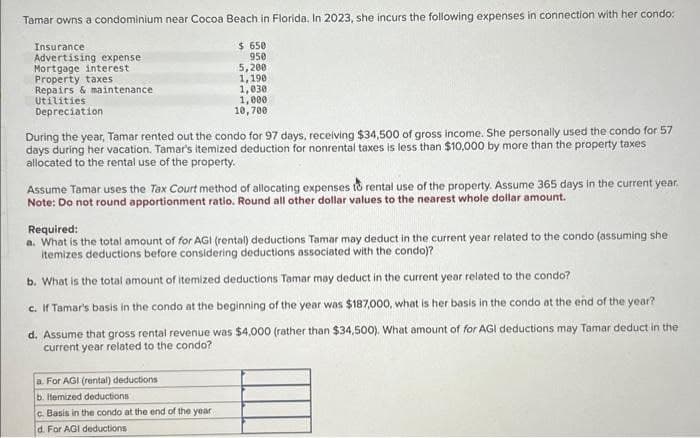

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: $ 650 950 5,200 1,190 1,030 Insurance Advertising expense Mortgage interest. Property taxes Repairs & maintenance Utilities Depreciation 1,000 10,700 During the year, Tamar rented out the condo for 97 days, receiving $34,500 of gross income. She personally used the condo for 57 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions associated with the condo)? b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo? c. If Tamar's basis in the condo at the beginning of the year was $187,000, what is her basis in the condo at the end of the year? d. Assume that gross rental revenue was $4,000 (rather than $34,500). What amount of for AGI deductions may Tamar deduct in the current year related to the condo? a. For AGI (rental) deductions b. Hemized deductions c. Basis in the condo at the end of the year d. For AGI deductions

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: $ 650 950 5,200 1,190 1,030 Insurance Advertising expense Mortgage interest. Property taxes Repairs & maintenance Utilities Depreciation 1,000 10,700 During the year, Tamar rented out the condo for 97 days, receiving $34,500 of gross income. She personally used the condo for 57 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions associated with the condo)? b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo? c. If Tamar's basis in the condo at the beginning of the year was $187,000, what is her basis in the condo at the end of the year? d. Assume that gross rental revenue was $4,000 (rather than $34,500). What amount of for AGI deductions may Tamar deduct in the current year related to the condo? a. For AGI (rental) deductions b. Hemized deductions c. Basis in the condo at the end of the year d. For AGI deductions

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 55P

Related questions

Question

Do not give answer in image and hand writing

Transcribed Image Text:Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo:

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

Utilities

Depreciation

$ 650

950

5,200

1,190

1,030

1,000

10,700

During the year, Tamar rented out the condo for 97 days, receiving $34,500 of gross income. She personally used the condo for 57

days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes

allocated to the rental use of the property.

Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year.

Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

Required:

a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she

itemizes deductions before considering deductions associated with the condo)?

b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c. If Tamar's basis in the condo at the beginning of the year was $187,000, what is her basis in the condo at the end of the year?

d. Assume that gross rental revenue was $4,000 (rather than $34,500). What amount of for AGI deductions may Tamar deduct in the

current year related to the condo?

a. For AGI (rental) deductions

b. Itemized deductions

c. Basis in the condo at the end of the year

d. For AGI deductions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT