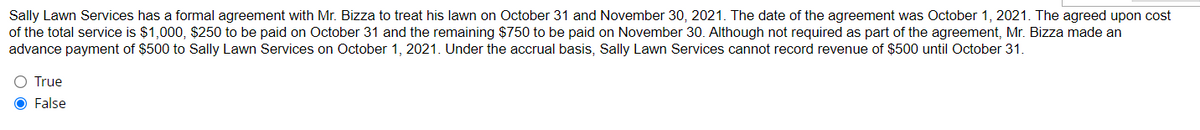

Sally Lawn Services has a formal agreement with Mr. Bizza to treat his lawn on October 31 and November 30, 2021. The date of the agreement was October 1, 2021. The agreed upon cost of the total service is $1,000, $250 to be paid on October 31 and the remaining $750 to be paid on November 30. Although not required as part of the agreement, Mr. Bizza made an advance payment of $500 to Sally Lawn Services on October 1, 2021. Under the accrual basis, Sally Lawn Services cannot record revenue of $500 until October 31. ○ True False

Sally Lawn Services has a formal agreement with Mr. Bizza to treat his lawn on October 31 and November 30, 2021. The date of the agreement was October 1, 2021. The agreed upon cost of the total service is $1,000, $250 to be paid on October 31 and the remaining $750 to be paid on November 30. Although not required as part of the agreement, Mr. Bizza made an advance payment of $500 to Sally Lawn Services on October 1, 2021. Under the accrual basis, Sally Lawn Services cannot record revenue of $500 until October 31. ○ True False

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:Sally Lawn Services has a formal agreement with Mr. Bizza to treat his lawn on October 31 and November 30, 2021. The date of the agreement was October 1, 2021. The agreed upon cost

of the total service is $1,000, $250 to be paid on October 31 and the remaining $750 to be paid on November 30. Although not required as part of the agreement, Mr. Bizza made an

advance payment of $500 to Sally Lawn Services on October 1, 2021. Under the accrual basis, Sally Lawn Services cannot record revenue of $500 until October 31.

○ True

False

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning