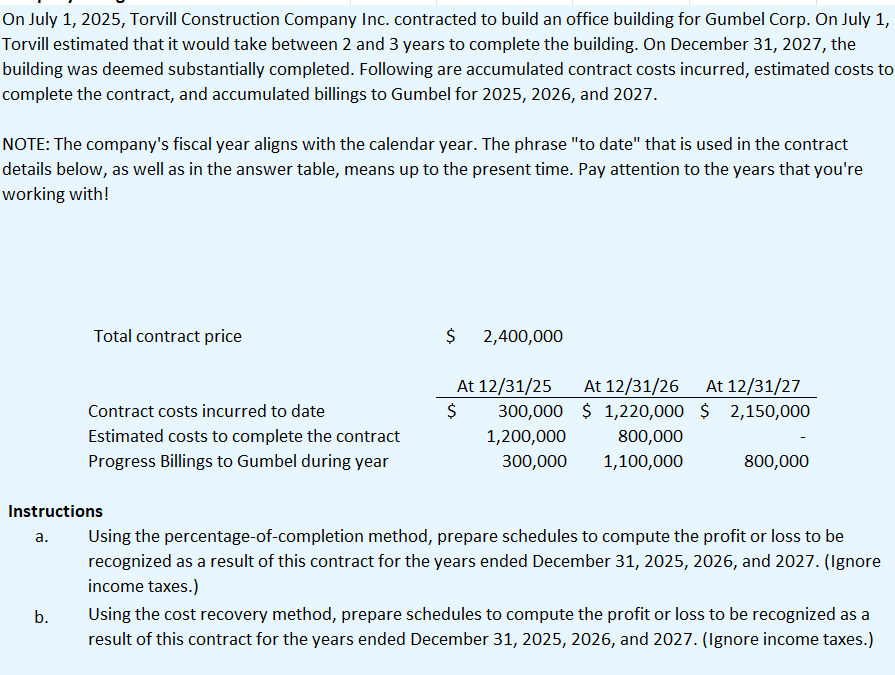

On July 1, 2025, Torvill Construction Company Inc. contracted to build an office building for Gumbel Corp. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2027, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2025, 2026, and 2027. NOTE: The company's fiscal year aligns with the calendar year. The phrase "to date" that is used in the contract details below, as well as in the answer table, means up to the present time. Pay attention to the years that you're working with! Total contract price $ 2,400,000 Contract costs incurred to date $ Estimated costs to complete the contract Progress Billings to Gumbel during year At 12/31/25 300,000 1,200,000 300,000 1,100,000 At 12/31/26 At 12/31/27 $1,220,000 $2,150,000 800,000 800,000 Instructions a. b. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.) Using the cost recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.)

On July 1, 2025, Torvill Construction Company Inc. contracted to build an office building for Gumbel Corp. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2027, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2025, 2026, and 2027. NOTE: The company's fiscal year aligns with the calendar year. The phrase "to date" that is used in the contract details below, as well as in the answer table, means up to the present time. Pay attention to the years that you're working with! Total contract price $ 2,400,000 Contract costs incurred to date $ Estimated costs to complete the contract Progress Billings to Gumbel during year At 12/31/25 300,000 1,200,000 300,000 1,100,000 At 12/31/26 At 12/31/27 $1,220,000 $2,150,000 800,000 800,000 Instructions a. b. Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.) Using the cost recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 10C

Related questions

Question

Transcribed Image Text:On July 1, 2025, Torvill Construction Company Inc. contracted to build an office building for Gumbel Corp. On July 1,

Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2027, the

building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to

complete the contract, and accumulated billings to Gumbel for 2025, 2026, and 2027.

NOTE: The company's fiscal year aligns with the calendar year. The phrase "to date" that is used in the contract

details below, as well as in the answer table, means up to the present time. Pay attention to the years that you're

working with!

Total contract price

$

2,400,000

Contract costs incurred to date

$

Estimated costs to complete the contract

Progress Billings to Gumbel during year

At 12/31/25

300,000

1,200,000

300,000

1,100,000

At 12/31/26 At 12/31/27

$1,220,000 $2,150,000

800,000

800,000

Instructions

a.

b.

Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be

recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore

income taxes.)

Using the cost recovery method, prepare schedules to compute the profit or loss to be recognized as a

result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT