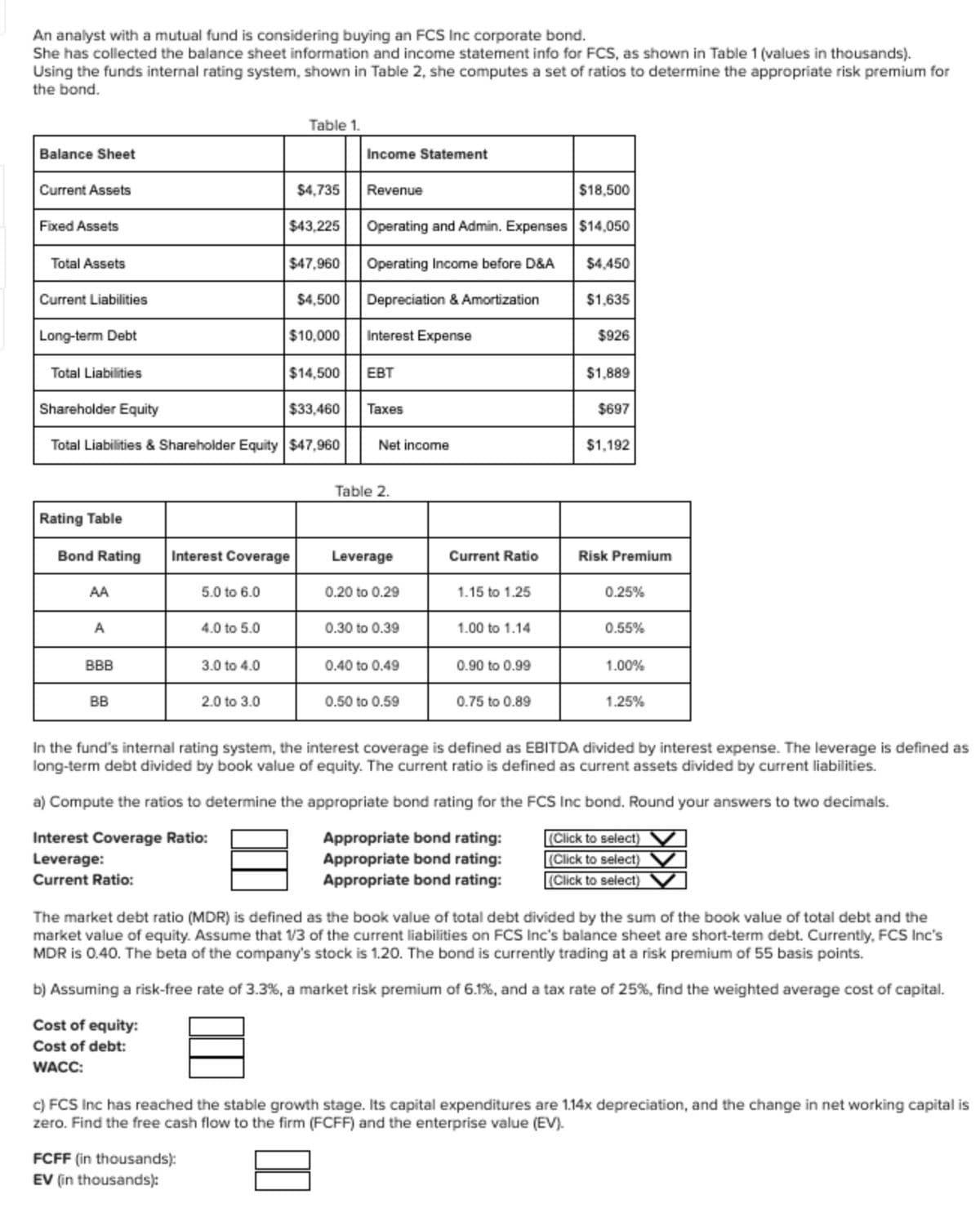

An analyst with a mutual fund is considering buying an FCS Inc corporate bond. She has collected the balance sheet information and income statement info for FCS, as shown in Table 1 (values in thousands). Using the funds internal rating system, shown in Table 2, she computes a set of ratios to determine the appropriate risk premium for the bond. Table 1. Balance Sheet Income Statement Current Assets $4,735 Revenue $18,500 Fixed Assets $43,225 Operating and Admin. Expenses $14,050 Total Assets $47,960 Operating Income before D&A $4,450 Current Liabilities $4,500 Depreciation & Amortization $1,635 Long-term Debt $10,000 Interest Expense $926 Total Liabilities $14,500 EBT $1,889 Shareholder Equity $33,460 Taxes $697 Total Liabilities & Shareholder Equity $47,960 Net income $1,192 Table 2. Rating Table Bond Rating Interest Coverage Leverage Current Ratio Risk Premium AA 5.0 to 6.0 0.20 to 0.29 1.15 to 1.25 0.25% A 4.0 to 5.0 0.30 to 0.39 1.00 to 1.14 0.55% BBB 3.0 to 4.0 0.40 to 0.49 0.90 to 0.99 1.00% BB 2.0 to 3.0 0.50 to 0.59 0.75 to 0.89 1.25% In the fund's internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as long-term debt divided by book value of equity. The current ratio is defined as current assets divided by current liabilities. a) Compute the ratios to determine the appropriate bond rating for the FCS Inc bond. Round your answers to two decimals. Interest Coverage Ratio: Leverage: Current Ratio: Appropriate bond rating: Appropriate bond rating: Appropriate bond rating: (Click to select) (Click to select) (Click to select) The market debt ratio (MDR) is defined as the book value of total debt divided by the sum of the book value of total debt and the market value of equity. Assume that 1/3 of the current liabilities on FCS Inc's balance sheet are short-term debt. Currently, FCS Inc's MDR is 0.40. The beta of the company's stock is 1.20. The bond is currently trading at a risk premium of 55 basis points. b) Assuming a risk-free rate of 3.3%, a market risk premium of 6.1%, and a tax rate of 25%, find the weighted average cost of capital. Cost of equity: Cost of debt: WACC: c) FCS Inc has reached the stable growth stage. Its capital expenditures are 1.14x depreciation, and the change in net working capital is zero. Find the free cash flow to the firm (FCFF) and the enterprise value (EV). FCFF (in thousands): EV (in thousands):

An analyst with a mutual fund is considering buying an FCS Inc corporate bond. She has collected the balance sheet information and income statement info for FCS, as shown in Table 1 (values in thousands). Using the funds internal rating system, shown in Table 2, she computes a set of ratios to determine the appropriate risk premium for the bond. Table 1. Balance Sheet Income Statement Current Assets $4,735 Revenue $18,500 Fixed Assets $43,225 Operating and Admin. Expenses $14,050 Total Assets $47,960 Operating Income before D&A $4,450 Current Liabilities $4,500 Depreciation & Amortization $1,635 Long-term Debt $10,000 Interest Expense $926 Total Liabilities $14,500 EBT $1,889 Shareholder Equity $33,460 Taxes $697 Total Liabilities & Shareholder Equity $47,960 Net income $1,192 Table 2. Rating Table Bond Rating Interest Coverage Leverage Current Ratio Risk Premium AA 5.0 to 6.0 0.20 to 0.29 1.15 to 1.25 0.25% A 4.0 to 5.0 0.30 to 0.39 1.00 to 1.14 0.55% BBB 3.0 to 4.0 0.40 to 0.49 0.90 to 0.99 1.00% BB 2.0 to 3.0 0.50 to 0.59 0.75 to 0.89 1.25% In the fund's internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as long-term debt divided by book value of equity. The current ratio is defined as current assets divided by current liabilities. a) Compute the ratios to determine the appropriate bond rating for the FCS Inc bond. Round your answers to two decimals. Interest Coverage Ratio: Leverage: Current Ratio: Appropriate bond rating: Appropriate bond rating: Appropriate bond rating: (Click to select) (Click to select) (Click to select) The market debt ratio (MDR) is defined as the book value of total debt divided by the sum of the book value of total debt and the market value of equity. Assume that 1/3 of the current liabilities on FCS Inc's balance sheet are short-term debt. Currently, FCS Inc's MDR is 0.40. The beta of the company's stock is 1.20. The bond is currently trading at a risk premium of 55 basis points. b) Assuming a risk-free rate of 3.3%, a market risk premium of 6.1%, and a tax rate of 25%, find the weighted average cost of capital. Cost of equity: Cost of debt: WACC: c) FCS Inc has reached the stable growth stage. Its capital expenditures are 1.14x depreciation, and the change in net working capital is zero. Find the free cash flow to the firm (FCFF) and the enterprise value (EV). FCFF (in thousands): EV (in thousands):

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 6P: The file MutualFunds contains a data set with information for 45 mutual funds that are part of the...

Related questions

Question

Transcribed Image Text:An analyst with a mutual fund is considering buying an FCS Inc corporate bond.

She has collected the balance sheet information and income statement info for FCS, as shown in Table 1 (values in thousands).

Using the funds internal rating system, shown in Table 2, she computes a set of ratios to determine the appropriate risk premium for

the bond.

Table 1.

Balance Sheet

Income Statement

Current Assets

$4,735

Revenue

$18,500

Fixed Assets

$43,225

Operating and Admin. Expenses $14,050

Total Assets

$47,960

Operating Income before D&A

$4,450

Current Liabilities

$4,500

Depreciation & Amortization

$1,635

Long-term Debt

$10,000

Interest Expense

$926

Total Liabilities

$14,500

EBT

$1,889

Shareholder Equity

$33,460

Taxes

$697

Total Liabilities & Shareholder Equity $47,960

Net income

$1,192

Table 2.

Rating Table

Bond Rating

Interest Coverage

Leverage

Current Ratio

Risk Premium

AA

5.0 to 6.0

0.20 to 0.29

1.15 to 1.25

0.25%

A

4.0 to 5.0

0.30 to 0.39

1.00 to 1.14

0.55%

BBB

3.0 to 4.0

0.40 to 0.49

0.90 to 0.99

1.00%

BB

2.0 to 3.0

0.50 to 0.59

0.75 to 0.89

1.25%

In the fund's internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as

long-term debt divided by book value of equity. The current ratio is defined as current assets divided by current liabilities.

a) Compute the ratios to determine the appropriate bond rating for the FCS Inc bond. Round your answers to two decimals.

Interest Coverage Ratio:

Leverage:

Current Ratio:

Appropriate bond rating:

Appropriate bond rating:

Appropriate bond rating:

(Click to select)

(Click to select)

(Click to select)

The market debt ratio (MDR) is defined as the book value of total debt divided by the sum of the book value of total debt and the

market value of equity. Assume that 1/3 of the current liabilities on FCS Inc's balance sheet are short-term debt. Currently, FCS Inc's

MDR is 0.40. The beta of the company's stock is 1.20. The bond is currently trading at a risk premium of 55 basis points.

b) Assuming a risk-free rate of 3.3%, a market risk premium of 6.1%, and a tax rate of 25%, find the weighted average cost of capital.

Cost of equity:

Cost of debt:

WACC:

c) FCS Inc has reached the stable growth stage. Its capital expenditures are 1.14x depreciation, and the change in net working capital is

zero. Find the free cash flow to the firm (FCFF) and the enterprise value (EV).

FCFF (in thousands):

EV (in thousands):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning