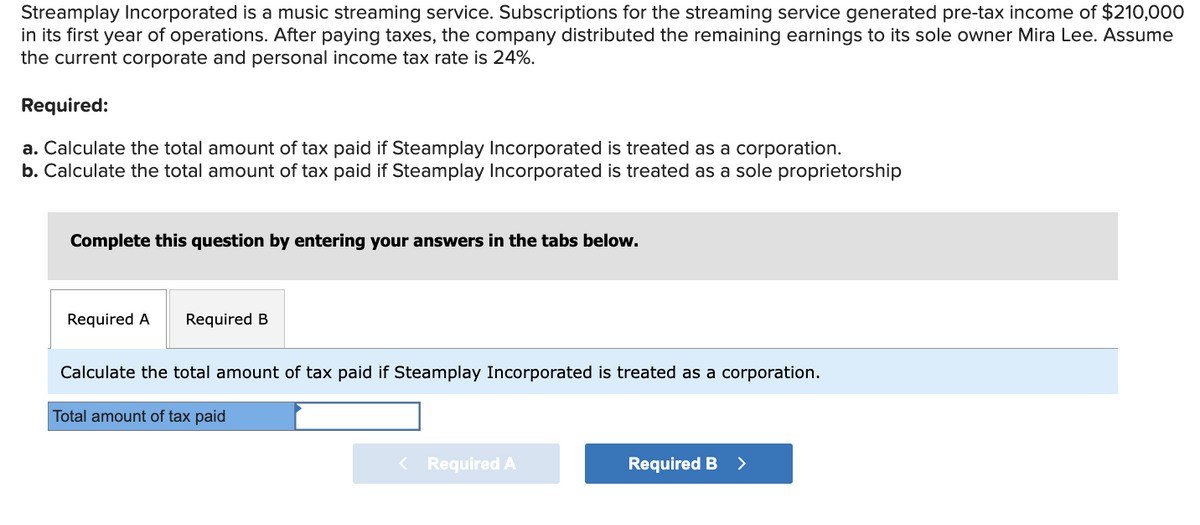

Streamplay Incorporated is a music streaming service. Subscriptions for the streaming service generated pre-tax income of $210,000 in its first year of operations. After paying taxes, the company distributed the remaining earnings to its sole owner Mira Lee. Assume the current corporate and personal income tax rate is 24%. Required: a. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a corporation. b. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a sole proprietorship

Streamplay Incorporated is a music streaming service. Subscriptions for the streaming service generated pre-tax income of $210,000 in its first year of operations. After paying taxes, the company distributed the remaining earnings to its sole owner Mira Lee. Assume the current corporate and personal income tax rate is 24%. Required: a. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a corporation. b. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a sole proprietorship

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

A5

Transcribed Image Text:Streamplay Incorporated is a music streaming service. Subscriptions for the streaming service generated pre-tax income of $210,000

in its first year of operations. After paying taxes, the company distributed the remaining earnings to its sole owner Mira Lee. Assume

the current corporate and personal income tax rate is 24%.

Required:

a. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a corporation.

b. Calculate the total amount of tax paid if Steamplay Incorporated is treated as a sole proprietorship

Complete this question by entering your answers in the tabs below.

Required A Required B

Calculate the total amount of tax paid if Steamplay Incorporated is treated as a corporation.

Total amount of tax paid

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT