FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Full Accounting Cycle Project

Scenario:

On August 1, 2022, the following were the account balances of Beam's Repair Services.

Account Balances for Beam's Repair Services

Debit

Credit

$ 6,040 Accumulated Depreciation-Equipment $ 600

2,910

Accounts Payable

2,300

4,000

Unearned Service Revenue

1,260

1,030

Salaries and Wages Payable

1,420

10,000

Common Stock

12,000

Retained Earnings

6,400

$23,980

Cash

Accounts Receivable

Notes Receivable

Supplies

Equipment

Transactions:

During August, the following summary transactions were completed.

Aug. 1

3

Aug. 1

$23,980

Transactions:

During August, the following summary transactions were completed.

3

5

10

Transactions

Paid $400 cash for advertising in local newspapers. Advertising flyers will be included with

newspapers delivered during August and September.

Paid August rent $380.

Transactions

Paid $400 cash for advertising in local newspapers. Advertising flyers will be included with

newspapers delivered during August and September.

Paid August rent $380.

Received $1,200 cash from customers in payment on account.

Paid $3,120 for salaries due to employees, of which $1,700 is for August and $1,420 is for July

salaries payable.

Received $2,800 cash for services performed in August.

12

15 Purchased store equipment on account $2,000.

20

Paid creditors $2,000 of accounts payable due.

22 Purchased supplies on account $800.

25

Paid $2,900 cash for employees' salaries.

27

Billed customers $3,760 for services performed.

29 Received $780 from customers for services to be performed in the future.

Adjustment data:

1. A count shows supplies on hand of $960.

2. Accrued but unpaid employees' salaries are $1,540.

3. Depreciation on equipment for the month is $320.

4. Services were performed to satisfy $800 of unearned service revenue.

5. One month's worth of advertising services has been received.

6. One month of interest revenue related to the $4,000 note receivable has accrued. The 4-month note has a 6% annual

interest rate.

To-Do:

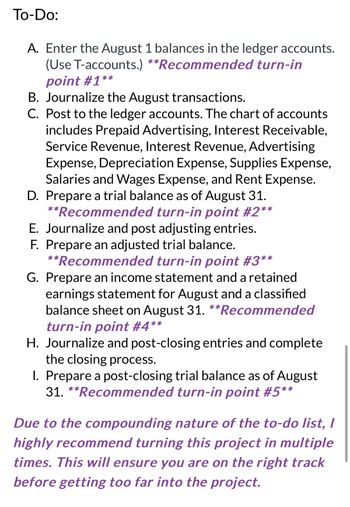

Transcribed Image Text:To-Do:

A. Enter the August 1 balances in the ledger accounts.

(Use T-accounts.) **Recommended turn-in

point #1**

B. Journalize the August transactions.

C. Post to the ledger accounts. The chart of accounts

includes Prepaid Advertising, Interest Receivable,

Service Revenue, Interest Revenue, Advertising

Expense, Depreciation Expense, Supplies Expense,

Salaries and Wages Expense, and Rent Expense.

D. Prepare a trial balance as of August 31.

**Recommended turn-in point #2**

E. Journalize and post adjusting entries.

F. Prepare an adjusted trial balance.

**Recommended turn-in point #3**

G. Prepare an income statement and a retained

earnings statement for August and a classified

balance sheet on August 31. **Recommended

turn-in point #4**

H. Journalize and post-closing entries and complete

the closing process.

I. Prepare a post-closing trial balance as of August

31. **Recommended turn-in point #5**

Due to the compounding nature of the to-do list, I

highly recommend turning this project in multiple

times. This will ensure you are on the right track

before getting too far into the project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Mar. 9) The company completed a $10,400 project for a client, who must pay within 30 days. Note: Enter debits before credits. Date Account Title Debit Credit Mar 09arrow_forwardcreate a journal entry for Jul 01 Purchased equipment, paying $6,060 cash and signing a 2-year note payable for $19,240. The equipment has a 8-year useful life. The note has a 9% interest rate, with interest payable on the first day of each following month.arrow_forwardAssume Avaya contracted to provide a customer with Internet infrastructure for $2,200,000. The project began in 2024 and was completed in 2025. Data relating to the contract are summarized below: 2024 2025 Costs incurred during the year $ 316,000 $ 1,700,000 Estimated costs to complete as of 12/31 1,264,000 0 Billings during the year 400,000 1,660,000 Cash collections during the year 290,000 1,770,000 Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024, assuming Avaya recognizes revenue over time according to percentage of completion. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2024, assuming this project does not qualify for revenue recognition over time.arrow_forward

- Subject: accountingarrow_forwardYour staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forwardAllocating Transaction Price to Performance Obligations and Recording Sales Value Dealership Inc. markets and sells the vehicles to retail customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $30,000 and the standalone selling price for the annual maintenance contract is $400. During October 2020, Value Dealership Inc. sold 30 vehicles for $30,250 per vehicle, each with a free annual maintenance contract. When answering the following questions: Round each allocated transaction price to the nearest dollar. If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Ignoring the cost entries, record the journal entry in October 2020 for Value Dealership’s sale of vehicles with the associated maintenance contracts to customers.…arrow_forward

- Sheridan Construction Company has entered into a contract beginning January 1, 2025, to build a parking complex. It has been estimated that the complex will cost $596,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $902,000. The following data pertain to the construction period. Costs to date Estimated costs to complete Progress billings to date Cash collected to date (a) $256,280 339,720 270,000 Gross profit recognized in 2025 Gross profit recognized in 2026 2025 Sok and Media 240,000 Gross profit recognized in 2027 $ GA $ LA 2026 Using the percentage-of-completion method, compute the estimated gross profit that would be recognized during each year of the construction period. (If answer is 0, please enter O. Do not leave any fields blank.) 5 $429,120 166,880 555,000 505,000 2027 $606,000 902,000 902.000arrow_forwardExplain clearlyarrow_forwardSubject :-Accountingarrow_forward

- subject; accountingarrow_forwardjournal entries needed for march 31, sept 30, and dec 31arrow_forwardIn 2021, Montana Corp. entered into a contract to begin work on a two-year project. Montana recognizes revenue over time according to percentage of completion for this contract, and provides the following information (dollars in millions): Accounts receivable, 12/31/2021 (from construction progress billings) $37.5 $140 Actual construction costs incurred in 2021 Cash collected on project during 2021 $105 Construction in progress, 12/31/2021 $210 Estimated percentage of completion during 2021 Selected Amounts O $70,000,000 What is the amount of gross profit on the project recognized by Montana during 2021? O $60,000,000 $35,000,000 O $105,000,000 50 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education