Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

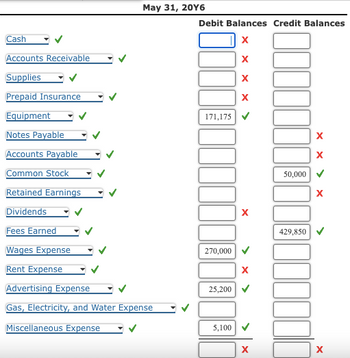

Transcribed Image Text:Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Notes Payable

Accounts Payable

Common Stock

Retained Earnings

Dividends

Fees Earned

Wages Expense

Rent Expense

May 31, 20Y6

Advertising Expense

Gas, Electricity, and Water Expense

Miscellaneous Expense

Debit Balances Credit Balances

x

x

171,175

x

< × ×

x

x

50,000

x

x

429,850

270,000

>

x

25,200

5,100

>

>

x

x

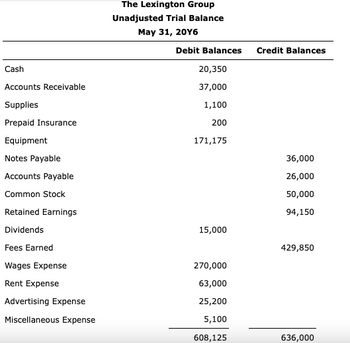

Transcribed Image Text:Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Notes Payable

Accounts Payable

The Lexington Group

Unadjusted Trial Balance

May 31, 2016

Debit Balances Credit Balances

20,350

37,000

1,100

200

171,175

36,000

26,000

Common Stock

50,000

Retained Earnings

94,150

Dividends

15,000

Fees Earned

429,850

Wages Expense

270,000

Rent Expense

63,000

Advertising Expense

25,200

Miscellaneous Expense

5,100

608,125

636,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assets Cash S.T. Investments Accts Receivable Inventories Total Current Assets Net PP&E Total Assets Liabilities. Accts Payable Notes Payable Accruals Balance Sheet Current Liabilities L.T. Bonds Preferred Stock Common Stock Retained Earnings Total Equity Total Liab. & Equity Less: Interest 2021 120 30 400 Pre-tax Earnings 1,200 1,750 3,000 4,750 100 100 300 500 520 200 530 3,000 3,530 4,750 Net Sales COGS except Dep Depreciation & Amortization Other Operating Expenses EBIT Income Statements 2021 5,500 3,800 180 600 920 60 860 215 Taxes (25%) Preferred Dividends 15 Net Income for CS Holders 630 2020 $102 40 384 774 1. What is the company's MVA? 2. What is the company's EVA in? 3. What is the current ratio of the Company? 1,300 1,780 3,080 180 28 370 578 350 100 500 1,552 2,052 3,080 Number of Common Stock Outstanding = 1,200 Price of Common Stock = 4.00 WACC Cost of Capital = 12.0% Return on Investment (ROI)= 15.97% 2020 4,800 3,710 180 470 440 40 400 100 7 293arrow_forwardNeed help filling in the blank area'sarrow_forwardCompared to the ROE in 2020, the ROE in 2021 has Improved / 6.65% Improved / 3.43% Worsened / -6.65% Worsened / -3.43% Stayed the same / 0% byarrow_forward

- On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…arrow_forwardHow did they get 12 million from this question? Explainarrow_forwardUse the following information for questions 2-9 Category Accounts payable Accounts receivable Accruals 2016 2017 34,500 37,500 96,000 102,000 13,500 11,250 Additional paid in capital Cash Common Stock@par value COGS Depreciation expense 187,500 204,000 6,000 16,800 10,500 11,550 109,500 144,000 18.000 19,500 Interest expense 13,500 13,800 Inventories 93,000 96,000 Long-term debt 112,500 116,250 Net fixed assets 315,000 ??? Notes payable 49,500 54,000 Operating expenses (excl. depr.) 42,000 52,500 Retained earnings Sales Taxes Net fixed assets in 2017 were $ 1) 331,750 2) 332,750 102,000 114,000 213,000 282,000 8,250 15,750 3) 333,750 4) 344,750 5) 345,750arrow_forward

- Find Earnings per share 2019 (i attached the balance sheet and income statement)arrow_forwardGiven the data in the following table, accounts receivable in 2023 was…arrow_forwardWhat Statements Do The Following Belong To and Do They Appear On One Or More1) Fund To Retire Bonds2) Retained Earnings3) Trucks4) Cash5) Prepaid Insurance6) Investment in XYZ7) Additional Paid-Capital8) Copyrights9) Machinery10) Merchandise Inventoryarrow_forward

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).arrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 70 on December 31, 2012. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 Retained earnings, January 1 Net income Dividends: On preferred stock On common stock Retained earnings, December 31 20Y2 $3,329,700 790,400 20Y1 $2,805,000 574,500 (9,800) (40,000) $4,070,300 (9,800) (40,000) $3,329,700 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 Sales Cost of merchandise sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue and expense: 20Y2 20Y1 $5,340,680 $4,920,640 1,737,400 1,598,410 $3,603,280 $1,292,110 1,100,680 $3,322,230 $1,583,590 930,050 $2,392,790 $2,513,640 $1,210,490 $808,590 Other revenue 63,710 51,610 Other expense (interest) (376,000) (207,200)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning