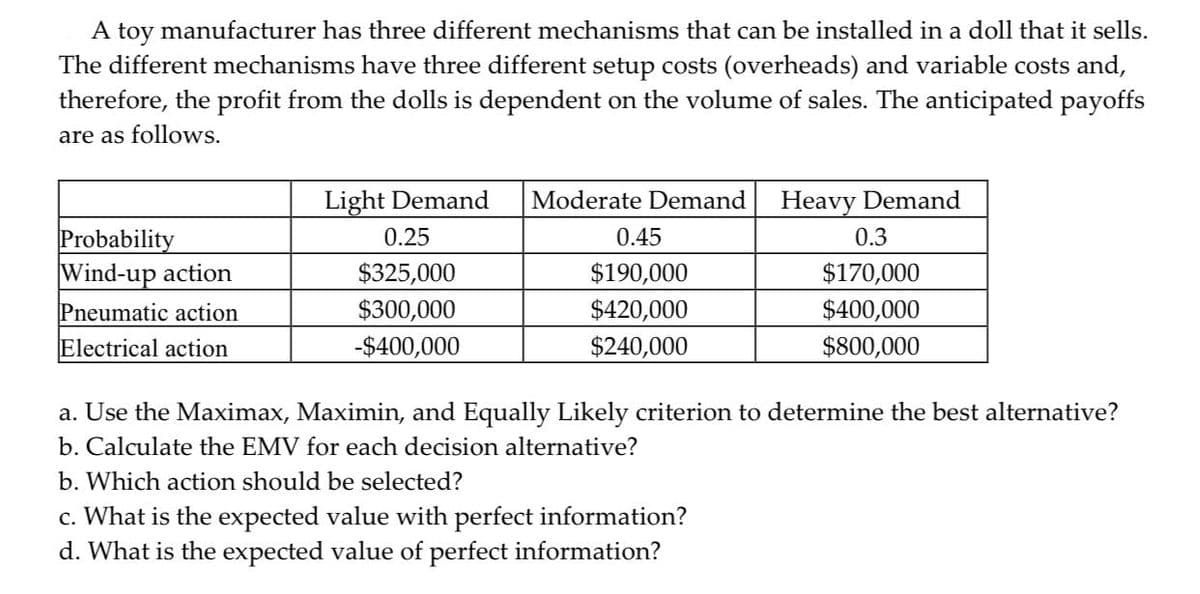

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells. The different mechanisms have three different setup costs (overheads) and variable costs and, therefore, the profit from the dolls is dependent on the volume of sales. The anticipated payoffs are as follows. Probability Wind-up action Pneumatic action Electrical action Light Demand 0.25 $325,000 $300,000 -$400,000 Moderate Demand 0.45 $190,000 $420,000 $240,000 Heavy Demand 0.3 $170,000 $400,000 $800,000 a. Use the Maximax, Maximin, and Equally Likely criterion to determine the best alternative? b. Calculate the EMV for each decision alternative? b. Which action should be selected? c. What is the expected value with perfect information? d. What is the expected value of perfect information?

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells. The different mechanisms have three different setup costs (overheads) and variable costs and, therefore, the profit from the dolls is dependent on the volume of sales. The anticipated payoffs are as follows. Probability Wind-up action Pneumatic action Electrical action Light Demand 0.25 $325,000 $300,000 -$400,000 Moderate Demand 0.45 $190,000 $420,000 $240,000 Heavy Demand 0.3 $170,000 $400,000 $800,000 a. Use the Maximax, Maximin, and Equally Likely criterion to determine the best alternative? b. Calculate the EMV for each decision alternative? b. Which action should be selected? c. What is the expected value with perfect information? d. What is the expected value of perfect information?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 31P

Related questions

Question

kindly do solve accurately and exact with correct formuas thanks..with complete steps

Transcribed Image Text:A toy manufacturer has three different mechanisms that can be installed in a doll that it sells.

The different mechanisms have three different setup costs (overheads) and variable costs and,

therefore, the profit from the dolls is dependent on the volume of sales. The anticipated payoffs

are as follows.

Probability

Wind-up action

Pneumatic action

Electrical action

Light Demand

0.25

$325,000

$300,000

-$400,000

Moderate Demand

0.45

$190,000

$420,000

$240,000

Heavy Demand

0.3

$170,000

$400,000

$800,000

a. Use the Maximax, Maximin, and Equally Likely criterion to determine the best alternative?

b. Calculate the EMV for each decision alternative?

b. Which action should be selected?

c. What is the expected value with perfect information?

d. What is the expected value of perfect information?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,