, Inc.

Net Sales

2023 Income Statement

Less: Cost of Goods Sold

Less: Depreciation

EBIT

Less: Interest Paid

Taxable Income

Less: Taxes

Net Income

$13,454

8,834

1,918

2,702

882

$ 1,820

637

$1,183

(a) From accounting's perspective, what is the cash flow from operating activities in 2023?

(b) From accounting's perspective, what is the cash flow from investment activities in 2023?

(c) What is the dividend amount paid in 2023? From accounting's perspective, what is the cash flow

from financing activities in 2023?

(d) From your answers to (a) to (c) figure out the change in cash flow in 2021, and show it is consistent

with what is reported in the balance sheet.

(e) From finance perspective, what is the change in the net working capital from 2022 to 2023?

(f) From finance perspective, what is the operating cash flow for 2023?

(g) From finance perspective, what is the cash flow from firm's asset for 2023?

(h) Compute Cash Flows to Shareholders, and Cash Flows to Bondholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 36 images

Knowledge Booster

Similar questions

- The accounting records of Nettle Distribution show the following assets and liabilities as of December 31,2018 and 2019.December 31 2018 2019Cash . . . . . . . . . . . . . . . . . . . . . . . . $ 64,300 $ 15,640Accounts receivable . . . . . . . . . . . 26,240 19,100Office supplies . . . . . . . . . . . . . . . . 3,160 1,960Office equipment . . . . . . . . . . . . . . 44,000 44,000Trucks . . . . . . . . . . . . . . . . . . . . . . . 148,000 157,000December 31 2018 2019Building . . . . . . . . . . . . . . . . . . . . . $ 0 $80,000Land . . . . . . . . . . . . . . . . . . . . . . . . 0 60,000Accounts payable . . . . . . . . . . . . . 3,500 33,500Note payable . . . . . . . . . . . . . . . . . 0 40,000Required1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equityon the balance sheet and remember that total equity equals the difference between assets and liabilities.2. Compute net income for 2019 by comparing total equity amounts for these…arrow_forwardThe comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux’s accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 111.0 $ 33.0 Accounts receivable 61.0 63.0 Less: Allowance for uncollectible accounts (6.0 ) (5.0 ) Dividends receivable 16.0 15.0 Inventory 68.0 63.0 Long-term investment 28.0 23.0 Land 83.0 40.0 Buildings and equipment 173.0 263.0 Less: Accumulated depreciation (9.0 ) (115.0 ) $ 525.0 $ 380.0 Liabilities Accounts payable $ 26.0 $ 33.0 Salaries payable 15.0 18.0 Interest payable 17.0 15.0 Income tax payable 20.0 21.0 Notes payable 43.0 0 Bonds payable 94.0…arrow_forwardPrepare a ratio analysis ( Conclusion only) on each statementarrow_forward

- Suppose McDonald's 2022 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities (a1) a. b. Compute the following values. C. $3,416.0 Interest expense 30,224.0 d. 2,988.0 16,191.0 Income taxes Net income $473.0 1,936.0 4,551.0 Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) Working capital. (Round to 1 decimal place, e.g. 5,275.5) Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) millions :1 % timesarrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable 2020 2021 $ 43,500 $48,240 29,625 32,160 Assets 2020 2021 Current assets Cash $ 8,250 $ 12,240 Accounts receivable 34,500 40,560 Inventory 58,500 86,160 Total $101,250 $ 138,960 Total es Long-term debt Owners' equity $ 73,125 $ 80,400 $ 45,000 $ 36,000 Common stock and paid-in surplus $60,000 $60,000 Retained earnings 196,875 303,600 $ Net plant and equipment $273,750 $341,040 Total $ 256,875 363,600 $ Total assets $375,000 480,000 Total liabilities and owners' equity $ $375,000 480,000 Prepare the 2020 and 2021 common-size balance sheets for Just Dew It. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardCarla Vista Co. has these comparative balance sheet data: CARLA VISTA CO.Balance SheetsDecember 31 2022 2021 Cash $ 16,140 $ 32,280 Accounts receivable (net) 75,320 64,560 Inventory 64,560 53,800 Plant assets (net) 215,200 193,680 $371,220 $344,320 Accounts payable $ 53,800 $ 64,560 Mortgage payable (15%) 107,600 107,600 Common stock, $10 par 150,640 129,120 Retained earnings 59,180 43,040 $371,220 $344,320 Additional information for 2022: 1. Net income was $32,500. 2. Sales on account were $392,900. Sales returns and allowances amounted to $27,300. 3. Cost of goods sold was $217,300. 4. Net cash provided by operating activities was $57,200. 5. Capital expenditures were $30,000, and cash dividends were $19,000. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forward

- Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: Dear Bartleby, can you please assist with the following, the data is included. Thank you. Also I would appreciate you sharing your calculations, so if I have further questions, they can be asked. WIPER INC.Condensed Balance SheetsDecember 31, 2020, 2019, 2018(in millions) 2020 2019 2018Current assets $ 685 $ 917 $ 773 Other assets 2,417 1,924 1,723 Total assets $ 3,102 $ 2,841 $ 2,496 Current liabilities $ 581 $ 816 $ 714 Long-term liabilities 1,510 995 860 Stockholders’ equity 1,011 1,030 922 Total liabilities and stockholders' equity $ 3,102 $ 2,841 $ 2,496 WIPER INC.Selected Income Statement and Other DataFor…arrow_forwardSuppose the 2022 Adidas financial statement contain the following selected data (in millions) current assets 4215 total assets 9000 current liabilities 4860 cash 755 interest expense 150 income tax 190 net income 275 a.working capital b.current ratio c.debt to assets ratio d.times interest earenedarrow_forward5) Consider the following financial statement information for the ABC Corporation: Account 2018 2019 Cash $7,516 26,547 10,808 12,416 1,000 $133,844 $16,195 $85,733 $6,424 $10,697 36,986 13,110 13,555 1,200 $151,611 S16,177 $100,063 $6,520 Inventory Accounts Receivable Accounts Payable Notes Payable Net Revenue Net Income Cost of Goods Sold Depreciation Expense a) Calculate the cash conversion efficiency for 2018 and 2019. b) Calculate the net liquid balance for 2018 and 2019. c) Based on each of these measures, is the company more or less liquid in 2019 that it was in 2018? Explain. d) Determine the cash conversion period and the operating cycle for both years. e) Do the cash conversion cycle and operating cycle values suggest that there is a problem management needs to address? If so, explain what it is and what you can to do about it.arrow_forward

- Suppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 3M CompanyBalance Sheets (partial) 2020 2019Current assets Cash and cash equivalents $3,200 $1,845Accounts receivable, net 3,450 3,180Inventories 2,639 3,042Other current assets 1,872 1,549Total current assets $11,161 $9,616Current liabilities $4,853 $5,893 (a)Calculate the current ratio and working capital for 3M for 2019 and 2020. (Round current ratio to 2 decimal places, e.g. 1.25 : 1. Enter working capital answers to million.) Current ratio 2019 :12020 :1 Working capital 2019 $ million2020 $ million (b)The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardThe current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement: REGENT INC. Comparative Balance Sheet Accounts 2024 2023 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory 9,100 12,880 Prepaid expenses 2,100 1,624 Accounts payable 12,040 10,080 Accrued expenses payable 1,400 2,240 Dividends payable 6,720 4,760 Income tax payable 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2024 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses $24,640 Depreciation expense 6,440 Loss on sale of equipment 2,240 33,320 Profit before income tax 32,480 Income tax expense 8,120 Profit for the year $24,360 Instructions Prepare the operating section of the cash flow statement using the direct method.arrow_forwardSuppose the following financial data were reported by 3M Company for 2019 and 2020 (dollars in millions). 3M CompanyBalance Sheets (partial) 2020 2019 Current assets Cash and cash equivalents $3,040 $1,908 Accounts receivable, net 3,370 3,180 Inventories 2,774 3,016 Other current assets 1,956 1,628 Total current assets $11,140 $9,732 Current liabilities $4,882 $5,875 Calculate the current ratio and working capital for 3M for 2019 and 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning