Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

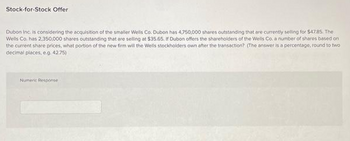

Transcribed Image Text:Stock-for-Stock Offer

Dubon Inc. is considering the acquisition of the smaller Wells Co. Dubon has 4,750,000 shares outstanding that are currently selling for $47.85. The

Wells Co. has 2,350,000 shares outstanding that are selling at $35.65. If Dubon offers the shareholders of the Wells Co. a number of shares based on

the current share prices, what portion of the new firm will the Wells stockholders own after the transaction? (The answer is a percentage, round to two

decimal places, e.g. 42.75)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Finance Loki Inc. and Thor Inc. have entered into a stock swap merger agreement whereby Loki will pay a 35% premium over Thor’s pre-merger price. A. If Thor’s pre-merger price per share was $37 and Loki’s was $52, what exchange ratio will Loki need to offer? B. On the day of the merger announcement, the increase in Thor (the target firm’s) stock price will be ______(higher/lower) than 35% (the takeover premium). C. Based on your answer in part B of this question, explain why you think Thor’s stock price increase will be higher or lower than the takeover premium at the time of the merger announcement.arrow_forwardOn May 1, 2020, Sunco Limited purchased a call option from Moonco Corporation. The option gave Sunco the right to purchase shares in a third company, Galaxy Company. Sunco settled the options in cash on June 16, 2020. Following are additional details pertaining to the option: Number of shares that can be purchased with the call option 7,400 Call option exercise price per share $ 10.03 Market price per share of Galaxy Company on May 1, 2020 $ 10.03 Price paid by Sunco to purchase the option $ 1,800 Market price per share of Galaxy Company on May 31, 2020 $ 11.24 Fair value of call option on May 31, 2020 $ 9,200 Market price per share of Galaxy Company on June 16, 2020 $ 11.29 Fair value of call option on June 16, 2020 $ 8,800 Sunco has a year end of May 31. Required: Prepare the journal entries required on the books of Sunco Limited on each of the…arrow_forwardInitial Public Offering (IPO), Istar Enterprises Shares Issued 25,000,000 Price per Share, Initially Offered to Public $80.00 Price, Close of First Day $83.00 IPO Underwriter Explicit Costs (percent of money raised) 0.07 Required: Using the information above, calculate: total money raised from the IPO, underwriter costs, net proceeds to the firm, and value of the company at the end of the first day. (Use cells A3 to B6 from the given information to complete this question.) Proceeds and Costs from IPO Dollars Total Money Raised from IPO Underwriter Costs Net Proceeds to Company Value of Company, End of First Dayarrow_forward

- The owners’ equity accounts for Vulcano International are shown here: Common stock ($.50 par value) $ 20,000 Capital surplus 210,000 Retained earnings 587,300 Total owners’ equity $ 817,300 a-1. If the company declares a 4-for-1 stock split, how many shares are outstanding now? (Do not round intermediate calculations.) a-2. What is the new par value per share? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) b-1. If the company declares a 1-for-5 reverse stock split, how many shares are outstanding now? (Do not round intermediate calculations.) b-2. What is the new par value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardLinpro Industries is considering the acquisition of Odetics Inc. in a stock-for-stock exchange. Assume no immediate synergistic benefits are expected. Selected financial data on the two companies are shown below: Linpro Odetics Sales (millions) $480 $90 Net income (millions) $38 $10.4 Common shares outstanding (millions) 10 2.1 Earnings per share $3.80 $4.95 Common stock (price per share) $45.60 $74.25 Calculate Linpro's post-merger EPS if the Odetics shareholders accept an offer of $90 a share in a stock-for-stock exchange. Question 9Answer a. $4.38 b. $3.81 c. $4.29 d. $3.42arrow_forwardFirm A is planning on merging with Firm B. Firm A will pay Firm B's stockholders the current value of their stock in shares of Firm A. Firm A currently has 1,800 shares of stock outstanding at a market price of $40 a share. Firm B has 1,200 shares outstanding at a price of $47 a share. What is the value per share of the merged firm?arrow_forward

- Nonearrow_forwardPLEASE DO NOT GIVE SOLUTION IN NIMAGE FORMATarrow_forwardBr. Shares are IPO published on sale and listed at 8,200 shares in primary market . The investors at IPO offer the price 18.00 with an unwriting discount at 6.5% Secondary market investors however were paying only 16.10 per share for Netshoes at 31.025 at 935 sharesoutstanding. total proceeds =!PO offer price for * IPO.arrow_forward

- A merger between Minnie Corporation and Mickey Corporation is under consideration. The financial information for these firms is as follows: Minnie Corporation Mickey Corporation Total earnings $1,682,000 $2,581,000 Number of shares of stock outstanding 290,000 890,000 EPS $5.80 $2.90 P/E ratio 10X 20X Market price per share $58 $58 a. On a share-for-share exchange basis, what will the postmerger EPS be? (Round the final answer to 2 decimal places.) Postmerger earnings per share $ b. If Mickey Corporation pays a 25 percent premium over the market value of Minnie Corporation, how many shares will be issued? (Do not round intermediate calculations.) Shares issued shares c. With the 25 percent premium, what will the postmerger EPS be? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Postmerger earnings per share $arrow_forwardEPS and postmerger price Data for Henry Company and Mayer Services are given in the following table. Henry Company is considering merging with Mayer by swap-ping 1.25 shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same price/earnings (P/E) multiple after the merger as before merging. Item Henry company Mayer Services Earnings available for common stock. $225,000 $50,000 Number of shares of common stock outstanding. $90,000 $15,000 Market price per share . $45 $50 a. Calculate the ratio of exchange in market price?arrow_forwardAssume Technical Investors is thinking about three different size offerings for issuance of additional shares. What is the percentage underwriting spread for each size offer? Size of Offer: Public Price: Net to Corporation: A: 1.1 million $30 $27.50 B: 7.0 million $30 $28.44 C: 28.0 million $30 $29.15arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education