Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

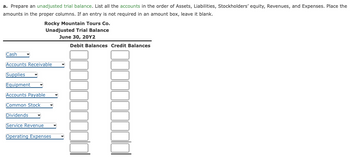

Transcribed Image Text:a. Prepare an unadjusted trial balance. List all the accounts in the order of Assets, Liabilities, Stockholders' equity, Revenues, and Expenses. Place the

amounts in the proper columns. If an entry is not required in an amount box, leave it blank.

Rocky Mountain Tours Co.

Unadjusted Trial Balance

June 30, 20Y2

Debit Balances Credit Balances

Cash

Accounts Receivable

Supplies

Equipment

Accounts Payable

Common Stock

Dividends

Service Revenue

Operating Expenses

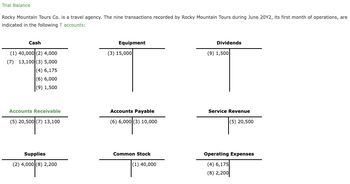

Transcribed Image Text:Trial Balance

Rocky Mountain Tours Co. is a travel agency. The nine transactions recorded by Rocky Mountain Tours during June 20Y2, its first month of operations, are

indicated in the following T accounts:

Cash

(1) 40,000 (2) 4,000

(7) 13,100 (3) 5,000

(4) 6,175

(6) 6,000

(9) 1,500

Equipment

(3) 15,000

Dividends

(9) 1,500

Accounts Receivable

Accounts Payable

Service Revenue

(5) 20,500 (7) 13,100

(6) 6,000 (3) 10,000

(5) 20,500

Supplies

(2) 4,000 (8) 2,200

Common Stock

Operating Expenses

(1) 40,000

(4) 6,175

(8) 2,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For each of the transactions below, create a journal? The assignment of accounts receivable journal entries are based on the following information: Accounts receivable 50,000 on 45 days terms Assignment fee of 1% (500) Initial advance of 80% (40,000) Cash received from customers 6,000 Interest on advances at 9%, outstanding on average for 40 days (40,000 x 9% x 40 / 365 = 395)arrow_forwardWhat was the September 30 balance in the control account?arrow_forwardThe details of the accounts receivable of AA Corporation as December 31, 2022 shows the following: Beginning balance P3,450,000 Sales on account made to customers 2,800,000 Collection of accounts receivable during the year 4,200,000 Accounts written off as uncollectible 90,000 The following transactions were included in the recorded transactions during the year: 1. Invoice dated December 28, 2022 for P350,000 was shipped and received by the buyer on December 31, 2022, this invoice was recorded in the book at P35,000. 2. Invoice dated and recorded on November 30, 2022 was erroneously priced at P32 per unit. There were 11,000 units of goods delivered which were received on December 10, 2022. The agreed price should be at P22 per unit only. AA's policy is to provide 5% of the outstanding balance of accounts receivable as uncollectible and there is beginning balance of allowance for bad debts of P40,000. Statement 1: The amount of bad debt expense in 2022 is P158,250. Statement 2: The…arrow_forward

- When examining the accounts of Palma Company, you ascertain that balance relating to bothreceivables and payables are included in a single controlling account (called receivables),which has a P23,050 debit balance. An analysis of the details of this account revealed thefollowing: Items Debit Credit Accounts Receivable - customers P 40,000 Accounts receivable - officers (Current collection expected) 2,500 Debit balances - creditors 450 Expense advances to salespersons 1,000 Share capital subscriptions receivable 4,600 Accounts payable for merchandise P 19,250 Unpaid salaries 3,300 Credit balance in customer accounts 2,000 Cash received in advance from customers for goods not yet shipped 450 Expected bad debts, cumulative 500 Required:1. Give the journal entry to eliminate the above account and to set up the appropriateaccounts to replace it.arrow_forwardWhen examining the accounts of Palma Company, you ascertain that balance relating to bothreceivables and payables are included in a single controlling account (called receivables),which has a P23,050 debit balance. An analysis of the details of this account revealed thefollowing: Items Debit Credit Accounts Receivable - customers P 40,000 Accounts receivable - officers (Current collection expected) 2,500 Debit balances - creditors 450 Expense advances to salespersons 1,000 Share capital subscriptions receivable 4,600 Accounts payable for merchandise P 19,250 Unpaid salaries 3,300 Credit balance in customer accounts 2,000 Cash received in advance from customers for goods not yet shipped 450 Expected bad debts, cumulative 500 Required:1. How should each item be reported on Palma Company’s statement of financial position?arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $130 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $28.59 October 16 Credit $20.00 October 25 Purchase $122.60 average daily balance = $ ___arrow_forward

- On March 4, Micro Sales makes $10,500 in sales on bank credit cards that charge a 2% service charge and deposits the funds into Micro Sales' bank accounts at the end of the business day. Required: Journalize the sales and recognition of expense as a single journal entry. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places.arrow_forwardOswego Clay Pipe Company provides services of $50,000 to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. What would Oswego record on April 12? A. Accounts Receivable 49,500 Sales Revenue 49,500 B. Accounts Receivable 50,000 Sales Revenue 49,500 Sales Discounts 500 C. Accounts Receivable 50,000 Sales Revenue 50,000 D. Accounts Receivable 50,000 Sales Discounts 500 Sales Revenue 50,500arrow_forwardCompute the balance in the subsidiary accounts at the end of the month!arrow_forward

- Sheffield Bikes Ltd. reports cash sales of $4,300 on October 1. (a) Record the sales assuming they are subject to 13% HST. (b) Record the sales assuming they are subject to 5% GST and 9.975% QST. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entrles. Round answers to 0 decimal places, e.g. 5,275.) No. Date Account Titles and Explanation Debit Credit (a) Oct. 1 (b) Oct. 1arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.)arrow_forwardFinancial Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning