FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

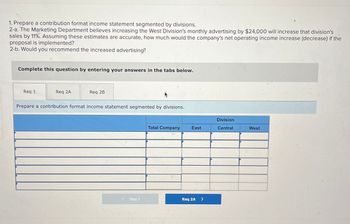

Transcribed Image Text:1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department believes increasing the West Division's monthly advertising by $24,000 will increase that division's

sales by 11%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the

proposal is implemented?

2-b. Would you recommend the increased advertising?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

Prepare a contribution format income statement segmented by divisions.

< Req 1

Total Company

East

Req 2A >

Division

Central

West

![Exercise 6-11 (Algo) Segmented Income Statement [LO6-4]

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses as shown by its most recent monthly

contribution format income statement:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income (loss)

$ 1,535,000

631,600

903,400

994,00

$ (90,600)

In an effort to resolve the problem, the company wants to prepare an income statement segmented by division. Accordingly, the

Accounting Department provided the following information:

Sales

Variable expenses as a percentage of sales

Traceable fixed expenses

East

$ 375,000

$ 287,000

56%

Division

Central

$ 660,000

26%

$ 336,000

West

$ 500,000

50%

$ 205,000

Required:

1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department believes increasing the West Division's monthly advertising by $24,000 will increase that division's

sales by 11%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the

proposal is implemented?

2-b. Would you recommend the increased advertising?](https://content.bartleby.com/qna-images/question/e6069db0-f496-4c11-99c9-1e809a876661/00b92697-e774-4af3-8c0e-9f705708c796/k4ue88b_thumbnail.jpeg)

Transcribed Image Text:Exercise 6-11 (Algo) Segmented Income Statement [LO6-4]

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses as shown by its most recent monthly

contribution format income statement:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income (loss)

$ 1,535,000

631,600

903,400

994,00

$ (90,600)

In an effort to resolve the problem, the company wants to prepare an income statement segmented by division. Accordingly, the

Accounting Department provided the following information:

Sales

Variable expenses as a percentage of sales

Traceable fixed expenses

East

$ 375,000

$ 287,000

56%

Division

Central

$ 660,000

26%

$ 336,000

West

$ 500,000

50%

$ 205,000

Required:

1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department believes increasing the West Division's monthly advertising by $24,000 will increase that division's

sales by 11%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the

proposal is implemented?

2-b. Would you recommend the increased advertising?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Department A $ 350,000 120,000 230,000 140,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Multiple Choice O $(133,800) The company says that $110,000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department B is discontinued the sales in Department A will drop by 6%. What is the financial advantage (disadvantage) of discontinuing Department B? O $(128,000) $(113,800) Total $ 800,000 320,000 480,000 400,000 $ 80,000 O $(124,000) Department B $ 450,000 200,000 250,000 260,000 $90,000 $ (10,000)arrow_forwardI want the get the solution from requirement a to earrow_forwardPlease Fo not Give image formatarrow_forward

- Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Multiple Choice O The company says that $110,000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department B is discontinued the sales in Department A will drop by 12%. What is the financial advantage (disadvantage) of discontinuing Department B? O O O $(148,000) $(152,000) $(147,600) Total $ 800,000 320,000 $(127,600) 480,000 400,000 $ 80,000 Department A Department B $ 350,000 $ 450,000 120,000 200,000 230,000 250,000 260,000 140,000 $ 90,000 $ (10,000)arrow_forwardH1.arrow_forwardCategorize each of the following activities as to which management responsibility it fulfills: planning, directing, or controlling. Some activities may fulfill more than one responsibility. (Select an "X" in the input field if the management responsibility is fulfilled. If the management responsibility is not fulfilled, leave the input field empty.) Question content area bottom Part 1 Activity Management Responsibility Planning Directing Controlling a. Management decides to increase sales growth by 20% next year. b. Management analyzes the impact of a recent advertising campaign by comparing budgeted sales to actual sales. c. Management reviews hourly sales reports to determine the level of staffing needed to staff the customer service desk. d. Management uses information on product costs to determine sales prices. e. To lower production costs, management moves production to China.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education