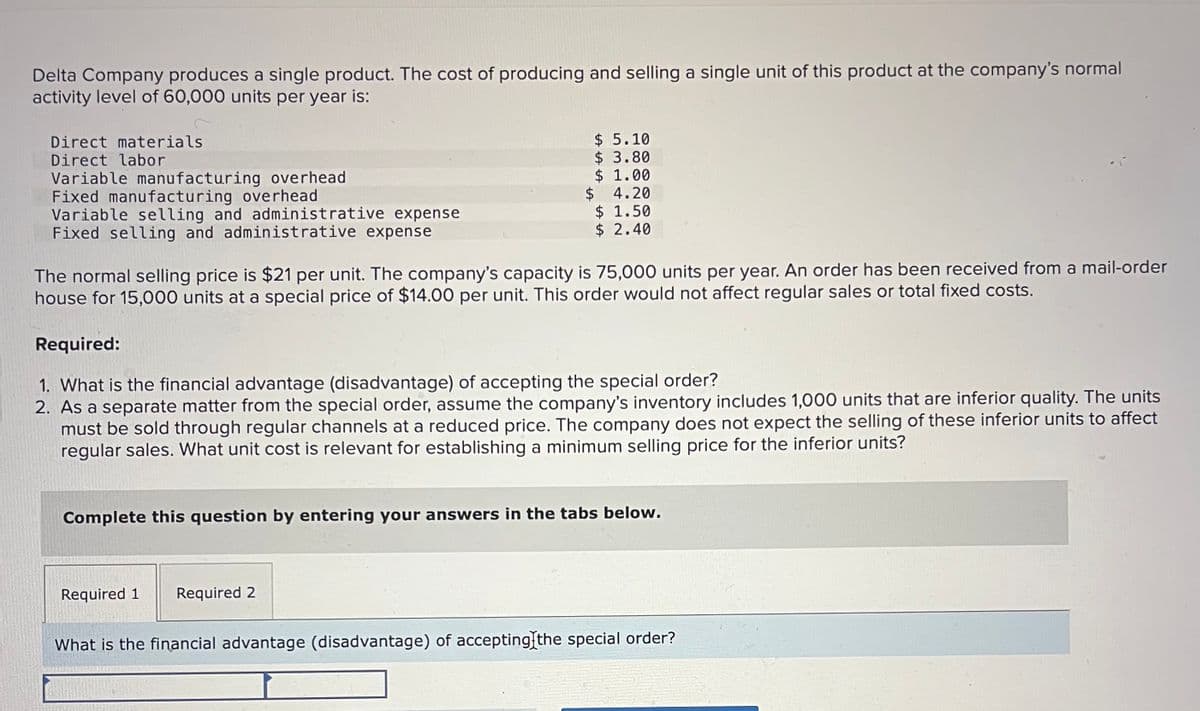

Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60,000 units per year is: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs. $ 5.10 $ 3.80 $ 1.00 $ 4.20 $ 1.50 $ 2.40 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior units to affect regular sales. What unit cost is relevant for establishing a minimum selling price for the inferior units? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order?

Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 60,000 units per year is: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs. $ 5.10 $ 3.80 $ 1.00 $ 4.20 $ 1.50 $ 2.40 Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior units to affect regular sales. What unit cost is relevant for establishing a minimum selling price for the inferior units? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 6PA: Gent Designs requires three units of part A for every unit of Al that it produces. Currently, part A...

Related questions

Question

Transcribed Image Text:Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal

activity level of 60,000 units per year is:

Direct materials.

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling and administrative expense

Fixed selling and administrative expense

The normal selling price is $21 per unit. The company's capacity is 75,000 units per year. An order has been received from a mail-order

house for 15,000 units at a special price of $14.00 per unit. This order would not affect regular sales or total fixed costs.

$ 5.10

$ 3.80

$ 1.00

$ 4.20

$ 1.50

$ 2.40

Required:

1. What is the financial advantage (disadvantage) of accepting the special order?

2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units

must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior units to affect

regular sales. What unit cost is relevant for establishing a minimum selling price for the inferior units?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

What is the financial advantage (disadvantage) of accepting the special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning