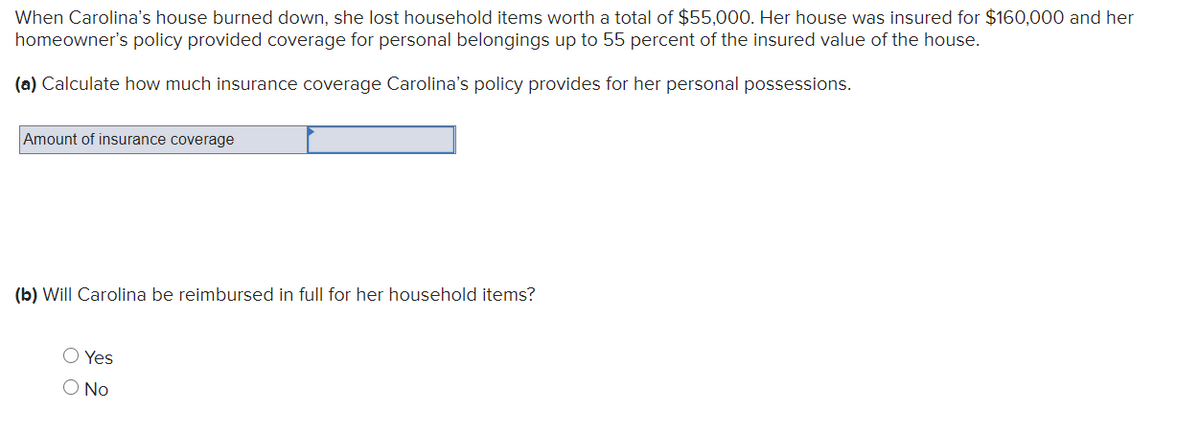

When Carolina's house burned down, she lost household items worth a total of $55,000. Her house was insured for $160,000 and her homeowner's policy provided coverage for personal belongings up to 55 percent of the insured value of the house. (a) Calculate how much insurance coverage Carolina's policy provides for her personal possessions. Amount of insurance coverage (b) Will Carolina be reimbursed in full for her household items? O Yes O No

When Carolina's house burned down, she lost household items worth a total of $55,000. Her house was insured for $160,000 and her homeowner's policy provided coverage for personal belongings up to 55 percent of the insured value of the house. (a) Calculate how much insurance coverage Carolina's policy provides for her personal possessions. Amount of insurance coverage (b) Will Carolina be reimbursed in full for her household items? O Yes O No

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 8DQ

Related questions

Question

Transcribed Image Text:When Carolina's house burned down, she lost household items worth a total of $55,000. Her house was insured for $160,000 and her

homeowner's policy provided coverage for personal belongings up to 55 percent of the insured value of the house.

(a) Calculate how much insurance coverage Carolina's policy provides for her personal possessions.

Amount of insurance coverage

(b) Will Carolina be reimbursed in full for her household items?

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT