FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

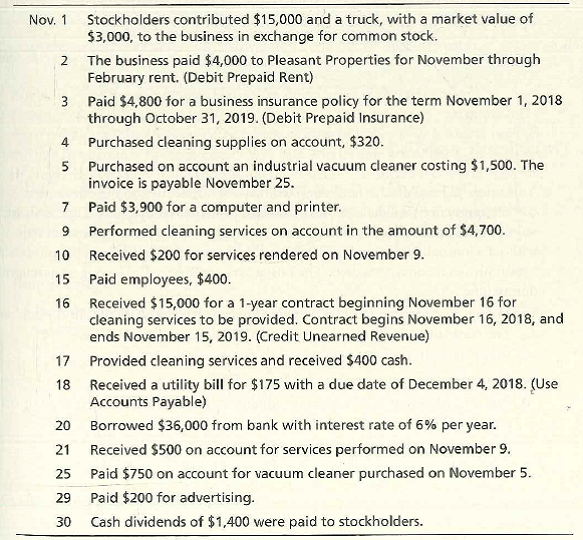

Journalizing transactions, posting to T-accounts, and preparing a

Consider the following transactional data for the first month of operations for Crystal Clear Cleaning.

Requirements

- Journalize the transactions, using the following accounts: Cash;

Accounts Receivable ; Cleaning Supplies; Prepaid Rent; Prepaid insurance; Equipment; Truck; Accounts Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Advertising Expense; and Utilities Expense. Explanations are not required. - Open a T-account for each account.

Post the journal entries to the T-accounts, and calculate account balances.- Prepare a trial balance as of November 30, 2018.

Transcribed Image Text:Nov. 1

Stockholders contributed $15,000 and a truck, with a market value of

$3,000, to the business in exchange for common stock.

2 The business paid $4,000 to Pleasant Properties for November through

February rent. (Debit Prepaid Rent)

3 Paid $4,800 for a business insurance policy for the term November 1, 2018

through October 31, 2019. (Debit Prepaid Insurance)

Purchased cleaning supplies on account, $320.

5 Purchased on account an industrial vacuum cleaner costing $1,500. The

invoice is payable November 25.

7 Paid $3,900 for a computer and printer.

4.

6.

Performed cleaning services on account in the amount of $4,700.

10 Received $200 for services rendered on November 9.

15 Paid employees, $400.

Received $15,000 for a 1-year contract beginning November 16 for

cleaning services to be provided. Contract begins November 16, 2018, and

ends November 15, 2019. (Credit Unearned Revenue)

16

17 Provided cleaning services and received $400 cash.

18 Received a utility bill for $175 with a due date of December 4, 2018. (Use

Accounts Payable)

20

Borrowed $36,000 from bank with interest rate of 6% per year.

21

Received $500 on account for services performed on November 9.

25

Paid $750 on account for vacuum cleaner purchased on November 5.

29

Paid $200 for advertising.

30

Cash dividends of $1,400 were paid to stockholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 21 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer.arrow_forwardThe following transactions occurred for Luminary Engineering: View the transactions. Journalize the transactions of Luminary Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Notes Payable; Luminary, Capital; Luminary, Withdrawals; Service Revenue; and Utilities Expense. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) July 2: Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Date Jul. 2 Transactions Jul. 2 Accounts and Explanation Jul. 4 Jul. 5 Jul. 10 Jul. 12 Jul. 19 Jul. 21 Jul. 27 Debit Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Paid utilities expense of $440. Purchased equipment on account, $2,600. Performed services for a client on account, $3,500. Borrowed $7,200 cash, signing a notes payable. Luminary withdrew $650 cash from the business. Purchased…arrow_forwardCreate a schedule of accounts receivable using the accounts receivable subsidiary ledger‘s.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education