FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

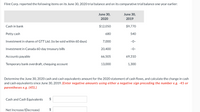

Transcribed Image Text:Flint Corp. reported the following items on its June 30, 2020 trial balance and on its comparative trial balance one year earlier:

June 30,

June 30,

2020

2019

Cash in bank

$12,050

$9,770

Petty cash

680

540

Investment in shares of GTT Ltd. (to be sold within 60 days)

7,000

-0-

Investment in Canada 60-day treasury bills

20,400

-0-

Accounts payable

66,505

69,310

Temporary bank overdraft, chequing account

13,000

1,300

Determine the June 30, 2020 cash and cash equivalents amount for the 2020 statement of cash flows, and calculate the change in cash

and cash equivalents since June 30, 2019. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or

parentheses e.g. (45).)

Cash and Cash Equivalents

24

Net Increase/(Decrease)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dogarrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardDelta Automotive Corporation has the following assets listed in its 12/31/2024 trial balance: Cash in bank-checking account $ 34,500 U.S. Treasury bills (mature in 60 days)*Footnote asterisk 7,000 Cash on hand (currency and coins ) 2,550 U.S. Treasury bills (mature in six months)*Footnote asterisk 22,000 Undeposited customer checks 3,040 * Footnote asterisk Purchased on 11/30/2024 Required: Determine the correct balance of cash and cash equivalents to be reported in the current asset section of the 2024 balance sheet. For each of the items not included in your answer to requirement 1, select the correct classification of the item.arrow_forward

- Analysis of Loss Allowance Boulder View Corporation accounts for uncollectible accounts receivable using the allowance method. As of December 31, 2021, the credit balance in Loss Allowance was $130,000. During 2022, credit sales totaled $10,000,000, $90,000 of accounts receivable were written off as uncollectible, and recoveries of accounts previously written off amounted to $15,000. An aging of accounts receivable at December 31, 2022, showed the following Classification of Receivable Current 1-30 days past due 31-60 days past due. Over 60 days past due Accounts Receivable Balance Percentage Estimated As of December 31, 2022 $1,140,000 600,000 400,000 120,000 $2,260,000 Uncollectible 2% 10 23 75 Required: 1. Prepare the journal entry to record expected credit loss for 2022, assuming that the aging of the receivable method is applied. 2. Record journal entries to account for the write-off of $90,000 uncollectible accounts receivable and the collection of $15,000 in receivables that had…arrow_forwardVikarmbhaiarrow_forwardChang Co. issued a $45,750, 120-day, discounted note to Guarantee Bank. The discount rate is 11%. Assuming a 360-day year, the cash proceeds to Chang Co. are Select the correct answer. $50,783 $46,169 $44,073 $45,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education