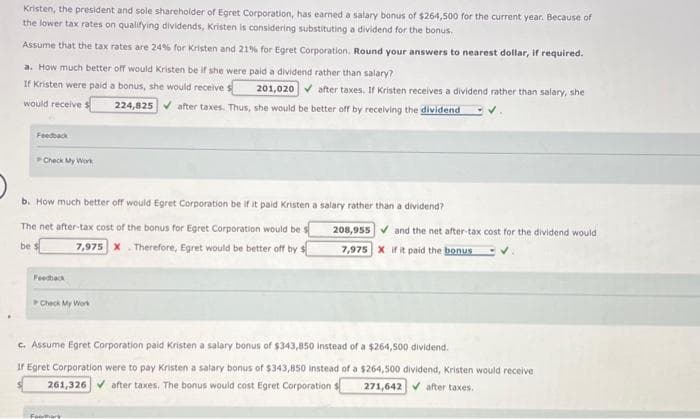

Kristen, the president and sole shareholder of Egret Corporation, has earned a salary bonus of $264,500 for the current year. Because of the lower tax rates on qualifying dividends, Kristen is considering substituting a dividend for the bonus. Assume that the tax rates are 24% for Kristen and 21% for Egret Corporation. Round your answers to nearest dollar, if required. a. How much better off would Kristen be if she were paid a dividend rather than salary? If Kristen were paid a bonus, she would receive s would receive 201,020 after taxes. If Kristen receives a dividend rather than salary, she 224,825✔ after taxes. Thus, she would be better off by receiving the dividend✔ Feedback Check My Work b. How much better off would Egret Corporation be if it paid Kristen a salary rather than a an a dividend? The net after-tax cost of the bonus for Egret Corporation would be t be 7,975 X Therefore, Egret would be better off by s Feedback Check My Work 208,955 and the net after-tax cost for the dividend would 7,975 X if it paid the bonus c. Assume Egret Corporation paid Kristen a salary bonus of $343,850 instead of a $264,500 dividend. If Egret Corporation were to pay Kristen a salary bonus of $343,850 instead of a $264,500 dividend, Kristen would receive 261,326✔ after taxes. The bonus would cost Egret Corporation s 271,642 after taxes.

Kristen, the president and sole shareholder of Egret Corporation, has earned a salary bonus of $264,500 for the current year. Because of the lower tax rates on qualifying dividends, Kristen is considering substituting a dividend for the bonus. Assume that the tax rates are 24% for Kristen and 21% for Egret Corporation. Round your answers to nearest dollar, if required. a. How much better off would Kristen be if she were paid a dividend rather than salary? If Kristen were paid a bonus, she would receive s would receive 201,020 after taxes. If Kristen receives a dividend rather than salary, she 224,825✔ after taxes. Thus, she would be better off by receiving the dividend✔ Feedback Check My Work b. How much better off would Egret Corporation be if it paid Kristen a salary rather than a an a dividend? The net after-tax cost of the bonus for Egret Corporation would be t be 7,975 X Therefore, Egret would be better off by s Feedback Check My Work 208,955 and the net after-tax cost for the dividend would 7,975 X if it paid the bonus c. Assume Egret Corporation paid Kristen a salary bonus of $343,850 instead of a $264,500 dividend. If Egret Corporation were to pay Kristen a salary bonus of $343,850 instead of a $264,500 dividend, Kristen would receive 261,326✔ after taxes. The bonus would cost Egret Corporation s 271,642 after taxes.

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:Kristen, the president and sole shareholder of Egret Corporation, has earned a salary bonus of $264,500 for the current year. Because of

the lower tax rates on qualifying dividends, Kristen is considering substituting a dividend for the bonus.

Assume that the tax rates are 24% for Kristen and 21% for Egret Corporation. Round your answers to nearest dollar, if required.

a. How much better off would Kristen be if she were paid a dividend rather than salary?

If Kristen were paid a bonus, she would receive s 201,020✔ after taxes. If Kristen receives a dividend rather than salary, she

would receive 224,825✔ after taxes. Thus, she would be better off by receiving the dividend

Feedback

Check My Work

b. How much better off would Egret Corporation be if it paid Kristen a salary rather than a dividend?

The net after-tax cost of the bonus for Egret Corporation would be s

7,975 X Therefore, Egret would be better off by s

be s

Check My Work

208,955✔ and the net after-tax cost for the dividend would

7,975 X if it paid the bonus

c. Assume Egret Corporation paid Kristen a salary bonus of $343,850 instead of a $264,500 dividend.

If Egret Corporation were to pay Kristen a salary bonus of $343,850 instead of a $264,500 dividend, Kristen would receive

261,326✔after taxes. The bonus would cost Egret Corporation

271,642 ✔ after taxes.

Faithark

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT