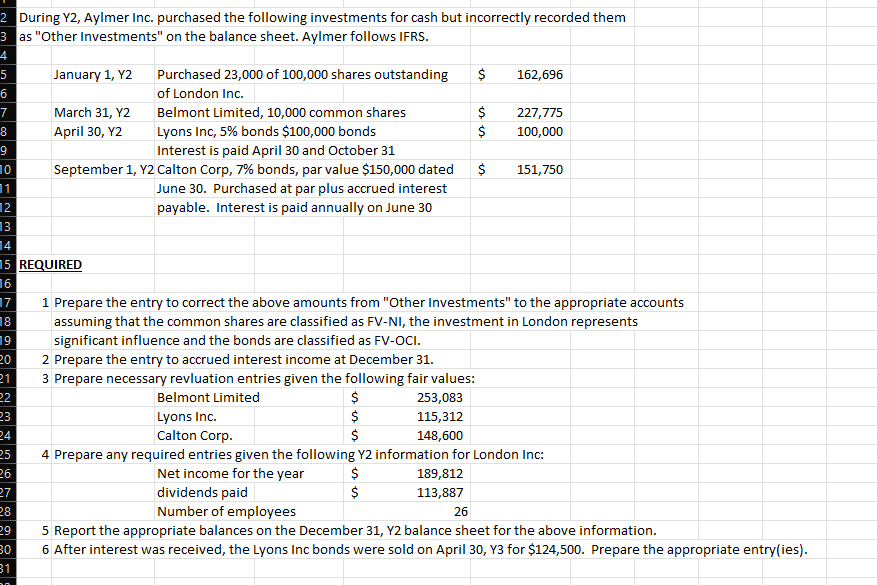

During Y2, Aylmer Inc. purchased the following investments for cash but incorrectly recorded them as "Other Investments" on the balance sheet. Aylmer follows IFRS. January 1, Y2 Purchased 23,000 of 100,000 shares outstanding of London Inc. Belmont Limited, 10,000 common shares Lyons Inc, 5% bonds $100,000 bonds Interest is paid April 30 and October 31 September 1, Y2 Calton Corp, 7% bonds, par value $150,000 dated $ 151,750 June 30. Purchased at par plus accrued interest payable. Interest is paid annually on June 30 March 31, Y2 April 30, Y2 REQUIRED 2 Prepare the entry to accrued interest income at December 31. 3 Prepare necessary revluation entries given the following fair values: Belmont Limited Lyons Inc. Calton Corp. $ 1 Prepare the entry to correct the above amounts from "Other Investments" to the appropriate accounts assuming that the common shares are classified as FV-NI, the investment in London represents significant influence and the bonds are classified as FV-OCI. SSS $ $ $ 253,083 115,312 148,600 $ $ 162,696 227,775 100,000

During Y2, Aylmer Inc. purchased the following investments for cash but incorrectly recorded them as "Other Investments" on the balance sheet. Aylmer follows IFRS. January 1, Y2 Purchased 23,000 of 100,000 shares outstanding of London Inc. Belmont Limited, 10,000 common shares Lyons Inc, 5% bonds $100,000 bonds Interest is paid April 30 and October 31 September 1, Y2 Calton Corp, 7% bonds, par value $150,000 dated $ 151,750 June 30. Purchased at par plus accrued interest payable. Interest is paid annually on June 30 March 31, Y2 April 30, Y2 REQUIRED 2 Prepare the entry to accrued interest income at December 31. 3 Prepare necessary revluation entries given the following fair values: Belmont Limited Lyons Inc. Calton Corp. $ 1 Prepare the entry to correct the above amounts from "Other Investments" to the appropriate accounts assuming that the common shares are classified as FV-NI, the investment in London represents significant influence and the bonds are classified as FV-OCI. SSS $ $ $ 253,083 115,312 148,600 $ $ 162,696 227,775 100,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Please Do Not Give Solution In Image Format And Fast Answering Please Thanks In Image

Transcribed Image Text:2 During Y2, Aylmer Inc. purchased the following investments for cash but incorrectly recorded them

3 as "Other Investments" on the balance sheet. Aylmer follows IFRS.

4

January 1, Y2

5

6

7

8

9

10

11

12

13

17

18

19

20

21

22

23

24

14

15 REQUIRED

16

25

G

26

27

Purchased 23,000 of 100,000 shares outstanding

of London Inc.

Belmont Limited, 10,000 common shares

Lyons Inc, 5% bonds $100,000 bonds

Interest is paid April 30 and October 31

September 1, Y2 Calton Corp, 7% bonds, par value $150,000 dated

June 30. Purchased at par plus accrued interest

payable. Interest is paid annually on June 30

28

29

30

31

March 31, Y2

April 30, Y2

Belmont Limited

Lyons Inc.

Calton Corp.

es es es

1 Prepare the entry to correct the above amounts from "Other Investments" to the appropriate accounts

assuming that the common shares are classified as FV-NI, the investment in London represents

significant influence and the bonds are classified as FV-OCI.

2 Prepare the entry to accrued interest income at December 31.

3 Prepare necessary revluation entries given the following fair values:

$

$

$

esss

$ 162,696

$ 227,775

$

100,000

253,083

115,312

148,600

$

$

151,750

4 Prepare any required entries given the following Y2 information for London Inc:

$

Net income for the year

dividends paid

189,812

113,887

26

Number of employees

5 Report the appropriate balances on the December 31, Y2 balance sheet for the above information.

6 After interest was received, the Lyons Inc bonds were sold on April 30, Y3 for $124,500. Prepare the appropriate entry(ies).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning