College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 9SPB

CALCULATING AND JOURNALIZING

REQUIRED

- 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--.

- 2. Prepare the entry for depreciation expense using a general journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculate the Annual Depreciation for each listed asset.

Assume the assets were purchased on January 1st and used for 12 months.

The first asset has been completed.

Utilize the straight-line depreciation method: (Original cost - Estimated Salvage Value) / Estimated Useful Life = Annual Depreciation

Plant Asset

Cash register

Computer

Vehicle

Machinery

Desk

Asset

Original Cost

500.00

4,500.00

15,500.00

8,000.00

2,500.00

Calculate the amount to be depreciated:

Annual

Depreciation

Cash register

Computer

Vehicle

Machinery

Desk

Estimated

Salvage Value

25.00

800.00

3,000.00

1,200.00

200.00

67.86

Estimated

Useful Life

7 years

5 years

10 years

5 years

15 years

Questions? Contact your instructor!

Required:

1. Prepare general journal entries to record the preceding transactions.

2. Post to general ledger T-accounts.

3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the

following information:

(a) accrued salaries at year-end total $1,000.

(b) for simplicity, the building and equipment are being depreciated using the straight-

line method over an estimated life of 20 years with no residual value.

(c) supplies on hand at the end of the year total $600.

(d) bad debts expense for the year totals $610; and

(e) the income tax rate is 30%; income taxes are payable in the first quarter of 2017.

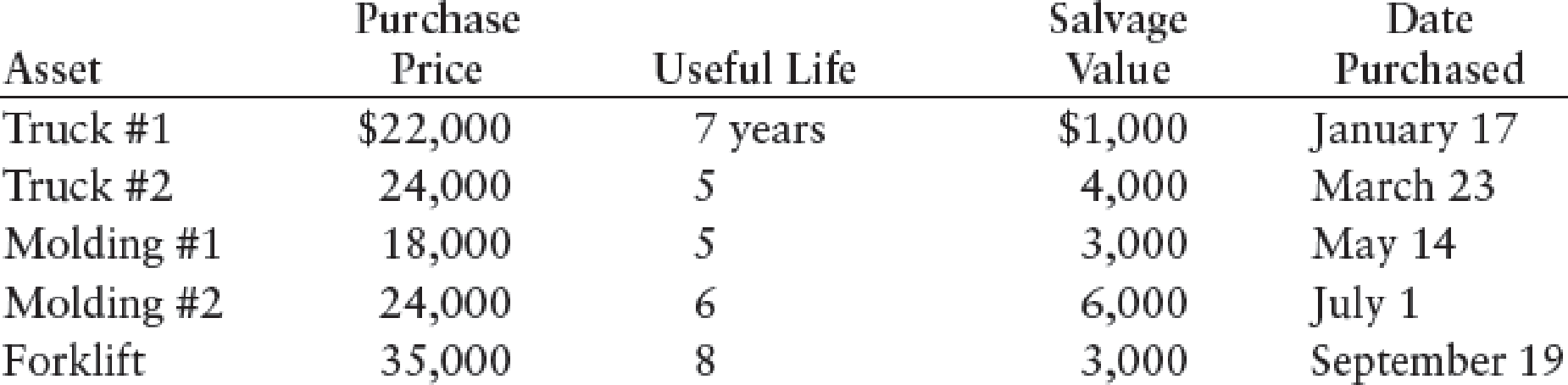

Calculating and Journalizing Depreciation

Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month.

In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired.

Purchase

Salvage

Date

Asset

Price

Useful Life

Value

Purchased

Truck #1

$19,050

8 years

$3,930

January 1

Truck #2

24,320

8

4,000

April 10

Tractor #1

18,010

5

3,010

May 1

Tractor #2

13,200

6

2,100

June 18

Forklift

38,410

10

3,910

September 1

Required:

1. Calculate the depreciation expense for Johnson Machine as of December 31, 20--.

2. Prepare the entry for depreciation expense using a general journal.

Page: 1

DOC. POST.

DATE

ACCOUNT TITLE

DEBIT CREDIT

NO. REF.

20--

1

Dec. 31

1

2

2

Chapter 18 Solutions

College Accounting, Chapters 1-27

Ch. 18 - Prob. 1TFCh. 18 - Prob. 2TFCh. 18 - Depreciation is a process of asset valuation; that...Ch. 18 - The straight-line method of depreciation allocates...Ch. 18 - Prob. 5TFCh. 18 - Prob. 1MCCh. 18 - Prob. 2MCCh. 18 - Prob. 3MCCh. 18 - Prob. 4MCCh. 18 - Prob. 5MC

Ch. 18 - The following costs were incurred to purchase a...Ch. 18 - Prob. 2CECh. 18 - A machine costing 350,000 has a salvage value of...Ch. 18 - Grandorf Company replaced the engine in a truck...Ch. 18 - Prepare journal entries for the following...Ch. 18 - Prob. 6CECh. 18 - Prob. 7CECh. 18 - Prob. 1RQCh. 18 - Prob. 2RQCh. 18 - Prob. 3RQCh. 18 - What is meant by the depreciable cost of a plant...Ch. 18 - Prob. 5RQCh. 18 - Prob. 6RQCh. 18 - Prob. 7RQCh. 18 - For assets acquired after 1986, but before...Ch. 18 - Prob. 9RQCh. 18 - Prob. 10RQCh. 18 - Prob. 11RQCh. 18 - Prob. 12RQCh. 18 - Prob. 13RQCh. 18 - Prob. 14RQCh. 18 - Prob. 15RQCh. 18 - Prob. 16RQCh. 18 - Prob. 17RQCh. 18 - Prob. 18RQCh. 18 - Prob. 19RQCh. 18 - Prob. 20RQCh. 18 - Prob. 21RQCh. 18 - Prob. 22RQCh. 18 - Prob. 23RQCh. 18 - Prob. 1SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - UNITS-OF-PRODUCTION METHOD The truck purchased in...Ch. 18 - Prob. 4SEACh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mitchell Parts...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mineral...Ch. 18 - INTANGIBLE LONG-TERM ASSETS Track Town Co. had the...Ch. 18 - Prob. 1SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - Prob. 3SEBCh. 18 - Prob. 4SEBCh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mayer Delivery...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mining...Ch. 18 - Prob. 13SPBCh. 18 - Prob. 1MYWCh. 18 - Creative Solutions purchased a patent from Russell...Ch. 18 - On April 1, 20-3, Kwik Kopy Printing purchased a...Ch. 18 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciationmethods: straight-line,units-of-production, and double-declining-balance. Show your computations. Note: Three depreciation schedules must be prepared. Begin by preparing a depreciation schedule using thestraight-line method. Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Cost Life Expense Depreciation Value 1-2-2024 $30,000 $30,000 12-31-2024 $24,000 ÷ 4 years = $6,000 $6,000 24,000 12-31-2025 24,000 ÷ 4 years = 6,000 12,000 18,000 12-31-2026 24,000 ÷ 4 years = 6,000 18,000 12,000 12-31-2027 24,000 ÷ 4 years = 6,000 24,000 6,000 Before calculating the units-of-production depreciationschedule, calculate the…arrow_forwardGiven the data, prepare a depreciation table (Depreciation Expense, Accumulated Depreciation, Carrying Amount) for the following methods: 1. Straight line 2. Service hours 3. Production method Also, identify the Gain or Loss for each year and every deprecation method if the machine is sold at: End of 1st Yr - 500,000 End of 2nd Yr - 360,000 End of 3rd Yr - 260,000 End of 4th Yr - 165,000 End of 5th Yr - 40,000arrow_forwardAnnual depreciation of equipment, where the amount of depreciation charged is computed by the machine-hours method.arrow_forward

- Wolfpack Corp. has determined it should record depreciation expense of $40,000 for the year ending 12/31/X7. Required: In the general journal below, complete the year-end entry to record depreciation. Debit Credit Dec 31 ? 40,000 ? 40,000arrow_forwardRequirement 1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value for each year of the asset's life. For the units of production method, round depreciation per unit to three decimal places. Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. One year Useful life (SL) Depreciation rate - X 1 More Info - X Requirements Complete the Straight-Line Depreciation Schedule. Begin by filling out the schedule through 2019, and then complete the schedule by entering the amounts through 2022. On January 4, 2018, Bailey Enterprises, Inc., paid $205,600 for equipment used in manufacturing automotive supplies. In addition to the basic purchase price, the company paid $1,000 for transportation charges, $100 for insurance for the equipment while in transit, $10,500 sales tax, and $2,800 for a special which to place the equipment in the plant.…arrow_forwardFor the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31. For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10-year useful life and residual value of $20,000. TIP: Calculate depreciation from the acquisition date to the end of the quarter.arrow_forward

- The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Depreciation is computed from the first of the month of acquisition to the first of the month of disposition. Land A and Building A were acquired from a predecessor corporation. Thompson paid $792,500 for the land and building together. At the time of acquisition, the land had a fair value of $70,400 and the building had a fair value of $809,600. Land B was acquired on October 2, 2019, in exchange for 2,800 newly issued shares of…arrow_forwardB. D E G H. J K 3. Create the fixed asset supporting schedule for the following purchases: Two fixed assets are purchased during the year: Computer server on 5/4/2014 for $2,214.55 Office furniture on 11/17/2014 for $1,234.54 MACRS 150% is going to be the depreciation method used and depreciation adjusting entries are made at the end of each month. (check figure: total depreciation expense = 107.63) What will be the depreciation general journal adjusting entry on 12/31/2014?arrow_forwardOn March 10, 2022, Bonita Company sells equipment that it purchased for $209,280 on August 20, 2015. It was originally estimated that the equipment would have a life of 12 years and a salvage value of $18,312 at the end of that time, and depreciation has been computed on that basis. The company uses the straight-line method of depreciation. Compute the depreciation charge on this equipment for 2015, for 2022, and the total charge for the period from 2016 to 2021, inclusive, under each of the six following assumptions with respect to partial periods. (Round depreciation per day to 2 decimal places, eg. 15.64 and final answers to O decimal places, eg. 45,892.) 2015 2016-2021 Inclusive 2022 Depreciation is computed for the exact period of time during which the 1. $ 2$ asset is owned. (Use 365 days for base and record depreciation through March 9, 2022.) 2. Depreciation is computed for the full year on the 24 $ January 1 balance in the asset account. 3. Depreciation is computed for the…arrow_forward

- Prepare a depreciation schedule for a piece of machinery purchased Jan 10 for $8800. Transportation costs amounted to $200. The estimated useful life is 10 years, and the machine salvage value is $900. The depreciation schedule spans the estimated life of the machine and includes the depreciation rate for each year, the dollar amount of that year's depreciation, the book value, and each years accumulated depreciation.arrow_forwardA copy machine acquired on May 1 with a cost of $2,545 has an estimated useful life of 3 years. Assuming that it will have a residual value of $745, determine the annual depreciation expense using the straight-line method (no journal entry necessary; show math).arrow_forwardA machine is depreciated using the sum of the years’ digit method. The total depreciation after 12 years is ₱ 16,253,532.67 and the depreciation on the 17th year is ₱ 541,784.42. Its book value at the end of the 14th year is ₱ 7,603,291.41. a. Compute the life of the machine. b. Find the total depreciation of the machine after its life. c. Find the first cost of the machine.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License