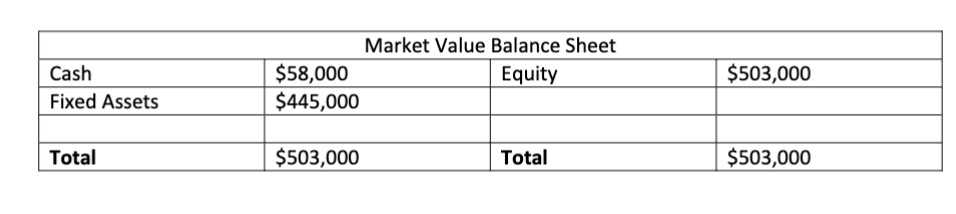

The balance sheet for Firth Group is provided below in market value terms. There are 12,000 shares outstanding. The company has declared a dividend of $1.9 per share. The stock goes ex dividend tomorrow. Assume zero tax rate. Answer the following questions. a) What is the stock price selling today? b) What is the stock price selling tomorrow? c) If the dividend tax rate is 10% and there is no capital gain tax, is the stock pricing selling tomorrow greater, lower, or equal to the answer you got in b)? Why?

Q1. The balance sheet for Firth Group is provided below in market value terms. There are 12,000

shares outstanding. The company has declared a dividend of $1.9 per share. The stock goes ex dividend tomorrow.

Assume zero tax rate. Answer the following questions.

a) What is the stock price selling today?

b) What is the stock price selling tomorrow?

c) If the

tomorrow greater, lower, or equal to the answer you got in b)? Why?

Step by step

Solved in 3 steps with 2 images

Q2. In Q1, suppose the company gives up the cash dividend plan because of shareholder opposition.

Instead, the company decides to buyback $22,800 worth of stock.

a) How many shares will be repurchased?

b) What will the price per share be after the repurchase according to MM model?