ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

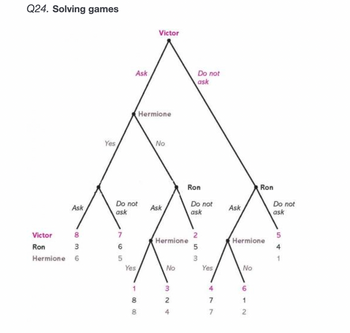

Q25. In the solution of the game, does Victor ask Hermione to go to the Yule ball?

- Yes

- No

Q26. In the solution of the game, does Hermione say yes to Victor?

- Yes

- No

Q27. In the solution of the game, does Ron ask Hermione to go to the Yule ball?

- Always

- Yes, unless Victor asked first

- Yes, unless Hermione said yes to Victor

- Never

Q28. In the solution of the game, does Hermione say yes to Ron?

- Yes, always

- Only if Victor didn't ask first

- Only after Victor asks first

- Never

Transcribed Image Text:Q24. Solving games

Ask

Victor

Ron

8

3

Hermione 6

Yes

Ask

Do not

ask

7

6

5

Yes

188

Victor

Hermione

No

Ask

Hermione

No

324

Ron

Do not

ask

Do not

ask

253

Yes

1477

Ask

Hermione

No

Ron

6

1

2

Do not

ask

5

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Problem 1. Andy (consumer A) and Red (consumer B) growing old together on a remote island on which only fish (good 1) and coconut (good 2) are available for consumption. Both Andy and Red have Cobb-Douglas preferences. That is, consumer i has u(xi, z) = (a)¹/2 (1)¹/2, where x is consumer i' s good j consumption with j = 1, 2. Also, Andy's ini- tial endowment is w (w, w) (1,3) while Red's initial endowment is w = (wi, wz) = = = = (3, 1). (a) Draw the Edgeworth box for this economy. Mark the point indicating the initial endowment of each consumer. (b) Draw the contract curve for this economy in an Edgeworth box (a graphical represen- tation is sufficient). Explain if it is Pareto efficient for Andy and Red to consume their endowments. (c) What is the set of allocations that could be the outcome under barter in this economy? (d) Let the price of fish be p₁ while the price of coconut be normalized to 1 without loss of generality. For each consumer, solve the utility maximization problem,…arrow_forwardAna and Ivan each individually and simultaneously decide whether to spend the evening at a play or a concert. Ana prefers to attend the concert twice as much without Ivan than to attend the play without him, and she prefers this three times more than being in the same place with Ivan (and at that point, she doesn't care where they are). Ivan prefers being in the same place with Ana twice as much as being at the play without her, and he prefers this four times more than being without Ana at the concert. Both have von Neumann-Morgenstern (vNM) preferences. With what probability will Ivan choose to attend the concert in Nashe's equilibrium?arrow_forwardMohamed and Kate each pick an integer number between 1 and 3 (inclusive). They make their choices sequentially.Mohamed is the first player and Kate the second player. If they pick the same number each receives a payoff equal to the number they named. If they pick a different number, they get nothing. What is the SPE of the game? a. Mohamed chooses 3 and Kate is indifferent between 1, 2 and 3. b. Mohamed chooses 3 and Kate chooses 1 if Mohamed chooses 1, 2 if Mohamed chooses 2, and 3 if Mohamed chooses 3. c. Mohamed chooses 1 and Kate chooses 1 if Mohamed chooses 1, 2 if Mohamed chooses 2 and 3 if Mohamed chooses 3. d. Mohamed chooses 3 and Kate chooses 3.arrow_forward

- Suppose you would have to pay Alicia at least $150 to get her to part with a ticket she just bought to see her favorite band play next Friday. Loss aversion implies that if Alicia had not yet bought the ticket, she would: Multiple Choice no longer be interested in purchasing it. be willing to pay more than $150 for it. be willing to pay exactly $150 for it. be willing to pay less than $150 for it.arrow_forwardYou are considering two options for your next family vacation. You can visit Disney World or Chicago. Your utility from Disney World is 100 if the weather is clear, and 0 if it rains. Chicago is worth a utility of 70 if the weather is clear and a utility of 40 if the weather is rainy. Also assume that the chance of rain at Disney World is going to be 50% and the chance of rain in Chicago is 40%. As a utility maximizer, should you plan to go to Disney World or Chicago? (Explain using relevant equations)arrow_forwardRachael starts out with 10 lobsters and 5 coconuts. Freya starts out with 10 lobsters and 15 coconuts. After trading, Rachael ends up with 8 lobsters and 10 coconuts. Rachael feels neither better nor worse off than when she started but cannot get Freya to agree to any more trades. Freya feels better off than when she started. Draw the Edgeworth box consistent with this story.arrow_forward

- Suppose you observe a person's answer to two decision problems. Problem 1: You are offered $40 today. What is the minimum amount x you demand one month from today in order to be willing to give up the $40 now? Answer: x = 52. Problem 2: Your are offered $40 today. What is the minimum amount x you demand one year from today in order to be willing to give up the $40 now? Answer: $60. 1. Demonstrate that the rational model of time preferences is violated for this choice pattern. 2. Derive this individual's B and d for the hyperbolic time discounting model. 3. Suppose the utility you get from eating ice cream now is 10 utils. But you pay a cost of -4 utils per hour for the next 4 hours, because it gives you indigestion and makes you feel lethargic. If your hourly B and d for this problem are B = .6 and d = .9, ... 1. What is the total discounted utility of eating ice cream now? 2. What is your total discounted utility now of planning to eat ice cream after lunch tomorrow? 3. Do you eat ice…arrow_forward39 In the following sequential game, person 1 chooses first and person 2 chooses second. Using backward induction, what choice should person 1 make? chooses no if person 2 chooses no chooses yes if person 2 chooses yes chooses yes chooses noarrow_forwardThe movie theater in Glendon has two types of customers: domestic students (group 1) and international students (group 2). At a price of p, cents, the number of movie tickets that domestic students are willing to buy per year is given by: q₁-170-0.7p₁. At a price of p₂ cents, the number of movie tickets that international students are willing to buy per year is given by: 92-87-0.3p₂. The total costs for the movie theater depend on the total number of tickets sold, q₁+92, and are given by the following total cost function C(q₁+92)=(91+9₂)². Suppose that the movie theater can identify which students are domestic and which students are international, and students are unable to resell movie tickets to each other. This enables the theater to charge different prices to domestic vs international students. How many movie tickets will domestic students buy (9₁)? How many movie tickets will international students buy (9₂)?arrow_forward

- When a famous painting becomes available for sale, it is often known which museum or collector will be the likely winner. Yet, the auctioneer actively woos representatives of other museums that have no chance of winning to attend anyway. Suppose a piece of art has recently become available for sale and will be auctioned off to the highest bidder, with the winner paying an amount equal to the second highest bid. Assume that most collectors know that Yakov places a value of $35,000 on the art piece and that he values this art piece more than any other collector. Suppose that if no one else shows up, Yakov simply bids $35,0002=$17,500 $35,000 2 = $17,500 and wins the piece of art. The expected price paid by Yakov, with no other bidders present, is. Suppose the owner of the artwork manages to recruit another bidder, Bob, to the auction. Bob is known to value the art piece at $28,000. The expected price paid by Yakov, given the presence of the second bidder Bob, is.arrow_forward15. A total of 10 players are each choosing a number from {0,1,2,3,4,5,6,7,8). If a player's number equals exactly half of the average of the numbers sub- mitted by the other nine players, then she is paid $100; otherwise, she is paid 0. Solve for the strategies that survive the IDSDS.arrow_forwardGive step by step answer with final answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education