Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:View

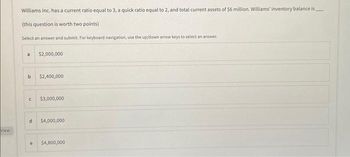

Williams Inc. has a current ratio equal to 3, a quick ratio equal to 2, and total current assets of $6 million. Williams' inventory balance is

(this question is worth two points)

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

b

C

$2,000,000

e

$2,400,000

$3,000,000

d $4,000,000

$4,800,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Directions: Create a % Change and Yr. 2 Common Size Balance Sheet for Dana Point. Use excel to do the calculations for you and don't round your answers. Dana Point Company Balance Sheet % Change Yr 2 Balance Sheet Common Size Yr 2 Yr 1 Balance Sheet Cash $ 7,000 $ 30,000 AR $ 67,500 $ 60,000 Inventory $ 49,000 $ 22,500 PPE $ 6,000 $ 4,500 Total Current Assets $ 129,500 $ 117,000 Building $ 187,500 $ 190,000 Total Assets $ 317,000 $ 307,000 Yr 2 Yr 1 Accounts Payable $ 65,500 $ 63,000 Wages Payable $ 37,000 $ 47,500 Total Current Liabilities $ 102,500 $ 110,500 Bank Loan Payable $ 83,000 $ 85,000 Total Liabilities $…arrow_forwardCalculate ROE for PotBelly Corp 2015. Use highlighted excel infoarrow_forwardPlease do not give solution in image format thankuarrow_forward

- The following is an example of: Cash Accounts receivable Inventory Equipment Total assets 10 Multiple Choice O O Ratio analysis. Horizontal analysis. Vertical analysis. Year NOV 17 2024 $300,000 500,000 800,000 1,200,000 $2,800,000 $2,600,000 2023 $800,000 200,000 700,000 900,000 ST 2arrow_forwardPlease do not give solution in image format thankuarrow_forwardPrepare an income statement and balance sheetarrow_forward

- Please don't give image formatarrow_forwardCricket Training Company has a current ratio of 0.80 to 1, based on current assets of $6.64 million and current liabilities of $8.30 million. 1. How, if at all, will a $880,000 cash purchase of inventory affect the current ratio? 2. How, if at all, will a $880,000 purchase of inventory on account affect the current ratio? Complete this question by entering your answers in the tabs below. Required 1 Required 2 How, if at all, will a $880,000 cash purchase of inventory affect the current ratio? The current ratio will Required 1 Next > ********* Check my • Coomarrow_forwardsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education