FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ROLAND COMPANY

Balance Sheet

+A

$

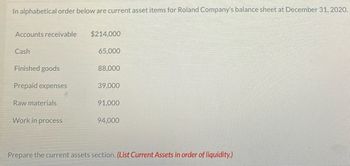

Transcribed Image Text:In alphabetical order below are current asset items for Roland Company's balance sheet at December 31, 2020.

Accounts receivable

Cash

Finished goods

Prepaid expenses

Raw materials

Work in process

$214,000

65,000

88,000

39,000

91,000

94,000

Prepare the current assets section. (List Current Assets in order of liquidity.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shown below are the balances of selected accounts of Fun Limited. Jan 2021 $241,500 $252,000 $63,000 $221,550 $72,450 31 Dec 2021 Accounts receivable Inventory Prepaid rent Accounts payable Salaries payable Net sales Cost of goods sold Operation expenses (including depreciation of $94,500) Gain from sale of equipment $273,000 $262,000 $67,200 $237,300 $66,150 $3,097,500 $1,627,500 $367,500 $10,000 Prepare the partial statement of cash flow for the year ended 31 December 2021, showing the computation of net cash from operating activities by indirect method.arrow_forwardThe following data apply to Stratford Ltd: Direct materials inventory, beginning of the year $5500 Direct materials inventory, end of the year $3,000 Direct materials purchased during the year $45,000 Calculate the amount of direct materials used during the year. Select one: O a. $36 500 Ob. $53 500 Oc. $42 500 O d. $47 500arrow_forwardwhats the income statement for this equation?arrow_forward

- Cash $ 35,000 Accounts Receivable 65,000 Finished Goods 120,000 Work in Process 58,683 Materials 14,000 Building 580,000 Accum. Deprec.—Building $ 43,500 Factory Equipment 440,000 Accum. Deprec.—Factory Equipment 110,000 Office Equipment 90,000 Accum. Deprec.—Office Equipment 33,750 Accounts Payable 85,000 Notes Payable 100,000 Capital Stock 470,000 Retained Earnings 560,433 Total $1,402,683 $1,402,683 During the month of August, the following transactions took place: a. Purchased raw materials at a cost of $55,000 and general factory supplies at a cost of $18,000 on account. (NOTE: Materials account includes both materials and supplies.) b. Issued raw material to be used in production, costing $45,500, and miscellaneous factory supplies, $13,500. c. Recorded the payroll, the payment to the…arrow_forwardVinubhaiarrow_forwardManufacturing Company Balance Sheet Partial balance sheet data for Diesel Additives Company at August 31 are as follows: Line Item Description Amount Finished goods inventory $13,600 Prepaid insurance 13,900 Accounts receivable 35,400 Work in process inventory 54,400 Supplies 24,500 Materials inventory 29,900 Cash 38,100 Prepare the “Current assets” section of Diesel Additives Company’s balance sheet at August 31. Diesel Additives Company Balance Sheet August 31 Line Item Description Amount Amount Current assets: $- Select - - Select - Inventories: $- Select - - Select - - Select - Total inventories Total inventories - Select - - Select - Total current assets $Total current assetsarrow_forward

- Sh16arrow_forwardPartial balance sheet data for Diesel Additives Company at August 31 are as follows: Finished goods inventory $42,000 Prepaid insurance 26,000 Accounts receivable 105,000 Work in process inventory 153,000 Supplies 72,300 Materials inventory 88,250 Cash 117,000 Prepare the Current assets section of Diesel Additives Company’s balance sheet at August 31. Refer to the Labels and Accounts list provided for the exact wording of the answer choices for text entries. Labels August 31 Current assets For the Month Ended August 31 For the Year Ended August 31 Inventories Accounts Accounts receivable Accumulated depreciation-equipment Cash Equipment Finished goods Materials Prepaid insurance Supplies Total inventories Work in process Prepare the Current assets section of Diesel Additives Company’s balance sheet at August 31. Refer to the Labels and Accounts list provided for the exact wording of the…arrow_forwardSir please help me sir urgently pleasearrow_forward

- Cash Accounts receivable Raw materiala inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Coat of goods sold Factory overhead General and administrative expenses Totals Debit Credit $ 71,000 40,000 25,000 0 12,000 4,000 $ 10,000 13,000 112,000 24,000 40,000 40,000 94,000 171,000 $ 328,000 $ 328,000 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materiala requisition 111 Materials requisition 121 Labor time ticket 521 Labor time ticket 53: Labor time ticket 541 $ 4,800 direct materials to Job 402 $ 7,400 direct materials to Job 404 $ 2,100 indirect materiala $ 6,000 direct labor to Job 402 $ 14,000 direct labor to Job 404 $ 5,000 indirect labor Jobs 402 and 404 are the only jobs in process at year-end. The predetermined overhead rate is 100% of direct labor cost. Problem 19-3A (Algo) Parts 4 and 5 4. Prepare an income…arrow_forwardComplete: Round to Nearest Current Assets Amount Hundredth Percent Cash $ 12,000 % Accounts receivable 9,000 % Prepaid rent Merchandise inventory 5,000 $ 28.000 Total current assets 100 %arrow_forwardThe following is information for Charles Company for the current year Cost of Goods Sold Operating Expenses Other Income and (Expenses) Gain on Sale of Equipment Loss on Disposal of Equipment Descontinued Operations Gain Income Tax Expense What is the company's net income for the year? $214,000 151.000 19,000 7.000 (6,000) 2,000 40%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education