ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

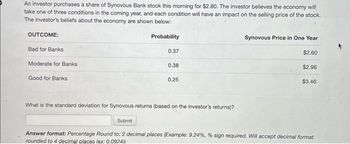

Transcribed Image Text:An investor purchases a share of Synovous Bank stock this morning for $2.80. The investor believes the economy will

take one of three conditions in the coming year, and each condition will have an impact on the selling price of the stock.

The investor's beliefs about the economy are shown below:

OUTCOME:

Probability

Bad for Banks

Moderate for Banks

Good for Banks

0.37

Submit

0.38

0.25

What is the standard deviation for Synovous returns (based on the investor's returns)?

Synovous Price in One Year

$2.60

$2.96

$3.46

Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format

rounded to 4 decimal places (ex: 0.0924))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that there is a 45 percent change that George's coffee shop will make $10000 in profits in January and a 45 percent chance it will make 0 profits and a 10 percent chance that it will make -$1000 in profits (i.e., it will lose $1000). Calculate the coffee shop's expected profitsarrow_forwardYou plan to invest $1,000 in a corporate bond fund or in a common stock fund. The following table represents the annual return (per $1,000) of each of these investments under various economic conditions and the probability that each of those economic conditions will occur. Compute the expected return for the corporate bond and for the common stock fund. Show your calculations on excel for expected returns. Compute the standard deviation for the corporate bond fund and for the common stock fund. Would you invest in the corporate bond fund or the common stock fund? Explain. If choose to invest in the common stock fund and in (c), what do you think about the possibility of losing $999 of every $1,000 invested if there is depression. Explain.arrow_forwardQuestion 5 (5.5 points): Hedge May 20th: Producer plans to sell corn in early November. Currently the December corn futures are trading at $4.33. The expected basis is -$0.36. • Does the producer have a long or short cash position? (buy/sell) Dec corn futures at $4.33/bu. Nov. 10th: To hedge: The producer will What is the expected price? • The producer must (buy/sell) corn locally in the cash market at • • $4.18/bu. To offset their future position, they must $4.67/bu. What is the actual basis? What is the realized price for the producer? ○ Method 1: Method 2: о The hedge resulted in a realized price of (buy/sell) Dec futures atarrow_forward

- Most ______ investments are not available to the general public. Money market mutual fund Closed-end fund Unit investment trust Hedge fund An order to the New York Stock Exchange to buy or sell at the best price available is called: A limit order A stop order A market order A GTC order.arrow_forward16. The market consists of only two assets, A and B, with normally distributed re- turns. Asset A's returns have a mean of 18% and a standard deviation of 14% and Asset B's returns have a mean of 15% and a standard deviation of 18%. In such a scenario a risk-averse investor would always want to invest all of her money in Asset A. 17. A call option offers the purchaser limited downside loss as given by the option premium paid, combined with limited upside potential. 18. The return earned on a risk free portfolio must be equal to the risk free interest rate. 19. CAPM assumes that all investors' optimal portfolio has a fraction invested in the risk-free asset and the remaining in the minimum variance portfolio. 20. For any frontier portfolio p, except the minimum variance portfolio, there exists a unique frontier portfolio with which p has zero covariance. 21. The market portfolio of all available assets is the supply of risky assets. 22. An arbitrage opportunity is an…arrow_forwardA risk-averse consumer with $100,000 in wealth faces 0.1 probability of losing half of his wealth within the next year. a. What is the consumer's expected wealth one year from now? b. An insurance company offers our consumer full insurance against the possible loss. What premium must the consumer be charged for the insurance company to expect to break even? c. Suppose our risk-averse consumer is indifferent between getting $85,000 wealth with certainty and facing the above described uncertain situation. What is the maximum premium that the insurance company will be able to charge this consumer for its full insurance policy?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education