Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash c Sea-Breeze shares traded near a total value of $276,000 both before and after the had the following assets and liabilities: Curront accoto Book Value Ś 150.000 Fair Value $ 150 000

Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash c Sea-Breeze shares traded near a total value of $276,000 both before and after the had the following assets and liabilities: Curront accoto Book Value Ś 150.000 Fair Value $ 150 000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Subject:

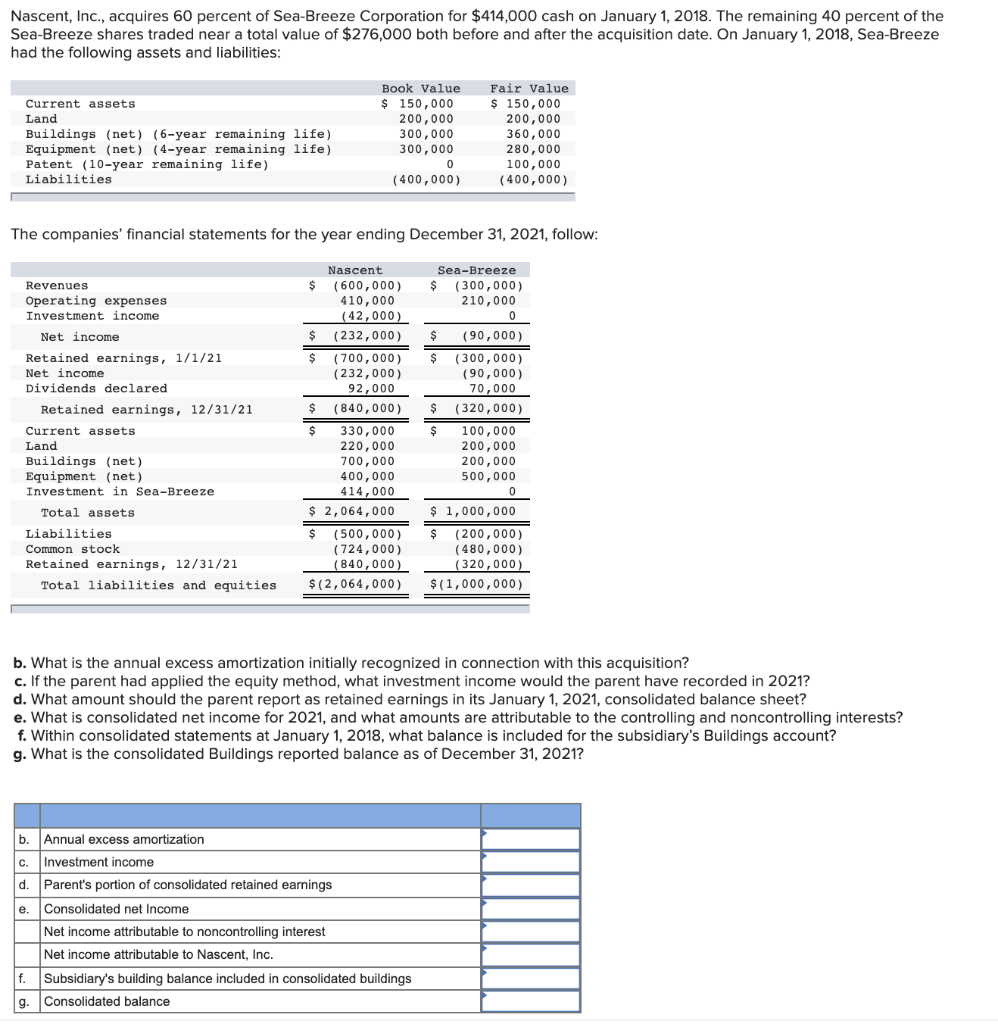

Transcribed Image Text:Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash on January 1, 2018. The remaining 40 percent of the

Sea-Breeze shares traded near a total value of $276,000 both before and after the acquisition date. On January 1, 2018, Sea-Breeze

had the following assets and liabilities:

Current assets

Land

Buildings (net) (6-year remaining life)

Equipment (net) (4-year remaining life)

Patent (10-year remaining life)

Liabilities

Revenues

Operating expenses

Investment income

Net income

Retained earnings, 1/1/21

Net income

Dividends declared

Retained earnings, 12/31/21

The companies' financial statements for the year ending December 31, 2021, follow:

Current assets

Land

Buildings (net)

Equipment (net)

Investment in Sea-Breeze

Total assets

Liabilities

Common stock

Retained earnings, 12/31/21

Total liabilities and equities

$

Annual excess amortization

f.

g.

$

$

$

$

Book Value

$ 150,000

200,000

300,000

300,000

(400,000)

330,000

220,000

700,000

400,000

414,000

$ 2,064,000

$

b.

c. Investment income

d. Parent's portion of consolidated retained earnings

e. Consolidated net Income.

Nascent

Sea-Breeze

(600,000) $ (300,000)

210,000

410,000

(42,000)

(232,000)

(500,000)

(724,000)

(840,000)

$(2,064,000)

Net income attributable to noncontrolling interest

Net income attributable to Nascent, Inc.

0

(90,000)

(300,000)

(700,000)

(232,000)

(90,000)

70,000

92,000

(840,000) $ (320,000)

$

Fair Value

$ 150,000

200,000

360,000

280,000

100,000

(400,000)

$

Subsidiary's building balance included in consolidated buildings

Consolidated balance

0

b. What is the annual excess amortization initially recognized in connection with this acquisition?

c. If the parent had applied the equity method, what investment income would the parent have recorded in 2021?

d. What amount should the parent report as retained earnings in its January 1, 2021, consolidated balance sheet?

e. What is consolidated net income for 2021, and what amounts are attributable to the controlling and noncontrolling interests?

f. Within consolidated statements at January 1, 2018, what balance is included for the subsidiary's Buildings account?

g. What is the consolidated Buildings reported balance as of December 31, 2021?

100,000

200,000

200,000

500,000

0

$ 1,000,000

$ (200,000)

(480,000)

(320,000)

$(1,000,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub