ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

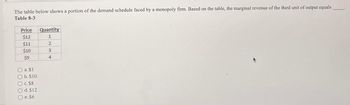

Transcribed Image Text:The table below shows a portion of the demand schedule faced by a monopoly firm. Based on the table, the marginal revenue of the third unit of output equals

Table 8-3

Price

$12

$11

$10

$9

a. $1

b. $10

c. $8

d. $12

O e. $6

00000

Quantity

1

2

3

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Table 15-9 Consider the following demand and cost information for a monopoly. Quantity Total Cost $6 $20 $34 $48 $62 $76 10 1 2 3 14 QUESTION 30 15 Refer to Table 15-9. What is the marginal revenue of the 3rd unit? O a. $20 b. $28 O c. $4 O d. $12 Price $32 $28 $24 $20 $16 $12 QUESTION 31 The fundamental source of monopoly power is O a. rising average total costs. O b. low fixed costs. O c. barriers to entry. O d. many buyers and sellers.arrow_forwardQUESTION 1 Bancroft Pharmaceuticals has a patent on a new medication used to treat high blood pressure, so it is the monopoly seller of this new drug product. The marginal cost of producing one dose of the drug is $10, and the elasticity of demand for the product is -3. What is the profit maximizing monopoly price for this patented drug product? A. $30 Ов. $10 В. Oc. $12.50 D. $15arrow_forwardExhibit 9-4: A Monopoly Total Quantity Total Fixed Variable Price Demanded Cost Cost $100 $20 $0 ts 90 1 $20 20 80 $20 48 70 $20 78 ments 60 4 $20 110 50 $20 150 Refer to Exhibit 9-4. At an output level of 4 units, the monopolist earns a total profits of about Tutoring $112.00 shboard $118.00 $110.00 O $120.00 ertsarrow_forward

- Suppose that the quantity of natural gas demanded in a city is 70 billion cubic meters when the price is $0.24 per cubic meter. The table below shows the total costs for a firm supplying natural gas to this market. Is the firm a natural monopoly? Quantity (billion m³) 20 30 40 50 60 70 Total cost ($ billion) 4.5 6. 9.0 12.0 15.5 19.5 No, because two or more firms could satisfy the entire market demand at a lower total cost than a single firm can. No, because two or more firms could satisfy the entire market demand at a lower average total cost than a single firm can. Yes, because a single firm can satisfy the entire market demand at a lower total cost than two or more firms could. Yes, because a single firm can satisfy the entire market demand at a lower average total cost than two or more firms could.arrow_forward21. Having discovered the secret to leprechauns' magic, you establish Lepre-Gone, the only producer of a leprechaun-eliminating spray. According to the graph, what is the deadweight loss caused by Lepre-Gone's monopoly? P Lepre-Gone $150 125 100 75 50 25 AC MC MR Demand 100 200 300 400 500 600 Q a. $10,000.00 b. $7,500.00 c. $5,000.00 d. $2,500.00arrow_forward47 and 48arrow_forward

- ↑ If a monopoly faces an inverse demand curve of p=270-Q has a constant marginal and average cost of $90, and can perfectly price discriminate, what is its profit? What are the consumer surplus, welfare, and deadweight loss? How would these results change if the firm were a single-price monopoly? Profit from perfect price discrimination (x) is $ 16.200 (Enter your response as a whole number) Corresponding consumer surplus is (enter your response as whole numbers): welfare is and deadweight loss is CS=$ W-s OWL-Sarrow_forwardPRICE (Dollars per subscription) 100 90 80 70 60 50 40 30 20 10 0 0 2 4 Pricing Mechanism Profit Maximization " 6 10 12 14 QUANTITY (Thousands of subscriptions) Marginal-Cost Pricing Average-Cost Pricing T 8 Complete the first row of the following table. MR O True O False Suppose the government has elected not to impose regulations on the industry, and so the firm faces no regulatory constraints in maximizing profits. 16 Complete the second row of the previous table. ATC MC Complete the third row of the previous table. D 18 20 Short Run Price Quantity (Subscriptions) (Dollars per subscription) Suppose now that the government decides to require the monopolist to set its price equal to marginal cost. Profit Suppose now that the government decides to require the monopolist to set its price equal to average total cost. Long-Run Decision True or False: Over time, the internet service provider has a very strong incentive to lower costs when subject to average-cost pricing regulations.arrow_forwardPlease see the images of the article below and help answer questions. 1. Evaluate this statement: "Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits." Must a perfectly competitive firm sell at a market-clearing price? Alternatively, is the market-clearing price the profit-maximizing price that a competitive firm chooses to set? Can a monopolist set any (price, quantity) combination? 2. Evaluate this statement: "Monopolies drive progress because the promise of years or even decades of monopoly profits provides a powerful incentive to innovate. Then monopolies can keep innovating because profits enable them to make the long-term plans and finance the ambitious research projects that firms locked in competition can't dream of." Cite a counter-example to this claim in which deregulation of a monopolist led to lower…arrow_forward

- (Figure: Electricity generation). If this monopoly were regulated under Average Cost (AC) pricing, the output produced is Group of answer choices 2,700 GWh 3,000 GWh 0 GWh 2,000 GWharrow_forwardExplain why it is not possible for a monopoly firm to maximise its profits by charging a price in the price region where demand is inelastic, even though there are no direct substitutes for its product. Also explain how a monopoly will be able to charge a higher price than a firm producing the good under perfect, oligopolistic, or monopolistic competitionarrow_forwardScenario 1: Barbara is a producer in a monopoly industry. Her demand curve, total revenue curve, marginal revenue curve, and total cost curve are given as follows: Q = 160 - 4P TR = 40Q- 0.25Q? MR = 40 - 0.5Q TC = 4Q MC = 4 Refer to Scenario 1. The price of her product will be O A. $32. O B. $4. O C. $72. O D. $22. E. $42.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education