Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Typed plzzz And Asap

Thanks

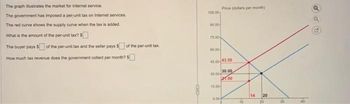

Transcribed Image Text:The graph illustrates the market for internet service.

The government has imposed a per-unit tax on Internet services.

The red curve shows the supply curve when the tax is added.

What is the amount of the per-unit tax? $

The buyer pays of the per-unit tax and the seller pays $of the per-unit tax

How much tax revenue does the government collect per month? $

CEID

105.00

90.00

75.00

00.00

45.00 43.50

30.00

21.00

30.00

15.00

Price (dollars per month)

0.00

14 20

20

o du

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- (Ignore income taxes in this problem.) Your Company has a telephone system that is in poor condition. The system must be either overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives: Present System Proposed New System Purchase cost when new $100,000 $110,000 Accumulated depreciation 90,000 Overhaul cost needed now 80,000 Working capital required 50,000 Annual cash operating costs 30,000 20,000 Salvage value now of old system 10,000 Salvage value in 8 years 2,000 15,000 Your Company uses a 12% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. What is the net present value of the new system alternative? Enter your answer without dollar signs. If the NPV is negative enter with a minus sign in front.arrow_forwardChatGi X Gincome X > DeepL X zto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mhe Questi X ssignment i Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On December 31, Hawkin's records show the following accounts. $ 5,900 1,000 3,600 14,800 Cash Accounts Receivable Supplies Equipment Accounts Payable Hawkin, Capital, December 1 Hawkin, Withdrawals Services Revenue Wages Expense Rent Expense Utilities Expense HAWKIN Statement of Owner's Equity For Month Ended December 31 Hawkin, Capital, December 1 Add: Investments by owner Hawkin, Capital, December 31 6,400 15,300 1,800 $ 16,400 8,000 1,900 1,100 QS 1-16 (Algo) Preparing a statement of owner's equity LO P2 Use the above information to prepare a statement of owner's equity for Hawkin for the month ended December 31. Hint: Owner investments are $0 for the period. 0 Copia d X 0 0 chat.op X Log…arrow_forwardCan someone check and tell me if my answer is correct?arrow_forward

- Typing clearly urjentarrow_forwardgle Chrome File Edit View History Bookmarks Profiles Tabl Window Help X M Inbox (231)- abigailof X M Verify Your Email Addra × The following unadjus! X iConnect - Home × M Question 5 - Chap C bis- Google Search ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 4 Homework 5 Saved Help Save & Ex 12.89 points eBook Ask Print References Problem 4-6AA (Algo) Preparing reversing entries LO P3 The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required year-end adjustments. a. As of December 31, employees had earned $855 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,522 of salaries will be paid. b. Cost of supplies still available at December 31 total is $2,575. c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,450. The…arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forward

- =U&launchmuri=nttps76253A pps76252rportal6252FITal poks Login -. Bb Module 5- Chap 1 &. H Office templates & t.. Il - Chapter 5 6 Sul Saved Help Save & Exit N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.000Θ 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 1.09273 o.91514 3.0909 2.82861 3.1836 2.91347 1.12551 0.88849 1.15927 0.86261 1.19405 0.83748 4 4.1836 3.71710 4.3091 3.82861 5.3091 4.57971 5.4684 4.71710 6 6.4684 5.41719 6.6625 5.57971 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11 1.38423 0.72242 11.4639 8.53020 11.8078 8.78611 12.8078 9.25262 13.1920 9.53020 14.6178 10.25262 16.0863 10.95400 12 1.42576 0.70138 14.1920 9.95400 13 1.46853 0.68095 15.6178 10.63496 17.5989 11.63496 17.0863 11.29607 18.5989 11.93794 19.1569 12.29607 20.1569 12.56110 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 20.7616 12.93794 Rosie's…arrow_forwardgle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (229) - abigailof X MGmail x iConnect - Home x Question 5 Mid-Term x Connect Getting to K wiL47988 xapp ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 5 Part 4 of 4 Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Ask Land Office equipment Accounts payable Owner investments $ 12,040 Cash withdrawals by owner 13,720 Consulting revenue 2,990 Rent expense 45,940 Salaries expense 17,710 Telephone expense 8,230 Miscellaneous expenses. 83,660 $ 1,760 13,720 3,210 6,690 870 680 Mc Graw Hill 一口 Help Save & E Also assume the following: a.…arrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (2 x ACC101 (4726) × Account x Account X M Question x iConnect x Content xM SmartBox →> C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwebapps%252Fb Saved Help Chapter 7 Quiz 2 QS 7-2 (Algo) Accounting information system principles LO C1 Match each description with the system principle it best reflects. 7.58 points esc Ask Mc Graw Hill Description 1. The benefits from an activity in an accounting information system outweigh the costs. 2. The accounting information system adapts to changes in the needs of decision makers. 3. The accounting information system reports useful information to decision makers. 4. The accounting information system conforms to the company's structure. 5. The accounting information system helps managers monitor business activities. 0 18 < Prev 2 of 10 tv G Search or type URL ☆ Principle VA Aa 3 5 6 8 O Carrow_forward

- AutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forward42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forwardne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education