Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

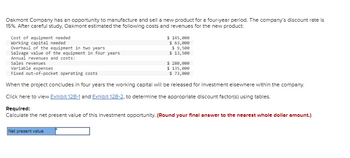

Transcribed Image Text:Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is

15%. After careful study. Oakmont estimated the following costs and revenues for the new product:

Cost of equipment needed

Working capital needed

Overhaul of the equipment in two years

Salvage value of the equipment in four years

Annual revenues and costs:

Sales revenues

$ 145,000

$ 63,000

$ 9,500

$ 13,500

$ 280,000

$ 135,000

Variable expenses

Fixed out-of-pocket operating costs

$ 73,000

When the project concludes in four years the working capital will be released for investment elsewhere within the company.

Click here to view Exhibit 128-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

Calculate the net present value of this investment opportunity. (Round your final answer to the nearest whole dollar amount.)

Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Calculate the hourly operating cost (under average conditions) for a 180- horsepower motor grader which costs $230,000 and is used in general contracting for 1500 hours per year for 10 years. The per gallon price of diesel fuel is $2.90. Salvage value is estimated to be $85,000 and a set of tires costs $5,000 for 2000 hours of average useful life. Assume a repair factor of 40% based on 10,000 hours of useful life as a percentage of hourly straight-line depreciation. (Use discount rate of 8%).arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 17%, After careful study, Oakmont estimated the following costs and revenues for the new product: Cost of equipment needed Working capital needed Overhaul of the equipment in year two Salvage value of the equipment in four years Annual revenues and costs: Sales revenues Variable expenses Fixed out-of-pocket operating costs $ 165,000 $ 67,000 $ 10,000 $ 13,000. $ 320,000 $ 155,000 $ 77,000 When the project concludes in four years the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 128-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using tables. (Use the tables to get your discount factors. The linked tables are the same tables as the ones in your course packet. If you calculate discount factors using Excel or a financial calculator, your answer may be different enough due to rounding…arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 16%. After careful study, Oakmont estimated the following costs and revenues for the new product: Cost of equipment needed Working capital needed $ 170,000 $ 68,000 Overhaul of the equipment in two years $ 12,000 $ 16,000 Salvage value of the equipment in four years Annual revenues and costs: Sales revenues $ 330,000 Variable expenses $ 160,000 $ 78,000 Fixed out-of-pocket operating costs When the project concludes in four years the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Calculate the net present value of this investment opportunity. (Round your final answer to the nearest whole dollar amount.)arrow_forward

- The original capacity of the equipment is 10,000 units per year. After paying $2,500 to replace an important part, the company increases the capacity of equipment to 12,000 units per year. How does the company deal with the $2,500 expenditures? Group of answer choices Increase the repair expenses by $2,500 Credit the equipment account by $2,500 Increase the value of equipment by $2,500 Don’t need do anything for accounting purposearrow_forwardCrane Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company’s tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $127,450 $176,875 $247,455 $254,440 $271,125 Expenses $141,410 $128,488 $137,289 $145,112 $139,556 Crane will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return enter the Accounting rate of return in percentages rounded to 1 decimal place %arrow_forwardPlease show excel workarrow_forward

- Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 17%. After careful study, Oakmont estimated the following costs and revenues for the new product: Cost of equipment needed Working capital needed) Overhaul of the equipment in two years. Salvage value of the equipment in four years Annual revenues and costs: Sales revenues $ 275,000 $ 86,000 $10,000 $ 13,000 $ 420,000 Variable expenses $ 205,000 Fixed out-of-pocket operating costs $ 87,000 When the project concludes in four years the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: Calculate the net present value of this investment opportunity. (Round your final answer to the nearest whole dollar amount.)arrow_forwardA company is planning to purchase a machine that will cost $39,552, have a six-year life, and will have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. A projected income statement for each year of the asset's life appears below. What is the payback period for this machine? $ 144,000 Sales Costs: Manufacturing Depreciation on machine Selling and administrative expenses Income Multiple Choice 6.18 years. 12 36 veare $ 86,400 4,000 48,000 (138,400) $ 5,600arrow_forwardGodoarrow_forward

- Net Present Value Analysis Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company’s discount rate is 15%. After careful study, Oakmont estimated the following costs and revenues for the new product: When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Calculate the net present value of this investment opportunity.arrow_forwardA general manager wants to know the economic service life of currently owned machines. The market value of the machines and the maintenance and operating costs are shown below. Use the company’s MARR of 15% per year to determine the ESL. Year Market Value Annual Cost Total Annual Worth 0 $40,000 N/A N/A 1 $30,000 $20,000 -$36,000 2 $25,000 $22,000 -$33,907 3 $12,000 $24,000 4 $2,000 $26,000 -$36,263arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 18% and it estimated the following costs and revenues for the new product: Cost of equipment needed Working capital needed Overhaul of the equipment in two years. Salvage value of the equipment in four years Annual revenues and costs: Sales revenues $ 220,000 $ 81,000 $ 7,500 $ 10,500 $ 370,000 $ 180,000 $ 82,000 Variable expenses Fixed out-of-pocket operating costs When the project concludes in four years, the working capital will be released for investment elsewhere within the company. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: Calculate the net present value of this investment opportunity. Note: Round your final answer to the nearest whole dollar amount. Net present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education