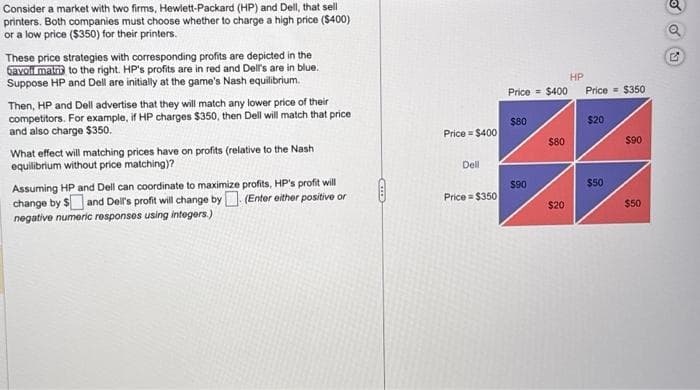

Consider a market with two firms, Hewlett-Packard (HP) and Dell, that sell printers. Both companies must choose whether to charge a high price ($400) or a low price ($350) for their printers. These price strategies with corresponding profits are depicted in the bavoli matris to the right. HP's profits are in red and Dell's are in blue. Suppose HP and Dell are initially at the game's Nash equilibrium. Then, HP and Dell advertise that they will match any lower price of their competitors. For example, if HP charges $350, then Dell will match that price and also charge $350. What effect will matching prices have on profits (relative to the Nash equilibrium without price matching)? Assuming HP and Dell can coordinate to maximize profits, HP's profit will change by $ and Dell's profit will change by. (Enter either positive or negative numeric responses using integers.) GLED Price $400 Dell Price $350 HP Price $400 Price $350 $80 $90 $80 $20 $20 $50 $90 $50 DU

Consider a market with two firms, Hewlett-Packard (HP) and Dell, that sell printers. Both companies must choose whether to charge a high price ($400) or a low price ($350) for their printers. These price strategies with corresponding profits are depicted in the bavoli matris to the right. HP's profits are in red and Dell's are in blue. Suppose HP and Dell are initially at the game's Nash equilibrium. Then, HP and Dell advertise that they will match any lower price of their competitors. For example, if HP charges $350, then Dell will match that price and also charge $350. What effect will matching prices have on profits (relative to the Nash equilibrium without price matching)? Assuming HP and Dell can coordinate to maximize profits, HP's profit will change by $ and Dell's profit will change by. (Enter either positive or negative numeric responses using integers.) GLED Price $400 Dell Price $350 HP Price $400 Price $350 $80 $90 $80 $20 $20 $50 $90 $50 DU

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.5P

Related questions

Question

Transcribed Image Text:Consider a market with two firms, Hewlett-Packard (HP) and Dell, that sell

printers. Both companies must choose whether to charge a high price ($400)

or a low price ($350) for their printers.

These price strategies with corresponding profits are depicted in the

bavoli matris to the right. HP's profits are in red and Dell's are in blue.

Suppose HP and Dell are initially at the game's Nash equilibrium.

Then, HP and Dell advertise that they will match any lower price of their

competitors. For example, if HP charges $350, then Dell will match that price

and also charge $350.

What effect will matching prices have on profits (relative to the Nash

equilibrium without price matching)?

Assuming HP and Dell can coordinate to maximize profits, HP's profit will

change by $ and Dell's profit will change by (Enter either positive or

negative numeric responses using integers.)

Price $400

Dell

Price $350

HP

Price = $400 Price $350

$80

$90

$80

$20

$20

$50

$90

$50

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning