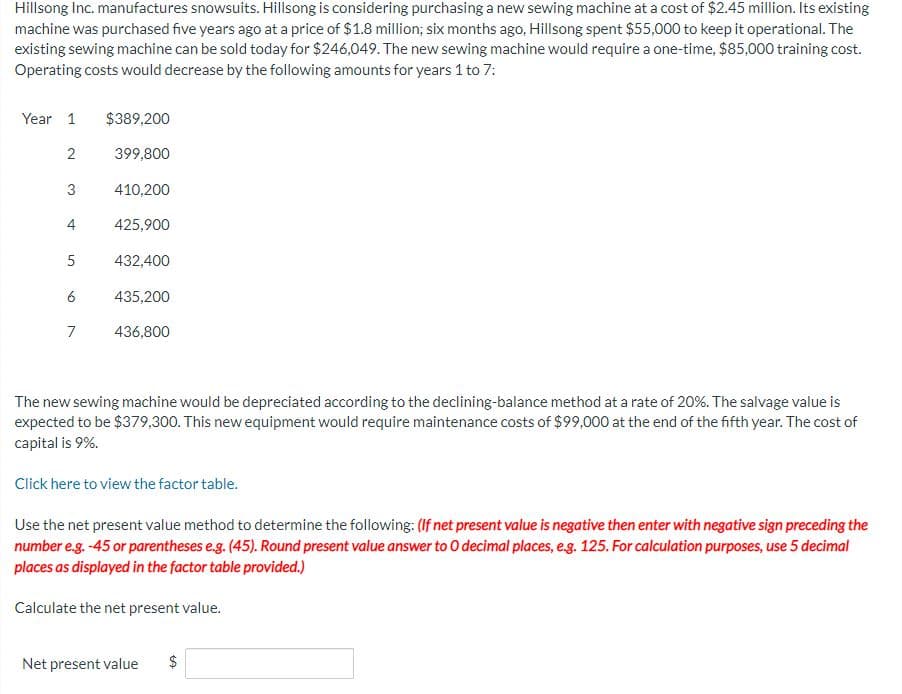

Hillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Hillsong spent $55,000 to keep it operational. The existing sewing machine can be sold today for $246,049. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 2 3 4 5 6 7 $389,200 399,800 410,200 425,900 432,400 435,200 436,800 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $379,300. This new equipment would require maintenance costs of $99,000 at the end of the fifth year. The cost of capital is 9%. Click here to view the factor table. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round present value answer to O decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Calculate the net present value. Net present value $

Hillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Hillsong spent $55,000 to keep it operational. The existing sewing machine can be sold today for $246,049. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 2 3 4 5 6 7 $389,200 399,800 410,200 425,900 432,400 435,200 436,800 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $379,300. This new equipment would require maintenance costs of $99,000 at the end of the fifth year. The cost of capital is 9%. Click here to view the factor table. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round present value answer to O decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Calculate the net present value. Net present value $

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 4P

Related questions

Question

Subject: acounting

Transcribed Image Text:Hillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing

machine was purchased five years ago at a price of $1.8 million; six months ago, Hillsong spent $55,000 to keep it operational. The

existing sewing machine can be sold today for $246,049. The new sewing machine would require a one-time, $85,000 training cost.

Operating costs would decrease by the following amounts for years 1 to 7:

Year 1

2

3

5

СЛ

6

7

$389,200

399,800

410,200

425,900

432,400

435,200

436,800

The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is

expected to be $379,300. This new equipment would require maintenance costs of $99,000 at the end of the fifth year. The cost of

capital is 9%.

Click here to view the factor table.

Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the

number e.g.-45 or parentheses e.g. (45). Round present value answer to O decimal places, e.g. 125. For calculation purposes, use 5 decimal

places as displayed in the factor table provided.)

Calculate the net present value.

Net present value $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,