Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

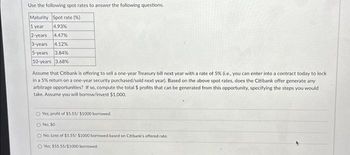

Transcribed Image Text:Use the following spot rates to answer the following questions.

Maturity Spot rate (%)

1 year

4.93%

2-years 4.47%

3-years 4.12%

5-years 3.84%

10-years 3.68%

Assume that Citibank is offering to sell a one-year Treasury bill next year with a rate of 5% (i.e., you can enter into a contract today to lock

in a 5% return on a one-year security purchased/sold next year). Based on the above spot rates, does the Citibank offer generate any

arbitrage opportunities? If so, compute the total $ profits that can be generated from this opportunity, specifying the steps you would

take. Assume you will borrow/invest $1,000.

O Yes: profit of $5.55/ $1000 borrowed.

O No: $0

O No: Loss of $5.55/ $1000 borrowed.based on Citibank's offered rate.

O Yes: $55.55/$1000 borrowed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mansukarrow_forwardExample: suppose that the three-month T-bills annualized rate is 8% and that Elizabeth company plans to issue 90-days commercial paper. If Elizabeth co. believes that an 0.7 percent default risk premium, an 0.2 percent liquidity premium, and a 0.3 percent tax adjustmer are necessary to sell its commercial paper to investors. What is the appropriate yield to be offered on the commercial paper? If the default risk premium decreases from 0.7 percent to 0.5 percent but the annualized T-bills rate increases from 8percent to 8.7 percent, what is the appropriate yield to be offered on the commercial paper?arrow_forwardYou enter into a five-to-eight-month forward rate agreement with a firm. You agree to lend the firm a 3-month loan of $5 million starting 5 months from now, with a quarterly compounded forward interest rate of 2.5% per annum. Currently, the continuously compounded 5-month and 8-month interest rates are 3% per annum and 3.5% per annum, respectively. 1) What is the implied forward rate for the 3-month period starting 5 months from now? 2) What is the present value of this forward rate agreement to you now?arrow_forward

- You are given a nominal annual rate of discount of 12% convertible (compounded) quarterly. Determine the present value on 1/1/2010 of $20,000 to be paid on 1/1/2015. Hint: Let X be the value on 1/1/2010. The future value is $20,000. Recall for an effective rate of discount, d, A(t) = Ap*(1-d)t. You will need to adjust your formula to reflect the fact that the given rate is a nomi O $11,000 but $11,250arrow_forwardA 10-year floating rate (annually paid) security selling for 101.32 pays a rate based on a reference rate plus 50 basis points. Assume the current value of the reference rate is 7%. What is the discount margin? O +30.94 bps O -309.4 bps O -30.94 bps O +309.4 bpsarrow_forwardA company has offered you two different payment plans for purchasing a product, • Option A. 15% down payment (of the total price) and 10 annual payments of $1,200.• Option B. No down payment and 12 annual payments of $ 1,500.Treat the down payment as occurring at Year 0. Assume an interest rate of 8% per year. a. What is the down payment of Option A?b. What is the price paid for the product under Option A?c. What is the price paid for the product under Option B?d. Which payment option should be selected, A or B?e. Briefly explain why someone might choose the option that has the larger sale price.arrow_forward

- Consider a loan of Sh. 50,000 with a 30 year term, interest of 6% (i + p) payable monthly. The loan balance is adjusted for inflation at the beginning of every 2 year s based on the CPI. The CPI increase at end of year two is 5%. Compute the new loan balance at the end of year two.arrow_forward15)arrow_forwardThe 1-year spot rate is 8%p.a. effective. The term structure of 1-year effective forwardratesisasfollows: attimet=1therateis7%,attimet=2therate is 6%, at time t = 3 the rate is 5%. (a) Determine the term structure of spot rates. (b) A fixed income security pays £10 annual coupons and it is redeemed after 4 years for £100. Compute its price at time t = 0.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education