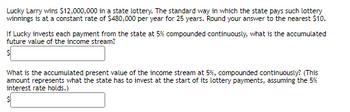

Lucky Larry wins $12,000,000 in a state lottery. The standard way in which the state pays such lottery winnings is at a constant rate of $480,000 per year for 25 years. Round your answer to the nearest $10. If Lucky invests each payment from the state at 5% compounded continuously, what is the accumulated future value of the income stream? $ What is the accumulated present value of the income stream at 5%, compounded continuously? (This amount represents what the state has to invest at the start of its lottery payments, assuming the 5% interest rate holds.)

Lucky Larry wins $12,000,000 in a state lottery. The standard way in which the state pays such lottery winnings is at a constant rate of $480,000 per year for 25 years. Round your answer to the nearest $10. If Lucky invests each payment from the state at 5% compounded continuously, what is the accumulated future value of the income stream? $ What is the accumulated present value of the income stream at 5%, compounded continuously? (This amount represents what the state has to invest at the start of its lottery payments, assuming the 5% interest rate holds.)

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:Lucky Larry wins $12,000,000 in a state lottery. The standard way in which the state pays such lottery

winnings is at a constant rate of $480,000 per year for 25 years. Round your answer to the nearest $10.

If Lucky invests each payment from the state at 5% compounded continuously, what is the accumulated

future value of the income stream?

$

What is the accumulated present value of the income stream at 5%, compounded continuously? (This

amount represents what the state has to invest at the start of its lottery payments, assuming the 5%

interest rate holds.)

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning