Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

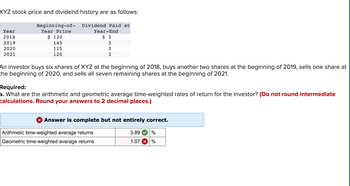

Transcribed Image Text:XYZ stock price and dividend history are as follows:

Year

2018

2019

2020

2021

Beginning-of-

Year Price

$ 120

145

115

120

Dividend Paid at

Year-End

$ 3

3

3

3

An investor buys six shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at

the beginning of 2020, and sells all seven remaining shares at the beginning of 2021.

Required:

a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

X Answer is complete but not entirely correct.

Arithmetic time-weighted average returns

Geometric time-weighted average returns

3.89

%

1.07 X %

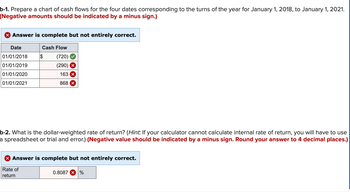

Transcribed Image Text:b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021.

(Negative amounts should be indicated by a minus sign.)

X Answer is complete but not entirely correct.

Date

01/01/2018

01/01/2019

01/01/2020

01/01/2021

Cash Flow

$

(720)

(290)

163 X

868 X

b-2. What is the dollar-weighted rate of return? (Hint: If your calculator cannot calculate internal rate of return, you will have to use

a spreadsheet or trial and error.) (Negative value should be indicated by a minus sign. Round your answer to 4 decimal places.)

X Answer is complete but not entirely correct.

Rate of

return

0.8087%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock has had the following year-end prices and dividends: Year 1 Price Dividend $ 43.41 2 48.39 $0.66 3 57.31 0.69 4 45.39 0.80 5 52.31 0.85 6 61.39 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.)arrow_forwardXYZ's stock price and dividend history are as follows: Beginning-of-Year Dividend paid at Price $ 102 122 92 102 Year 2018 2019 2020 2021 Year-End $4 Arithmetic average rate of return Geometric average rate of return 4 An investor buys three shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the beginning of 2020, and sells all four remaining shares at the beginning of 2021. 4 4 a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. If your calculator cannot calculate internal rate of return, you will have to use trial i and error.) (Round your answer to 4…arrow_forwardA stock has had the following year-end prices and dividends: Year 1 2355N 4 6 Price $ 64.63 71.50 77.30 63.57 73.71 82.75 Dividend Arithmetic average return Geometric average return $.66 .71 .77 .86 .93 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forward

- Suppose a stock had an initial price of $60 per share, paid a dividend of $.60 per share during the year, and had an ending share price of $72. Compute the percentage total return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Total Return:arrow_forwardq7- Which of the following statements is true? Select one: a. Trailing P/E is based on the current share price and forward P/E is based on next year's forecast share price. b. Trailing P/E is based on last year's share price and forward P/E is based on the current share price. c. Both trailing and forward P/E are based on the current share price. d. Trailing P/E is based on last year's share price and forward P/E is based on next year's forecast share price. Clear my choicearrow_forwardA stock is bought for $23.25 and sold for $28.69 a year later, immediately after it has paid a dividend of $4.18. What is the capital gain rate for this transaction? NOTE: Enter the PERCENTAGE number rounding to two decimals. If your decimal answer is 0.034576, your answer must be 3.46. DO NOT USE the % sign. A stock is bought for $29.45 and sold for $35.96 a year later, immediately after it has paid a dividend of $3.97. What is the dividend yield for this transaction? NOTE: Enter the PERCENTAGE number rounding to two decimals. If your decimal answer is 0.034576, your answer must be 3.46. DO NOT USE the % sign. You own a portfolio that has $3,764 invested in Stock A and $7,514 invested in Stock B. If the expected returns on these stocks are 9.33% and 11.67%, respectively, what is the expected return on the portfolio? NOTE: Enter the PERCENTAGE number rounding to two decimals. If your decimal answer is 0.034576, your answer must be 3.46. DO NOT USE the % sign.arrow_forward

- Using the data from the following table,calculate the return for investing in this stock from January 1 to December 31. Prices are after the dividend has been paid. Stock Price Dividend Jan 1 $50.18 Mar 31 $51.11 $0.58 Jun 30 $49.56 $0.58 Sep 30 $51.93 $0.75 Dec 31 $52.53 $0.75 The return from January 1 to March 31 is enter your response here. (Round to five decimal places.) Part 2 The return from March 31 to June 30 is enter your response here. (Round to five decimal places.) Part 3 The return from June 30 to September 30 is enter your response here. (Round to five decimal places.) Part 4 The return from September 30 to December 31 is enter your response here. (Round to five decimal places.) Part 5 enter your response here%. (Round to two decimal places.)arrow_forwardA stock has had the following year-end prices and dividends: Year 1234 in 10 5 6 Price $64.68 71.55 77.35 63.62 73.81 83.25 Dividend Arithmetic average return. Geometric average return $.67 .72 .78 .87 .94 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16. % %arrow_forwardCalculate the total cost (in $), proceeds (in $), total gain (or loss) (in $), and return on investment for the mutual fund investment. The offer price is the purchase price of the shares, and the net asset value is the price at which the shares were later sold. (Round your return on investment to one decimal place.) Shares OfferPrice TotalCost Net AssetValue Proceeds Per ShareDividends Total Gain(or Loss) Return onInvestment% 500 $10.60 $ $12.80 $ $0.65 $ %arrow_forward

- Suppose that an investor purchases the common stock at the current market price of $58/share and simultaneously sells for $12 a call to buy the shares at the strike price of $50. At the expiration of the call, price of stock is $77. What is the net profit on the position for this investor? (Round your answer the nearest dollar, do not enter with the dollar sign)arrow_forwardo The following information is available concerning the price evolution of Microsoft stocks between 2016-2019 and the dividends paid by them. Date March 1, 2016 April 1, 2016 July 1, 2016 March 1, 2017 March 1, 2019 Close price 55.23 49.87 56.68 65.86 117.94 Total Dividends - 0.36 1.50 4.88 o Requirements: Considering that you bought Microsoft shares on March 1, 2016, compute the holding-period return for each maturity • Annualize the holding-period returns using EAR and APR • Comment on the resultsarrow_forward30. Questions 30 and 31 are related. Use the following information regarding an equal-weighted equity index and assume that all dividend payments are made at the end of the year and are reinvested in the stock that paid the dividend. Security Price at the End of 2021 Price at the End of 2022 Dividends per Share A $26 $0.50 B $45 $0.20 C $36 $0.40 Ꭰ $135 $0.50 Note: The dollar value of the index on December 31, 2021 is $10,000 and using a divisor of 100, the index level equals 100. a. b. C. 31. a. b. C. The weight of Security B in the index on December 31, 2022 with dividends reinvested and before rebalancing is closest to: 16.75% 18.55% 19.24% $25 $50 $31.25 $100 7.35% 7.87% The total return on the index referenced in the previous question for the year 2022 is closest to: 8.90% d. 22.16% e. 23.33% f. 25.00% d. 10.53% e. 12.10% f. 12.54%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education