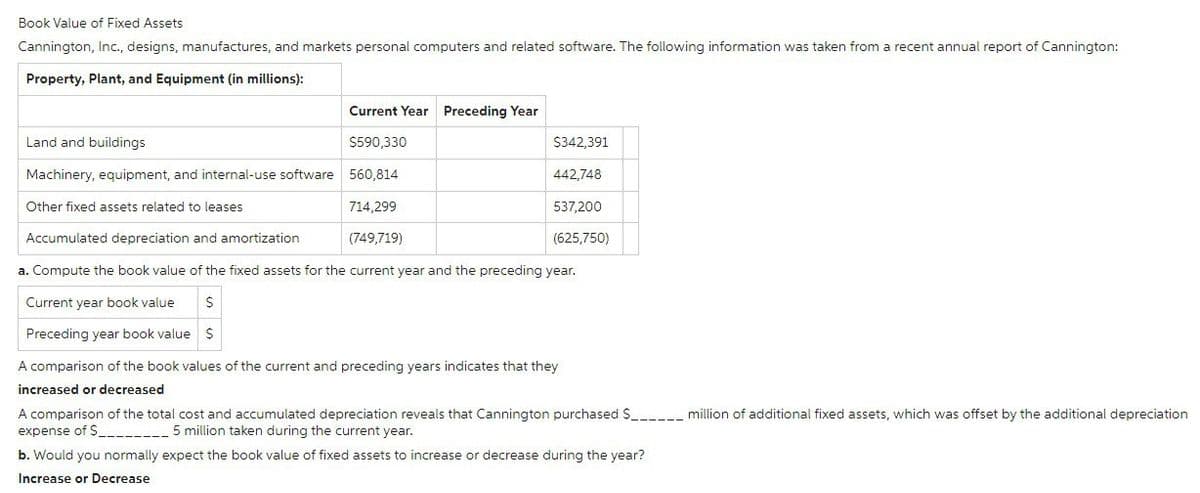

Book Value of Fixed Assets Cannington, Inc., designs, manufactures, and markets personal computers and related software. The following information was taken from a recent annual report of Cannington: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $590,330 Machinery, equipment, and internal-use software 560,814 Other fixed assets related to leases. 714,299 Accumulated depreciation and amortization (749,719) a. Compute the book value of the fixed assets for the current year and the preceding year. Current year book value $ Preceding year book value $ A comparison of the book values of the current and preceding years indicates that they increased or decreased $342,391 442,748 537,200 (625,750) A comparison of the total cost and accumulated depreciation reveals that Cannington purchased S___________ million of additional fixed assets, which was offset by the additional depreciation expense of $_______________ 5 million taken during the current year. b. Would you normally expect the book value of fixed assets to increase or decrease during the year? Increase or Decrease

Book Value of Fixed Assets Cannington, Inc., designs, manufactures, and markets personal computers and related software. The following information was taken from a recent annual report of Cannington: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $590,330 Machinery, equipment, and internal-use software 560,814 Other fixed assets related to leases. 714,299 Accumulated depreciation and amortization (749,719) a. Compute the book value of the fixed assets for the current year and the preceding year. Current year book value $ Preceding year book value $ A comparison of the book values of the current and preceding years indicates that they increased or decreased $342,391 442,748 537,200 (625,750) A comparison of the total cost and accumulated depreciation reveals that Cannington purchased S___________ million of additional fixed assets, which was offset by the additional depreciation expense of $_______________ 5 million taken during the current year. b. Would you normally expect the book value of fixed assets to increase or decrease during the year? Increase or Decrease

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.18E: Book value of fixed assets Apple. Inc., designs, manufactures, and markets personal computers...

Related questions

Question

please no copy from other answers answer with steps and all work like explanation , calculation ,formula answer in text need complete and correct answer without copy paste

Transcribed Image Text:Book Value of Fixed Assets

Cannington, Inc., designs, manufactures, and markets personal computers and related software. The following information was taken from a recent annual report of Cannington:

Property, Plant, and Equipment (in millions):

Current Year Preceding Year

Land and buildings

$590,330

Machinery, equipment, and internal-use software 560,814

Other fixed assets related to leases

714,299

(749,719)

$342,391

442,748

537,200

(625,750)

Accumulated depreciation and amortization

a. Compute the book value of the fixed assets for the current year and the preceding year.

Current year book value $

Preceding year book value $

A comparison of the book values of the current and preceding years indicates that they

increased or decreased

A comparison of the total cost and accumulated depreciation reveals that Cannington purchased $____________ million of additional fixed assets, which was offset by the additional depreciation

expense of $____________ 5 million taken during the current year.

b. Would you normally expect the book value of fixed assets to increase or decrease during the year?

Increase or Decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning