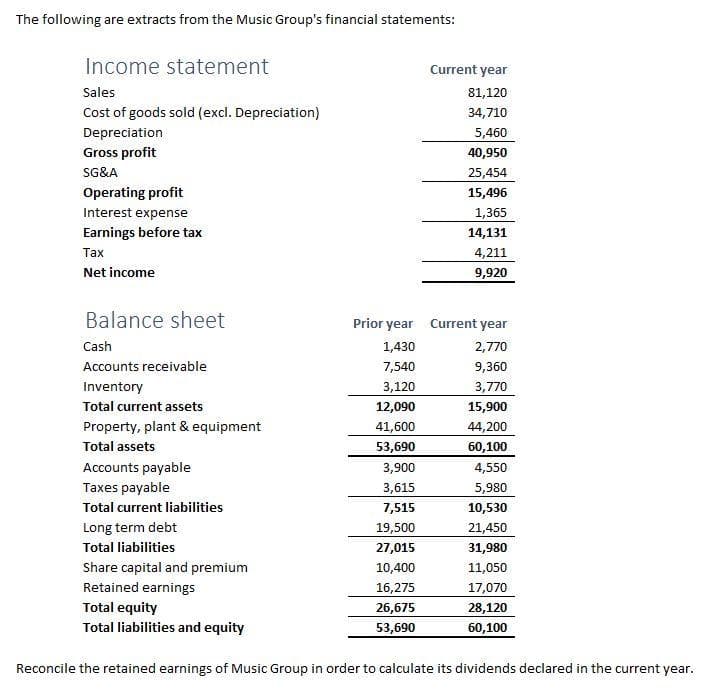

The following are extracts from the Music Group's financial statements: Income statement Sales Cost of goods sold (excl. Depreciation) Depreciation Gross profit SG&A Operating profit Interest expense Earnings before tax Tax Net income Balance sheet Cash Accounts receivable Inventory Total current assets Property, plant & equipment Total assets Accounts payable Taxes payable Total current liabilities Long term debt Total liabilities Share capital and premium Retained earnings Prior year 1,430 7,540 3,120 12,090 41,600 53,690 3,900 3,615 7,515 19,500 27,015 10,400 16,275 26,675 53,690 Current year 81,120 34,710 5,460 40,950 25,454 15,496 1,365 14,131 4,211 9,920 Current year 2,770 9,360 3,770 15,900 44,200 60,100 4,550 5,980 10,530 21,450 31,980 11,050 17,070 28,120 60,100 Total equity Total liabilities and equity Reconcile the retained earnings of Music Group in order to calculate its dividends declared in the current year.

The following are extracts from the Music Group's financial statements: Income statement Sales Cost of goods sold (excl. Depreciation) Depreciation Gross profit SG&A Operating profit Interest expense Earnings before tax Tax Net income Balance sheet Cash Accounts receivable Inventory Total current assets Property, plant & equipment Total assets Accounts payable Taxes payable Total current liabilities Long term debt Total liabilities Share capital and premium Retained earnings Prior year 1,430 7,540 3,120 12,090 41,600 53,690 3,900 3,615 7,515 19,500 27,015 10,400 16,275 26,675 53,690 Current year 81,120 34,710 5,460 40,950 25,454 15,496 1,365 14,131 4,211 9,920 Current year 2,770 9,360 3,770 15,900 44,200 60,100 4,550 5,980 10,530 21,450 31,980 11,050 17,070 28,120 60,100 Total equity Total liabilities and equity Reconcile the retained earnings of Music Group in order to calculate its dividends declared in the current year.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 3E

Related questions

Question

H1.

Transcribed Image Text:The following are extracts from the Music Group's financial statements:

Income statement

Sales

Cost of goods sold (excl. Depreciation)

Depreciation

Gross profit

SG&A

Operating profit

Interest expense

Earnings before tax

Tax

Net income

Balance sheet

Cash

Accounts receivable

Inventory

Total current assets

Property, plant & equipment

Total assets

Accounts payable

Taxes payable

Total current liabilities

Long term debt

Total liabilities

Share capital and premium

Retained earnings

Prior year

1,430

7,540

3,120

12,090

41,600

53,690

3,900

3,615

7,515

19,500

27,015

10,400

16,275

26,675

53,690

Current year

81,120

34,710

5,460

40,950

25,454

15,496

1,365

14,131

4,211

9,920

Current year

2,770

9,360

3,770

15,900

44,200

60,100

4,550

5,980

10,530

21,450

31,980

11,050

17,070

28,120

60,100

Total equity

Total liabilities and equity

Reconcile the retained earnings of Music Group in order to calculate its dividends declared in the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning