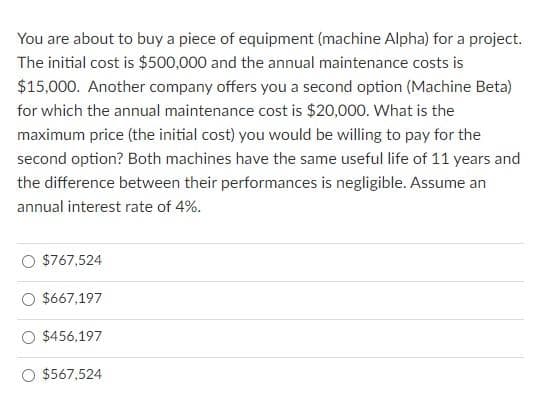

You are about to buy a piece of equipment (machine Alpha) for a project. The initial cost is $500,000 and the annual maintenance costs is $15,000. Another company offers you a second option (Machine Beta) for which the annual maintenance cost is $20,000. What is the maximum price (the initial cost) you would be willing to pay for the second option? Both machines have the same useful life of 11 years and the difference between their performances is negligible. Assume an annual interest rate of 4%.

You are about to buy a piece of equipment (machine Alpha) for a project. The initial cost is $500,000 and the annual maintenance costs is $15,000. Another company offers you a second option (Machine Beta) for which the annual maintenance cost is $20,000. What is the maximum price (the initial cost) you would be willing to pay for the second option? Both machines have the same useful life of 11 years and the difference between their performances is negligible. Assume an annual interest rate of 4%.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

8

Transcribed Image Text:You are about to buy a piece of equipment (machine Alpha) for a project.

The initial cost is $500,000 and the annual maintenance costs is

$15,000. Another company offers you a second option (Machine Beta)

for which the annual maintenance cost is $20,000. What is the

maximum price (the initial cost) you would be willing to pay for the

second option? Both machines have the same useful life of 11 years and

the difference between their performances is negligible. Assume an

annual interest rate of 4%.

$767,524

$667,197

$456,197

$567,524

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning